The confusion between a stage-2 stock & a stage-2 base should not be there. These are two separate concepts that most traders tend to combine.

Stan Weinstein (SW) uses the word stage for a different meaning that what William O’Neil (WON) uses it for.

SW (originally, at least) doesn't care about base counting. WON doesn't care about stage analysis. WON's base counting is a continuous process that doesn't stop even when the moving averages are in a bearish alignment.

SW's stage analysis will only very broadly tell you that a stock has had a long run, or is in a "late" stage 2. Other than eyeballing the chart, & counting the number of weeks, it has no other measures of quantification.

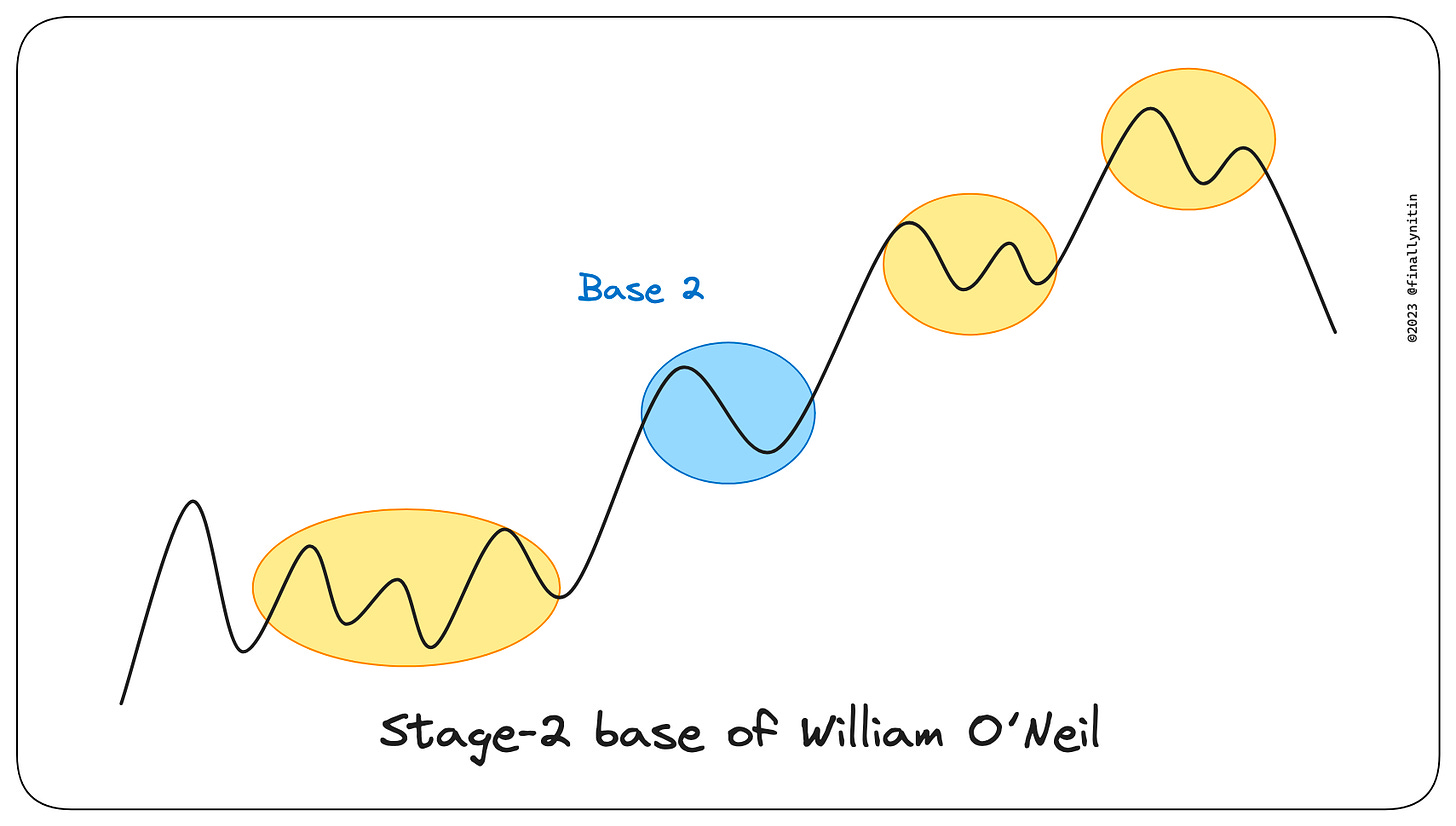

WON’s base counting will tell this in no uncertain terms. Late-stage bases (3rd, 4th, & beyond) will have more failure rates, in general. As the stock falls down from, say, a base in stage 4 or stage 5, the base count will get reset. New bases will, more or less, mostly form when the stock is in (or around) SW's stage 2.

The popular approach is a combination of the two, in that the WON base count can be done only in SW stage 2. This is also fine, but only one of the two is sufficient. But we can't seem to have enough of it, can we? 😉