Burst Power indicator

TradingView Script

Burst Power: A New Way to Gauge Stock Momentum

Ever wondered how to spot stocks poised for explosive moves? Let's dive into the Burst Power score, a fresh perspective on identifying stocks with momentum.

In the ever-evolving world of trading, finding the next big mover can feel like searching for a needle in a haystack. Traders often rely on a mix of indicators, gut feelings, and a dash of luck to pinpoint stocks ready to surge. But what if there was a way to quantify a stock's potential for significant price movements?

Enter the Burst Power score—an innovative metric designed to help traders identify stocks with the propensity for rapid and substantial moves. Whether you're a momentum trader seeking quick gains or a positional trader aiming for steady growth, understanding the Burst Power score could be your new secret weapon.

What is the Burst Power Score?

At its core, the Burst Power score is a numerical value that reflects how frequently a stock experiences significant upward price movements over a specified period.

The score is calculated by analyzing historical price data and counting the number of times a stock has made substantial gains. These gains are categorized into three tiers:

5% Moves: Days when the stock's closing price increased between 5% and 10% from the previous close.

10% Moves: Days with a closing price jump between 10% and 19%.

19% Moves: Days where the stock soared by 19% or more.

By weighting these counts and combining them, we arrive at the Burst Power score.

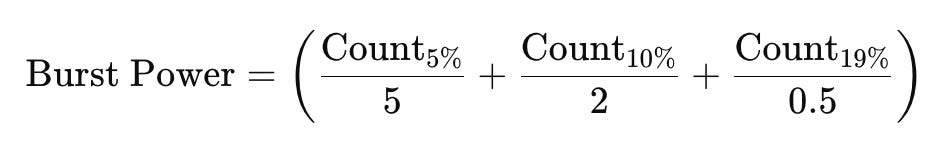

How is the Burst Power Score Calculated?

The calculation might sound a bit technical, but it's straightforward once you break it down:

Here's what this means:

Count of 5%+ moves divided by 5: This gives moderate weight to days with 5-10% gains.

Count of 10%+ moves divided by 2: Adds more weight to days with 10-19% gains.

Count of 19%+ moves divided by 0.5: Heavily weights days where the stock exploded by 19% or more.

By summing these weighted counts, we get the Burst Power score. The higher the score, the more frequently the stock has made significant moves.

Why Does the Burst Power Score Matter?

Understanding a stock's Burst Power score can help you tailor your trading strategy:

High Burst Power Scores: Momentum Movers

A high Burst Power score signals frequent significant moves, & sharp price increases, making it attractive for momentum trading. Ideal for traders looking for quick swings and momentum plays. Some examples:

FACT (Fertilizers and Chemicals Travancore Limited): Score: 24

REFEX (Refex Industries Limited): Score: 21

OPTIEMUS (Optiemus Infracom Limited): Score: 18

COCHINSHIP (Cochin Shipyard Limited): Score: 16

Low Burst Power Scores: Steady Climbers

A lower score indicates that a stock is less volatile, potentially offering more sustained, albeit slower, upward trends. Such stocks have fewer sudden price spikes, potentially offering more stable growth over time. A steadier price movement makes them suitable for less volatile swing trades, or positional trades.

AUROPHARMA (Aurobindo Pharma Limited): Score: 2

KEC (KEC International Limited): Score: 6

KPRMILL (K.P.R. Mill Limited): Score: 4

MRF (MRF Limited): Score: 1

Customizing the Burst Power Score

The Burst Power score isn't a one-size-fits-all metric. You can adjust the lookback period to to align with your trading horizon.:

Short-Term Focus (3-12 Months): Analyzes recent market behavior, which might be more relevant for day traders and short-term swing traders.

Long-Term Focus (3-5 Years): Provides a broader view of the stock's historical performance, useful for positional trades.

Another customisation here is to count a move only when the closing for the day is strong. For this, we have an additional filter to see if close is within the chosen % of the range of the day. Closing within the top 1/3, for instance, indicates a way more bullish day tha, say, closing within the bottom 25%.

The indicator also marks out days with significant moves. You can choose to hide or show the markers on the candles/bars.

Limitations and Considerations

While the Burst Power score is a valuable tool, it's important to remember:

No Guarantees: Past performance doesn't predict future results. A high score doesn't ensure future price bursts. The nature/character of a stock can change over time.

Use as Part of a Holistic Strategy: The Burst Power score should complement, not replace, other forms of analysis.

Conclusion

The Burst Power score offers a fresh lens through which to view stock momentum. By quantifying a stock's historical propensity for significant moves, it empowers traders to make more informed decisions aligned with their trading goals.

Whether you're chasing the next big breakout or seeking steady growth, understanding the Burst Power score can help you navigate the complex landscape of the stock market with greater confidence.

Ready to incorporate the Burst Power score into your trading toolkit? Start by analyzing your favorite stocks and see how this metric aligns with your trading strategy. Remember, knowledge is power—but only when applied wisely.

Link to the TradingView Script

Here is the link to the Burst Power indicator for Tradingview:

Sir mini mode mein, size of table change nahi paa raha hai.

Any option to do it?

Wonderful