Easy Earnings Comparison (EEC) is a situation where there is a high probability of reporting blockbuster results in the upcoming quarter. The concept of EEC was explained in the book ‘Insider Buy Superstocks’ by Jesse Stine.

The concept of Easy Earnings Comparisons (EEC) can give us a better idea of when a stock’s earnings can be considered worthy of news headlines. Selecting stocks with EEC can be a smart strategy because big year-over-year growth can create excitement around a stock, leading to inflows of liquidity & a rise in the stock price.

What is an Earnings Comparison?

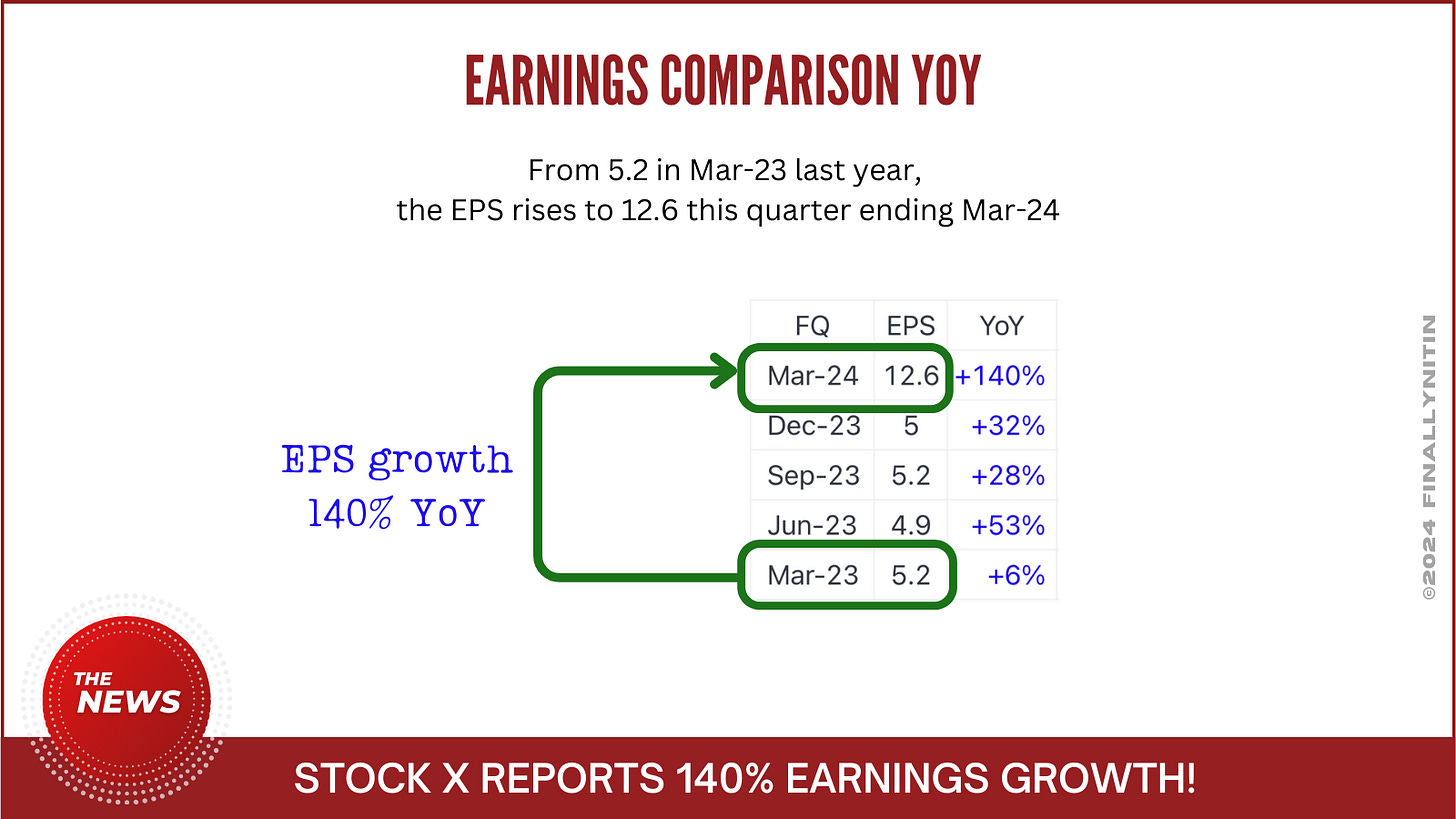

An earnings comparison looks at a company’s earnings (or sales) from one quarter to the same quarter in the previous year. This is called an Year-over-Year (YoY) comparison. For example, if a company had an EPS of 5.2 last year and this rises to 12.6 this year, that's a 140% increase. Investors love seeing big increases like this because it shows the company is growing quickly.

Why Do Easy Earnings Comparisons Matter?

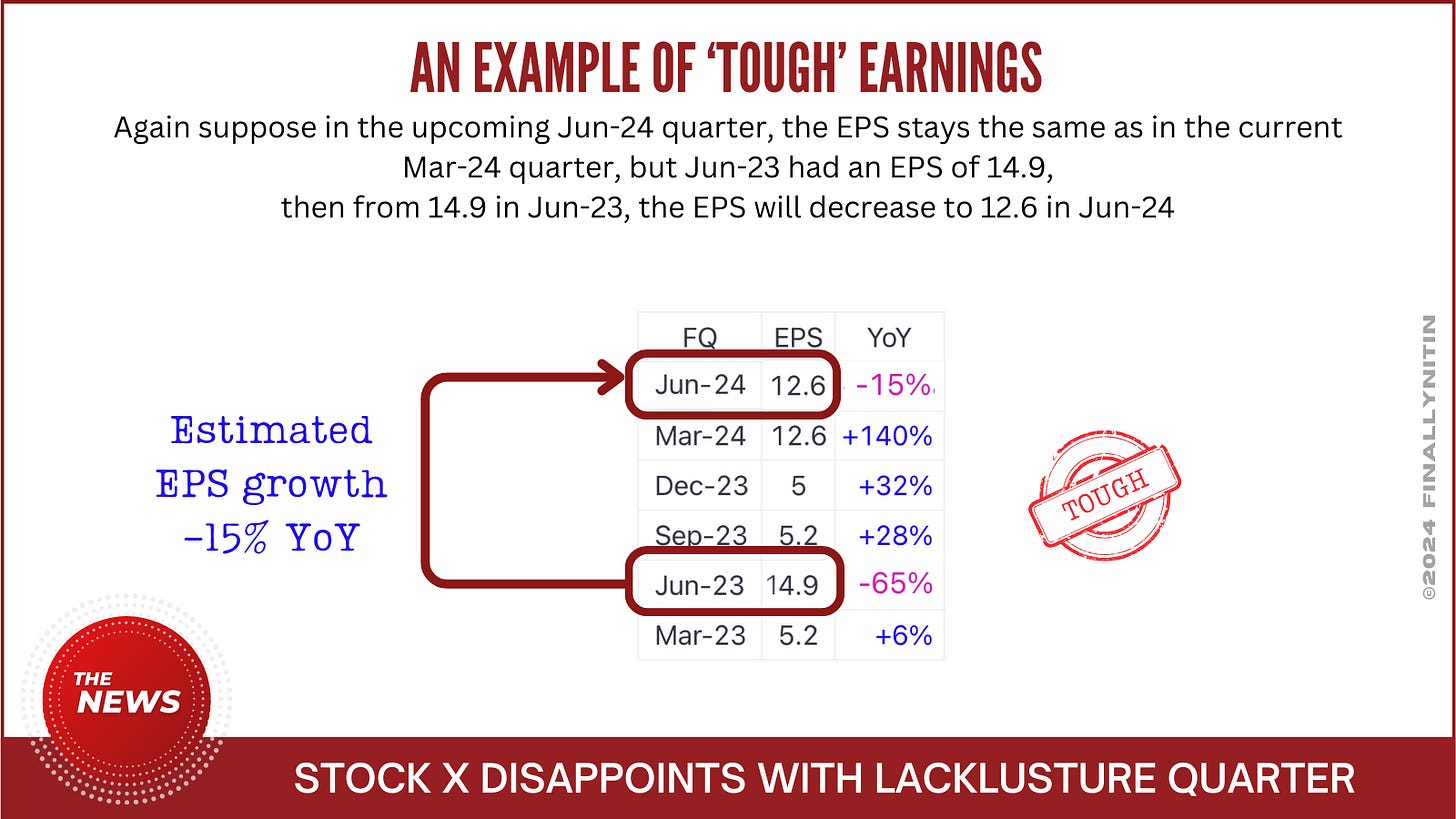

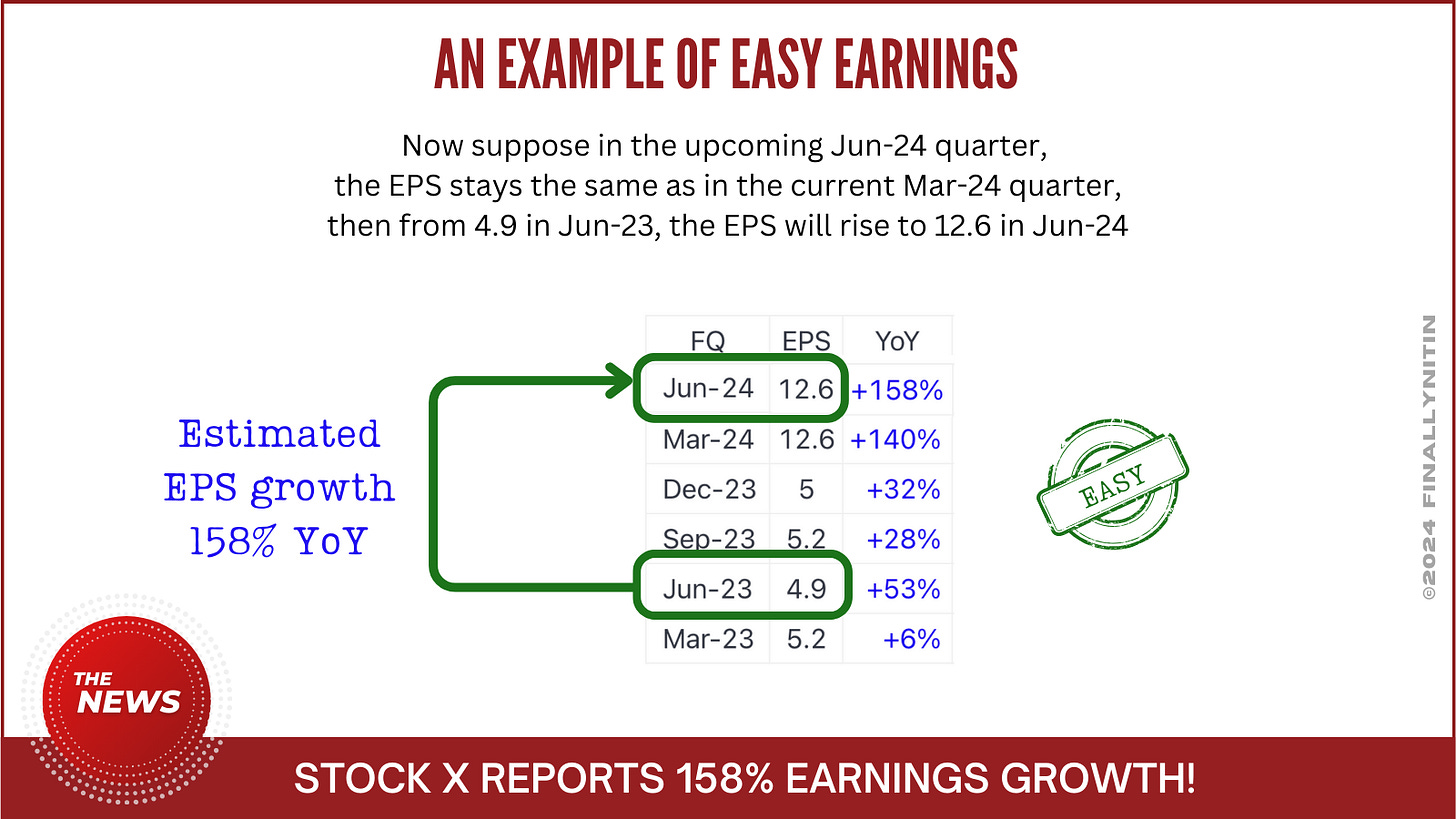

Now, let’s say the company posted an EPS of 12.6 again next quarter, but last year it had an EPS of 14.9 in that same quarter. Even though the company is still making money, the year-over-year comparison shows a decline, which might not impress investors. They might think the company isn't growing as fast anymore and lose interest in the stock.

To avoid this, we look for stocks with easy earnings comparisons coming up. This means we look for companies that are expected to show big growth when comparing their earnings to the same period last year.

How to Spot a Good EEC Opportunity

Look at the EPS of same quarter last year: Check what was the EPS in the same quarter last year. If the upcoming quarter is June 2024 (for example), then we need to look at the EPS of June 2023.

Look at the current quarter’s EPS: If the EPS of the current quarter (March 2024) are much higher than what the company earned 3 quarters back (June 2023) last year, it’s a good sign. Our assumption is that the company will at least post the same EPS in the upcoming June 2024 quarter.

Check for One-Time Events: Make sure the earnings growth is not just due to one-time events or other income.

Compare the Numbers: If the comparison shows a significant increase, for example, if you expect 143 this year compared to 2.3 last year, that’s a good jump. Headlines like “Stock X reports 500% profit growth” will attract a lot of attention.

The easy way to calculate easy earnings

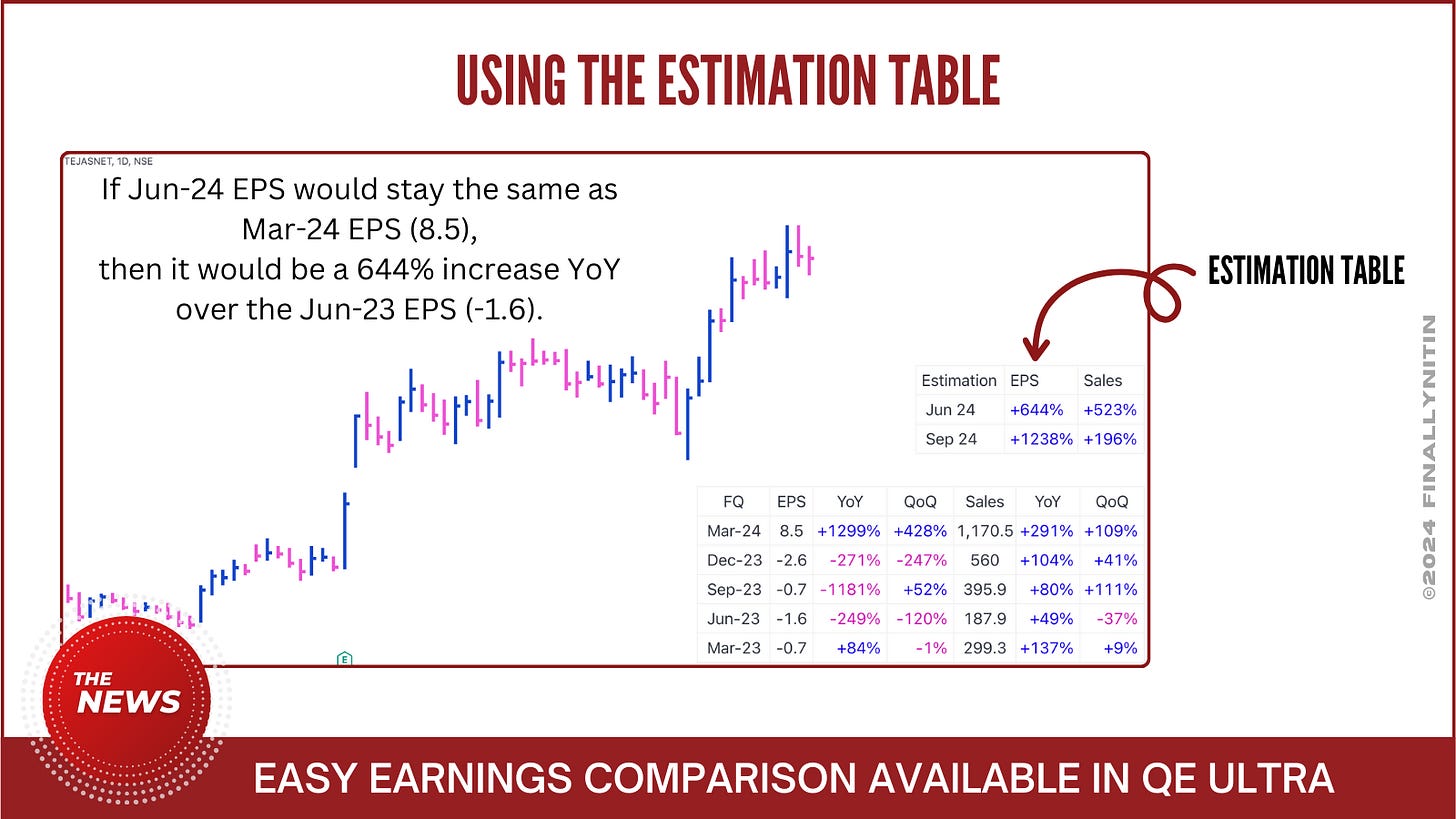

The QE Ultra script for TradingView has a companion estimation table that automatically displays the EEC (both EPS & sales) for the next 2 quarters.

Final Thoughts

Understanding the concept of Easy Earnings Comparisons can help you select potential winning stocks. By focusing on companies with strong year-over-year growth, you can make more informed investment decisions. Remember to do your research, compare the numbers, and watch out for any one-time events that might skew the results. Happy trading!

How is estimation calculated?

The script link doesn’t work.