→ Hard-money market

→ Anticipating tough times for the bulls.

→ Swing portfolios should be hold their positions with strict trailing stop losses, ready to fold back if the bears strike.

⦿ Bias: Positive

⦿ Breadth: Improving

⦿ Momentum: Negative but improving

⦿ Swing: Downswing under strain

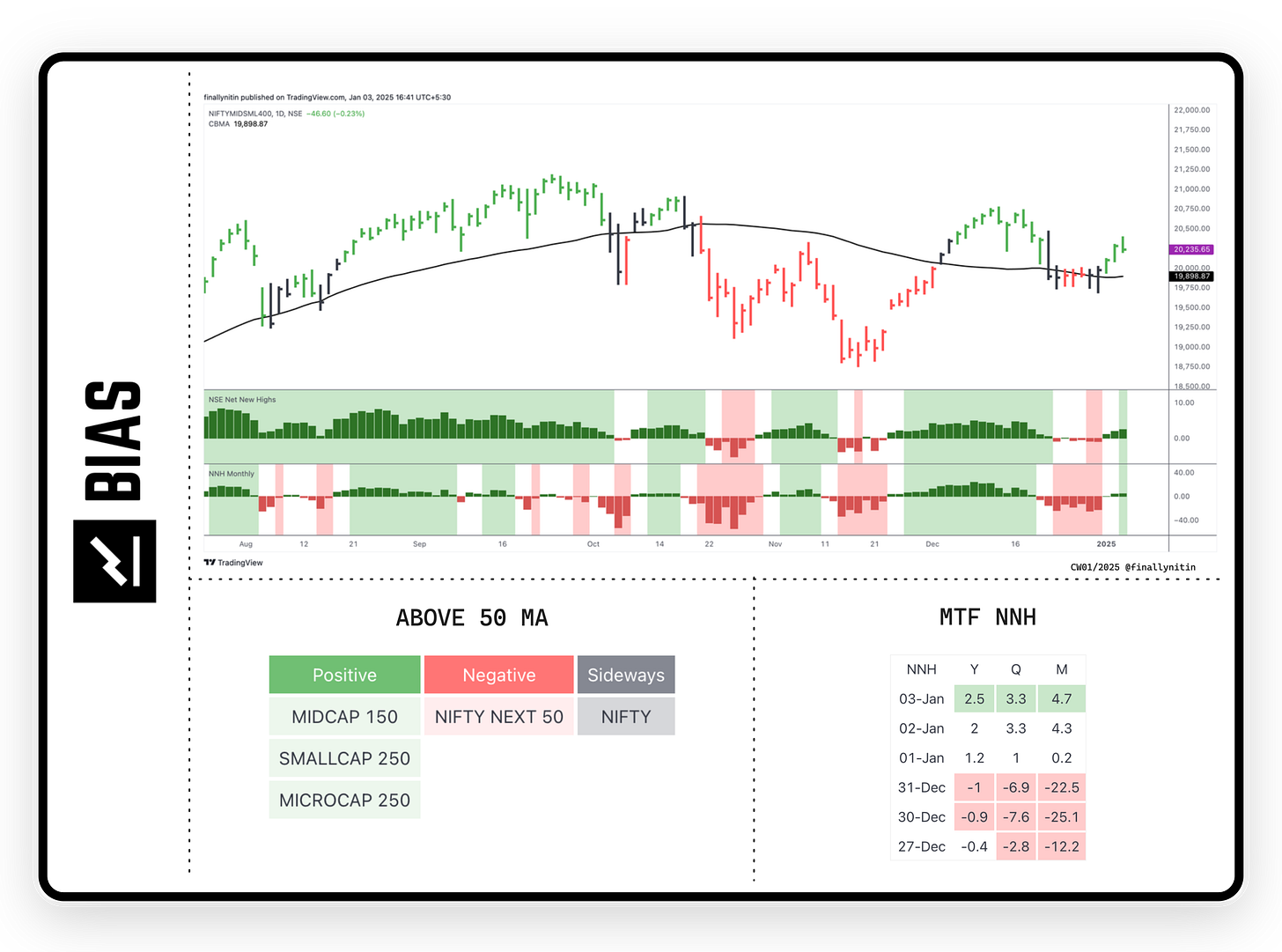

Bias → Positive

After turning negative last week, the bias is now positive.

52-week Net New Highs are positive for past 3 consecutive days.

The Monthly (20-day) NNH are also positive for past 3 consecutive days.

Majority of indices above the 50-day MA for past 3 consecutive days. The large-cap indices are below their 50-day MA.

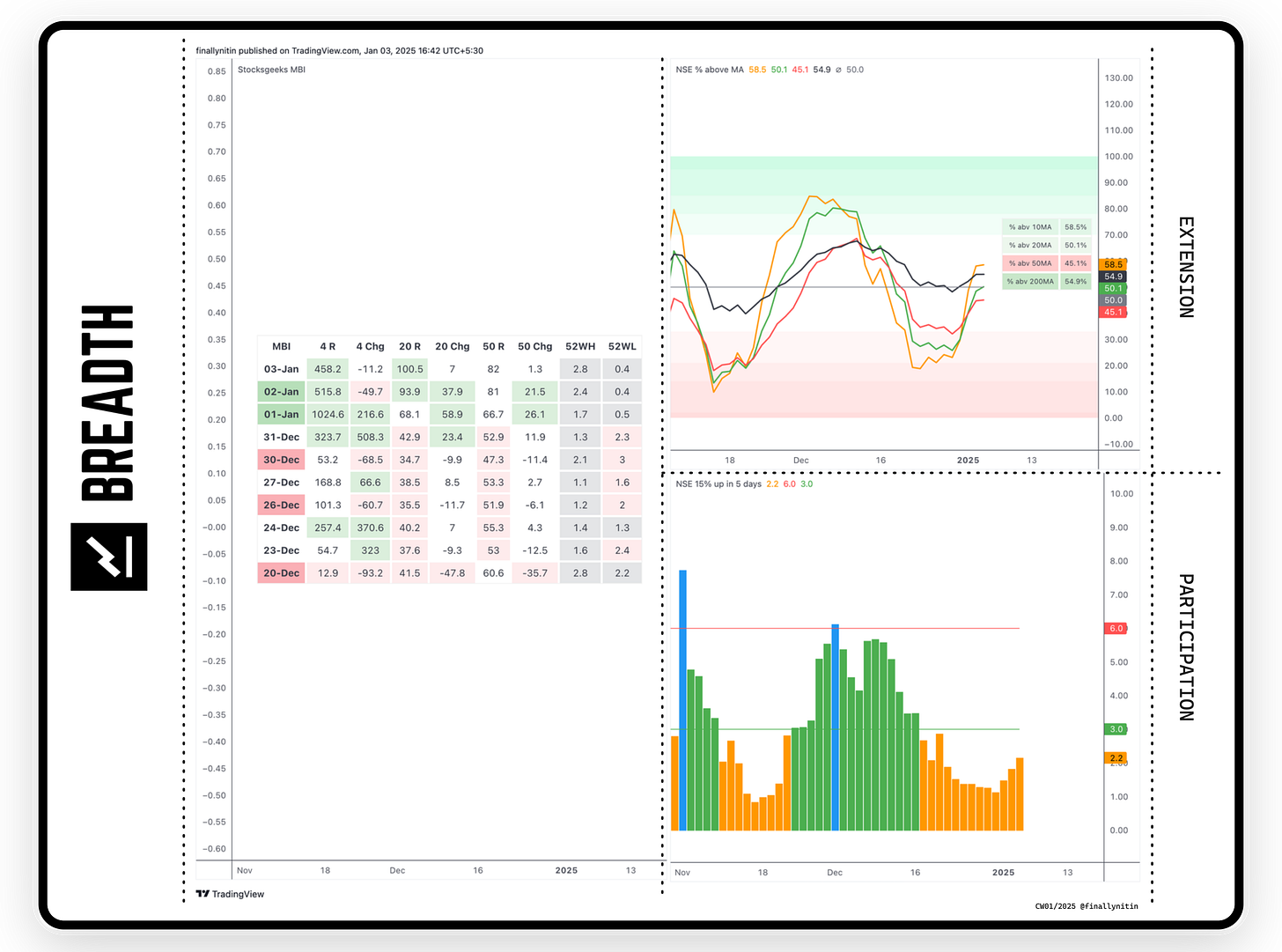

Breadth → Improving

█ Breadth with regard to extension: The % of stocks above the 10-day MA & 20-day MA are now above the 50% mark. Till the 10-day MA line stays above the 20-day MA line, we are in a short-term bullish swing.

The % of stocks above the 50-day MA stay below the 50% bullish threshold for 3 weeks now.

The % of stocks above the 200-day MA are again above the 50% threshold.

█ Breadth with regard to participation: Stocks 15% up in 5 days have again improved this week, but we still haven’t got even a +3 day, let alone a +6 day. This shows that the broader market participation still need lots of improvement from here.

Stocksgeeks MBI began this week with a red day, but then turned green on the first day of the new year with 1000+ numbers. But on the following 2 days, we did not get the expected follow-through. The 20R numbers have turned green again, while the 50R are yet to. This indicates that the downtrend is still not over on higher timeframes. From here, the bulls need to stamp their presence with another strong day, failing which the rally is at risk of fizzling away.

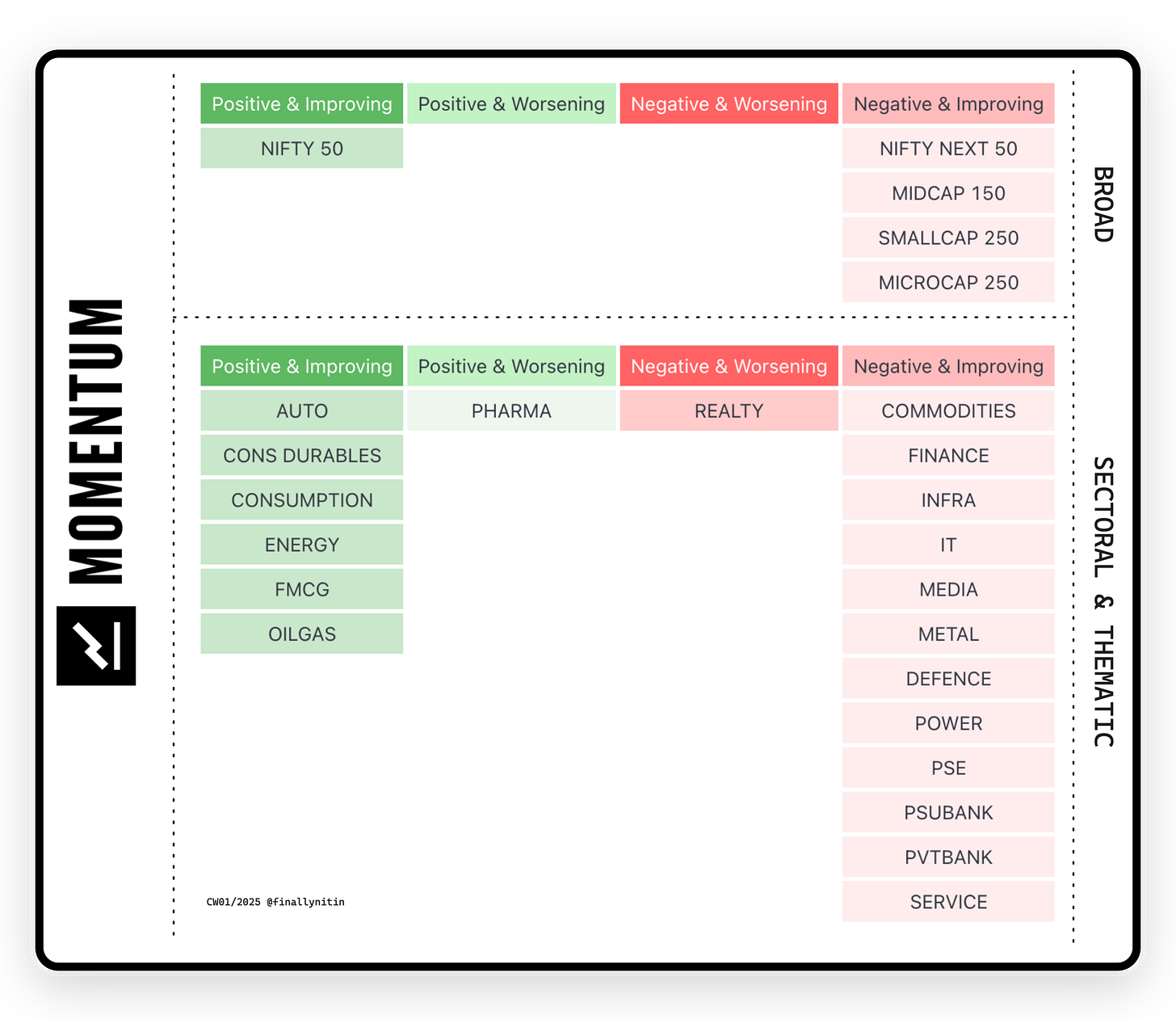

Momentum → Negative but improving

Most broad & sectoral indices are having negative but improving momentum. Nifty has positive & improving momentum.

Auto, Consumption, FMCG, OilGas are notable sectoral indices with positive & improving momentum.

Realty is the only index having negative & worsening momentum.

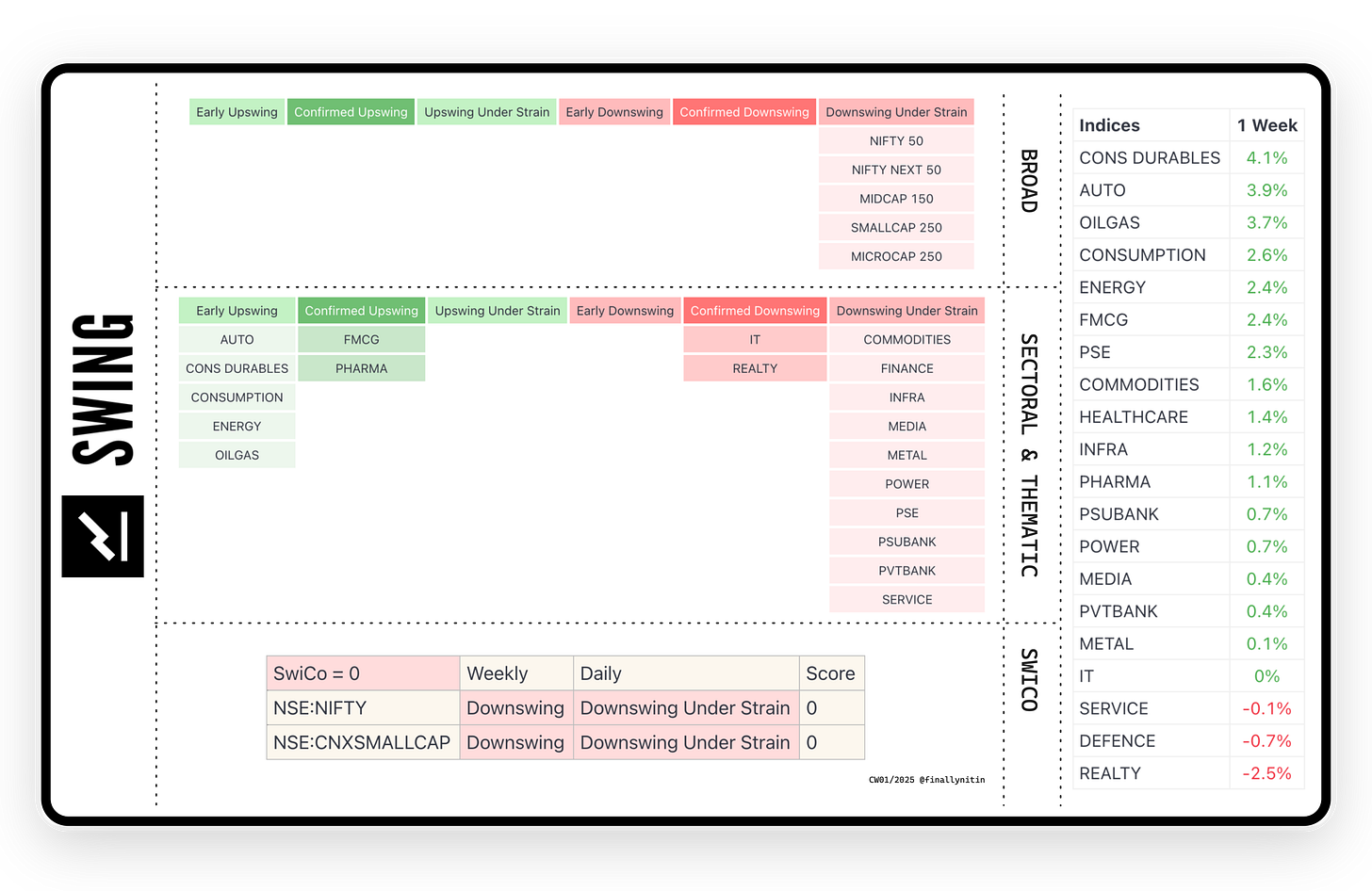

Swing → Downswing Under Strain

Most broad & sectoral indices are in a downswing under strain.

FMCG, Pharma/Healthcare are still in a confirmed upswing. Auto, Consumer Durables, Energy & OilGas are the only sectoral indices in an early upswing. IT & Realty are in a confirmed downswing.

Surprisingly, Swing Confidence is still 0, which means that the portfolio should not be having any open risk. This is a very conservative stance. Just one more bullish day will improve the SwiCo score.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.