→ No-money market

→ Anticipating a reversal day (but overall bearish continuation)

→ Stay in all-cash. Wait for a gap-down & undercut for reversal day trading.

⦿ Bias: Negative

⦿ Breadth: Weak & Oversold

⦿ Momentum: Negative & worsening

⦿ Swing: Confirmed Downswing

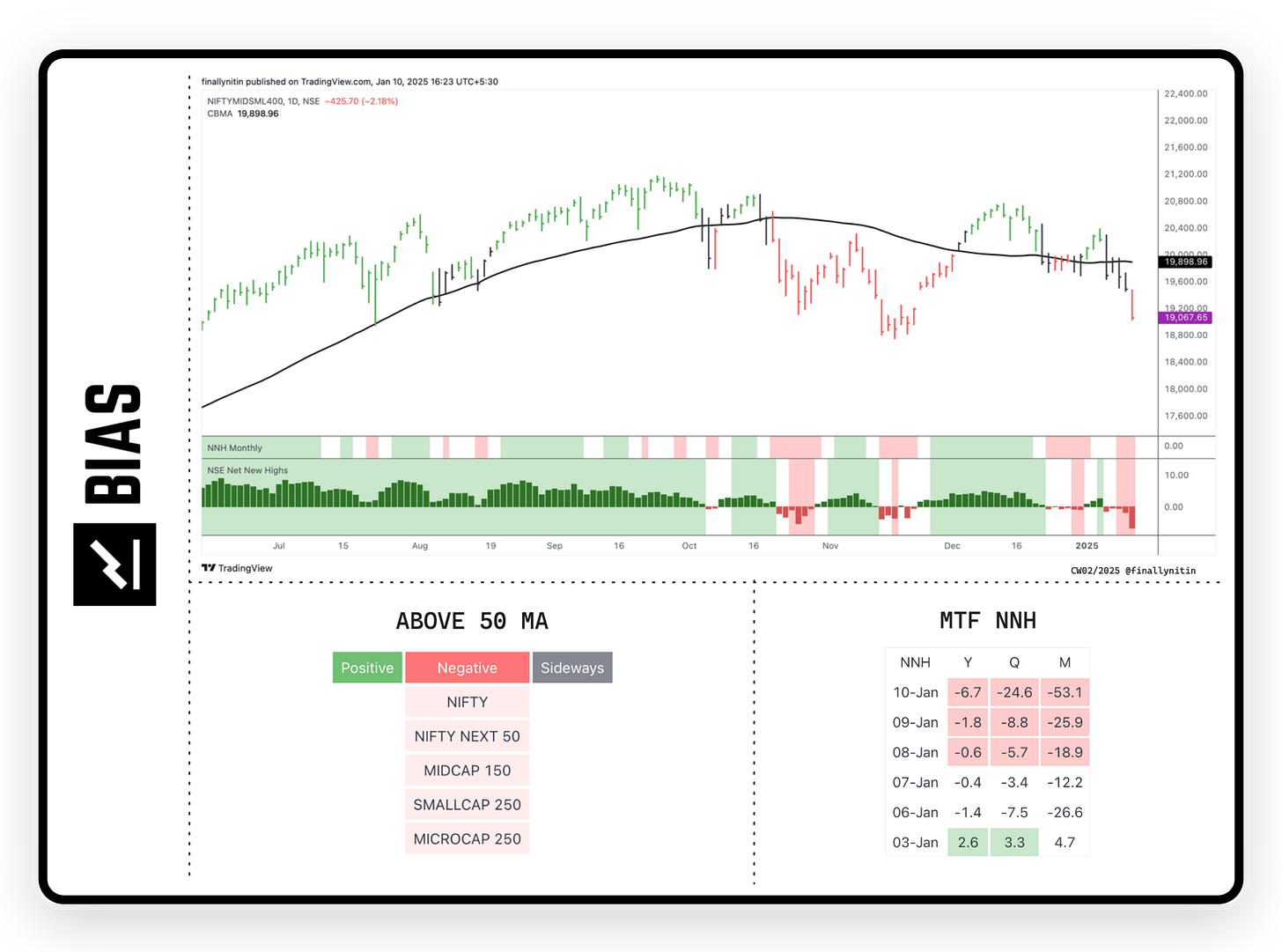

Bias → Negative

After turning briefly positive last week, the bias is now negative.

52-week Net New Highs are negative for past 3 consecutive days.

The Monthly (20-day) NNH are also negative for past 3 consecutive days.

All indices are below the 50-day MA for past 3 consecutive days.

Breadth → Weak & Oversold

█ Breadth with regard to extension: The % of stocks above the 10-day MA & 20-day MA are below the 50% mark, & in oversold territory, with till some more scope to touch one-digit figures.

The % of stocks above the 50-day MA stay below the 50% bullish threshold for 4 weeks now.

The % of stocks above the 200-day MA are again below the 50% threshold. In the coming days, sustenance of these levels for more than a month can confirm the transition of the ongoing bull market into a bear one.

█ Breadth with regard to participation: Stocks 15% up in 5 days have now dried down to historic lows. This shows that there is practically no broader market participation on the bullish side.

Stocksgeeks MBI began this week with a red day, followed by a bounce, & progressively bearish days since then. We have ended the week with single digit 4R numbers, which are slightly higher than the ones we got on 6th Jan. The 20R & 50R numbers have turned red again, which indicates that we are in a downtrend on all timeframes. A gap-down open on Monday will set the stage for an immediate technical reversal.

Momentum → Negative & worsening

Most broad & sectoral indices are having negative & worsening momentum.

IT is the only index with positive & improving momentum.

FMCG & Oil/Gas have positive but worsening momentum.

Swing → Confirmed Downswing

Most broad & sectoral indices are in a confirmed downswing.

FMCG is still in a confirmed upswing. Auto, Pharma & Oil/Gas are in an early downswing. IT index is an early upswing.

Swing Confidence is 0, which means that the portfolio should not be having any open risk.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.

How your giving score for all these your 4, if i want to learn this where it is availble in any books of any courses or any thing available in social media, it would be highly appreciate if you can suggest me

Hi nitinbhai, superb would you please briefly explain how you make swing and momentom if possible..