→ No-money market transitioning into a hard-money market

→ Anticipating bullish continuation of the counter-trend rally.

→ Conservative swing portfolios should continue staying in all-cash, but ready to deploy.

⦿ Bias: Negative

⦿ Breadth: Weak (but improving)

⦿ Momentum: Negative but improving

⦿ Swing: Early Upswing

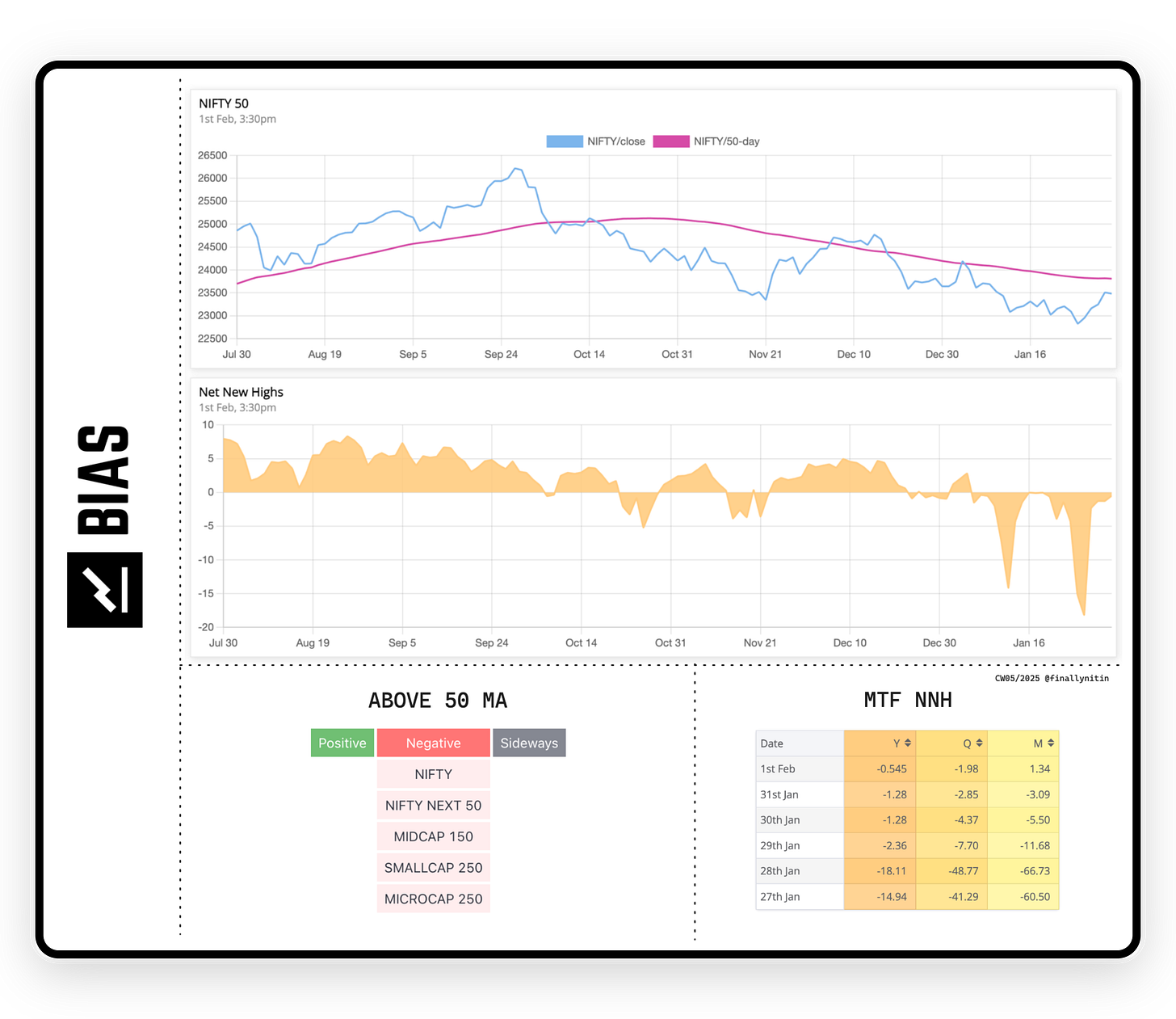

Bias → Negative

The bias stays negative for the 2nd week now.

52-week Net New Highs are negative for past 3 consecutive days.

The Monthly (20-day) NNH are no longer negative for past 3 consecutive days.

All indices are below the 50-day MA for past 3 consecutive days.

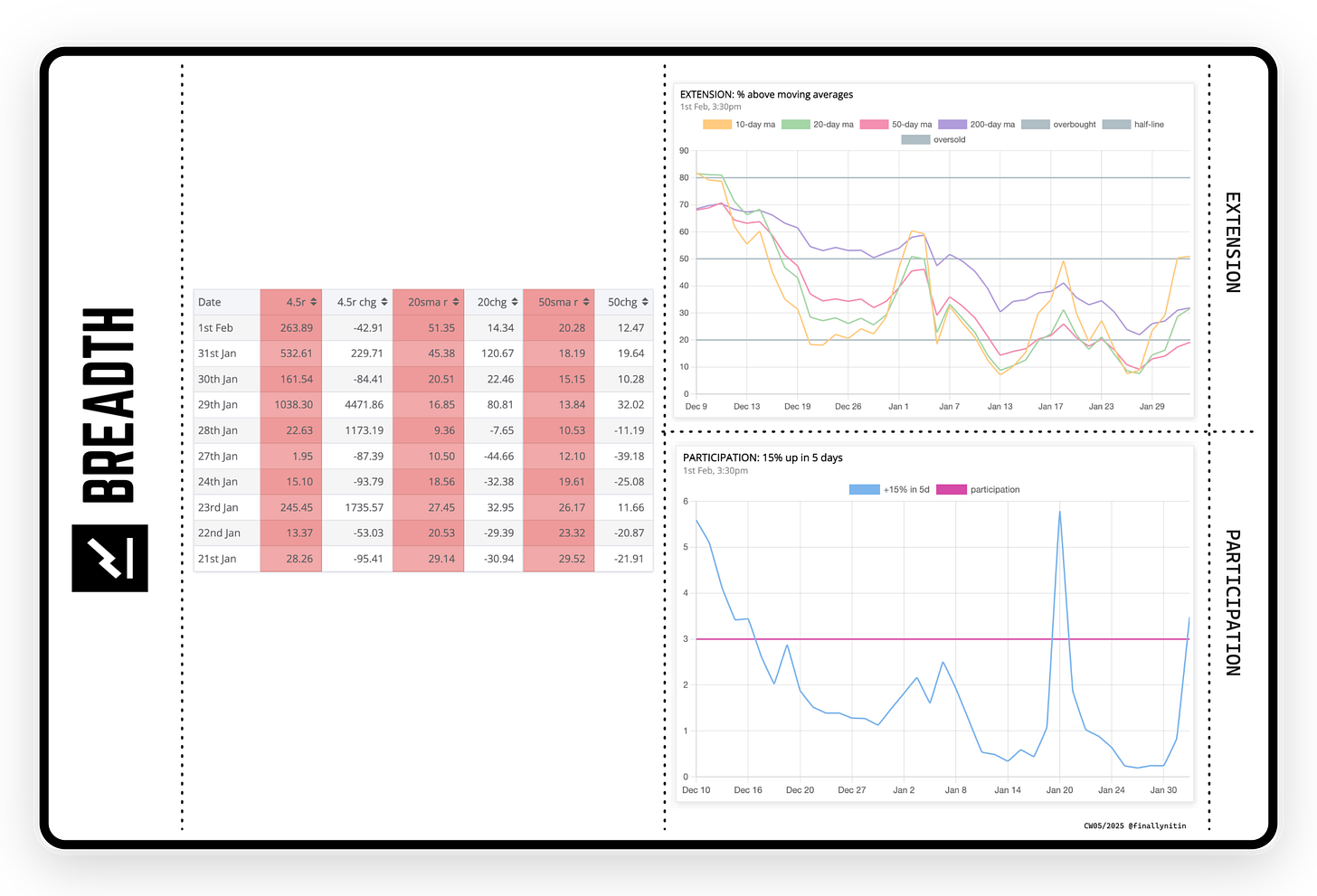

Breadth → Weak (but improving)

█ Breadth with regard to extension: The % of stocks above the 10-day MA is approaching the 50% mark, while the % of stocks above the 20-day MA are still well below the 50% mark. As the 10 line is above the 20, we are in an upswing.

The % of stocks above the 50-day MA stay below the 50% bullish threshold for 7 weeks now.

The % of stocks above the 200-day MA are sustaining below the 50% threshold for 4 weeks now. Sustenance of these levels for more than a month (i.e. one more week) can confirm this ongoing transition of the bull market into a bear one.

█ Breadth with regard to participation: Stocks 15% up in 5 days stay dried down through the week, except for the budget day (Saturday), where we have witnessed a burst. If this burst gets follow-through on Monday, we can infer improved market participation on the bullish side.

Stocksgeeks MBI has stayed in the red trend for 4 weeks now. We had 2 bullish days in between, but that was insufficient for a stance change in the MBI day color. The 20R numbers are improving now & some more nudge might push them into green territory. The 50R numbers continue to stay red, which indicates the continuation of downtrend on higher timeframes.

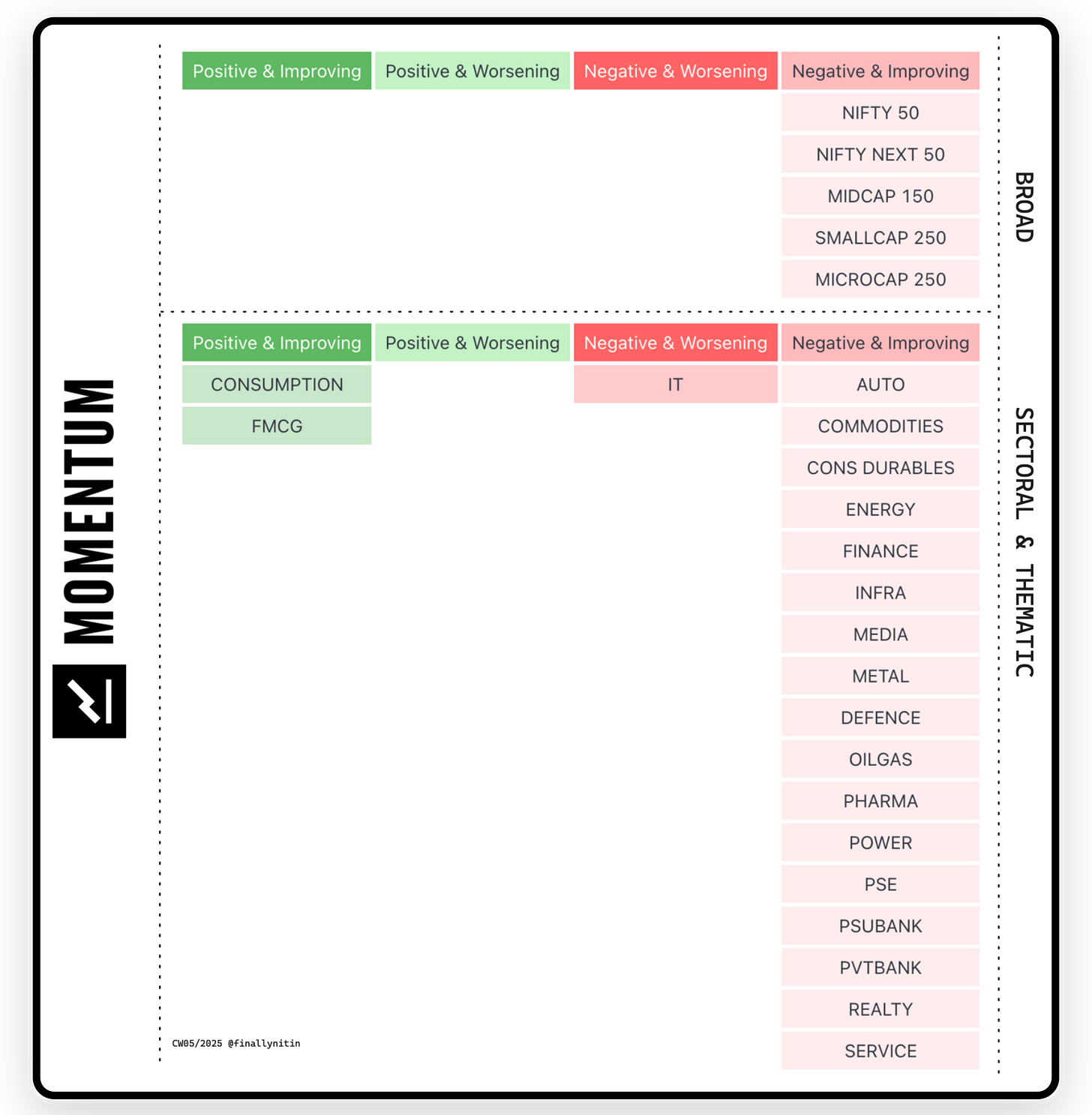

Momentum → Negative but improving

All broad indices & most sectoral indices are having negative but improving momentum.

IT index has negative & worsening momentum.

Consumption & FMCG are having positive & improving momentum.

Swing → Early Upswing

Most broad & sectoral indices are in a early upswing.

Commodities, Finance, Banks & FMCG are in a confirmed upswing. IT & metal are in a confirmed downswing.

Swing Confidence is 25, which means that the portfolio can take the minimum possible open risk.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.

Thank you!