→ Hard-money market, with very few setups

→ Anticipating choppy continuation of the counter-trend rally.

→ Swing portfolio 30% invested. Will only deploy further if quality setups emerge.

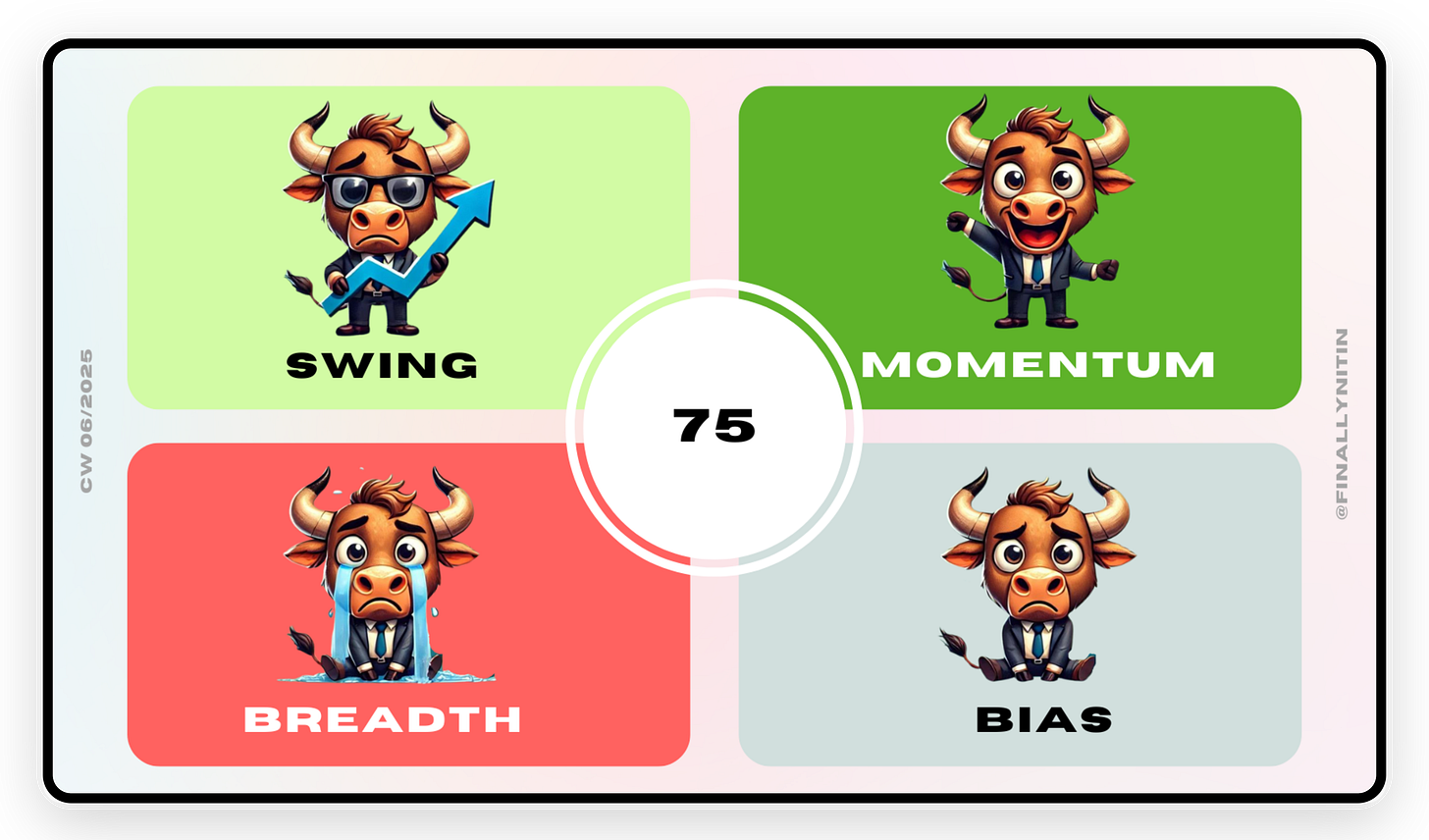

⦿ Bias: Neutral

⦿ Breadth: Weak

⦿ Momentum: Positive & improving

⦿ Swing: Early Upswing

When the components of the quadrant are in complete dissociation with each other, this indicates a choppy & indecisive market.

Bias → Neutral

After becoming negative last week, the bias is neutral now.

52-week Net New Highs are no longer negative for past 3 consecutive days.

The Monthly (20-day) NNH are now positive for past 3 consecutive days.

All indices are still below the 50-day MA for past 3 consecutive days.

Breadth → Weak

█ Breadth with regard to extension: The % of stocks above the 10-day MA has again dipped below the 50% mark, while the % of stocks above the 20-day MA has throughout stayed below the 50% mark. As the 10 line is above the 20, we are still in an upswing, but the graph is now falling.

The % of stocks above the 50-day MA stay below the 50% bullish threshold for 8 weeks now.

The % of stocks above the 200-day MA are sustaining below the 50% threshold for 5 weeks now. Sustenance of these levels for more than a month has now confirmed this ongoing transition of the bull market into a full-fledged bear market.

█ Breadth with regard to participation: Stocks 15% up in 5 days gave a burst on the budget day (Saturday), but this burst did not get any follow-through during this week. This shows that there is still sparse market participation on the bullish side.

Stocksgeeks MBI, after staying in the red trend for 4 weeks, finally turned green. The numbers were not extremely strong, & were further followed by only very subdued numbers. The 20R numbers have still not crossed over into green territory. The 50R numbers continue to stay red, which indicates the continuation of downtrend on higher timeframes.

Momentum → Positive & improving

Most broad indices are now having positive & improving momentum. Only the Smallcap index still has negative but improving momentum.

Most sectoral indices also are now having positive & improving momentum.

IT & FMCG indices have negative & worsening momentum.

Swing → Early Upswing

Most broad indices are in an early upswing. The larger-cap indices, Nifty 50 & Next 50, are in a confirmed upswing.

Most sectoral indices are in a confirmed upswing. Indices still in downswing are Power, FMCG, energy, Oil/Gas & PSE.

Swing Confidence is 75, which means that the portfolio can take less than the maximum possible open risk.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.