We are experiencing improving momentum in a downswing within a downtrending bear market.

The strategy is to not participate until the improving momentum leads us into a fresh upswing with good participation.

⦿ Bias: Bear market

⦿ Trend: Downtrend

⦿ Swing: Early Downswing

⦿ Momentum: Positive & improving

Bias → Bear Market

From a long-term perspective, we are currently in a bear market.

Over 50% of stocks have remained below the 200-day moving average (MA) for 18 weeks.

Sustenance of these levels for more than a month has already confirmed that we are in a full-fledged bear market.

Even after three months in a bear phase, there is no significant improvement, and hardly 15 to 20 percent of stocks are above their 200-day moving average.

Trend → Downtrend

Last week’s sideways trend appears to have deteriorated further into a downtrend.

52-week Net New Highs have remained consistently negative for the past three days.

While all major indices have consistently stayed above their 50-day moving averages for the past three days, less than 50% of stocks have remained above their 50-day moving averages for the last three weeks.

The trend will again turn positive if the 52-week highs sustain above the 52-week lows and if more than 50% of stocks remain above their 50-day moving averages.

Swing → Downswing

We are currently in an early downswing.

While the MBI initially turned red and quickly reverted to green, the 4.5R numbers have remained very low. Watchlist feedback was decent on intraday timeframes, but we still are not seeing any follow-through moves on the daily timeframe. Heavy news flow emerged as the war-like scenario began unfolding, and technical analysis does not work efficiently under such situations.

Most broad indices have remained consistently below their 10-day moving averages. Over 50% of stocks continue to trade below their 10-day moving averages, and fewer stocks are above their 10-day moving average than their 20-day moving average.

Swing Confidence is 0, indicating that the portfolio should not have any open risk.

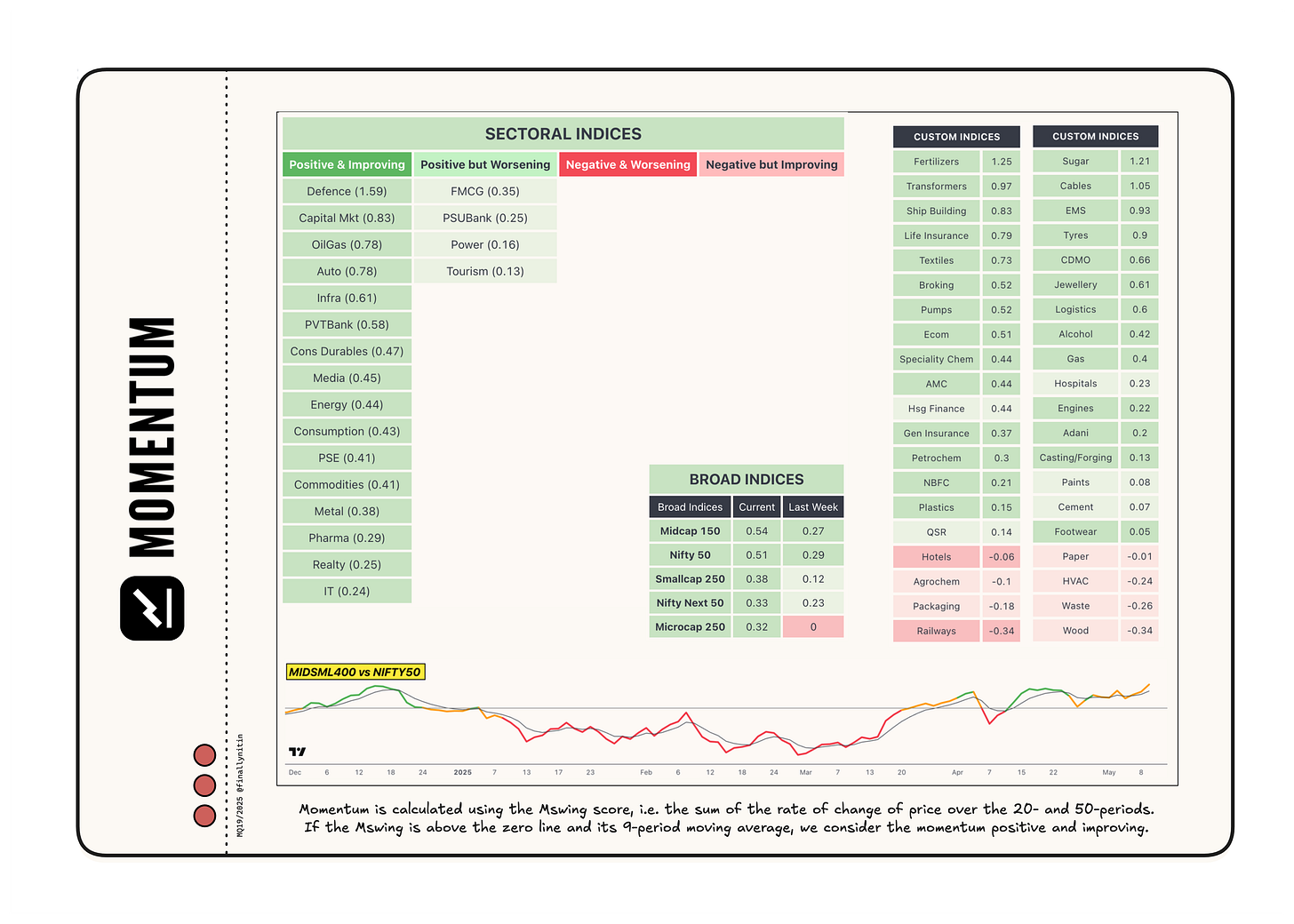

Momentum → Positive & improving

All broad indices exhibit positive momentum since the momentum score is above the zero line and their 9-period moving averages.

All sectoral indices have positive momentum.

Sugar, Fertilizers, Transformers, Cables, Ship-building, and EMS sectors are notable custom indices with positive and improving momentum.

That’s all for this week. If you'd like to know when I publish something new, subscribe to my newsletter, and you'll receive the latest directly in your inbox.