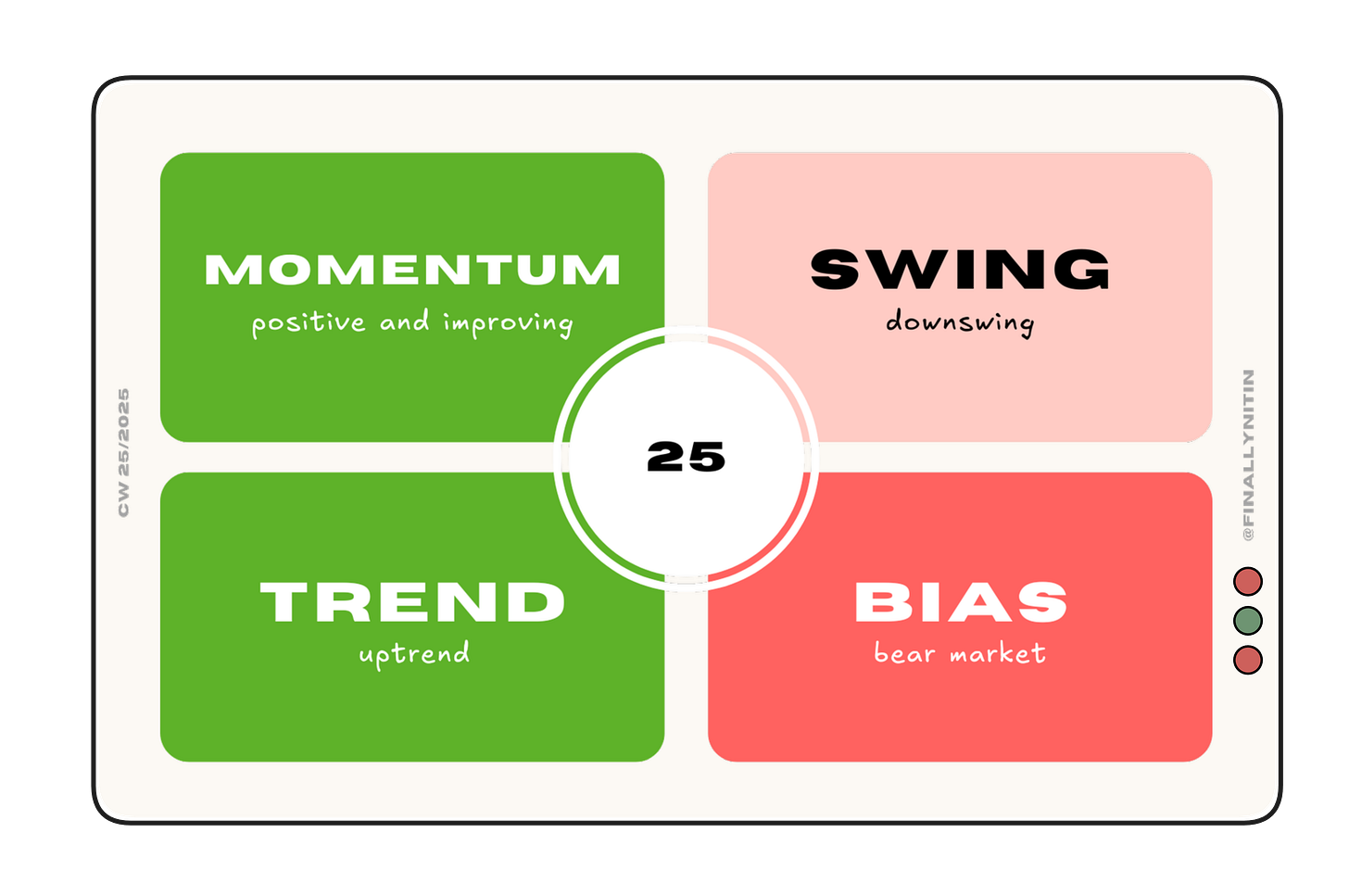

We are observing improving momentum in a downswing within an uptrending bear market.

A hard money environment with the majority of momentum stocks bouncing back after pulling back to their short-term moving averages.

Conservative swing portfolios should stay in cash.

⦿ Bias: Bear market

⦿ Trend: Uptrend

⦿ Swing: Downswing

⦿ Momentum: Positive and improving

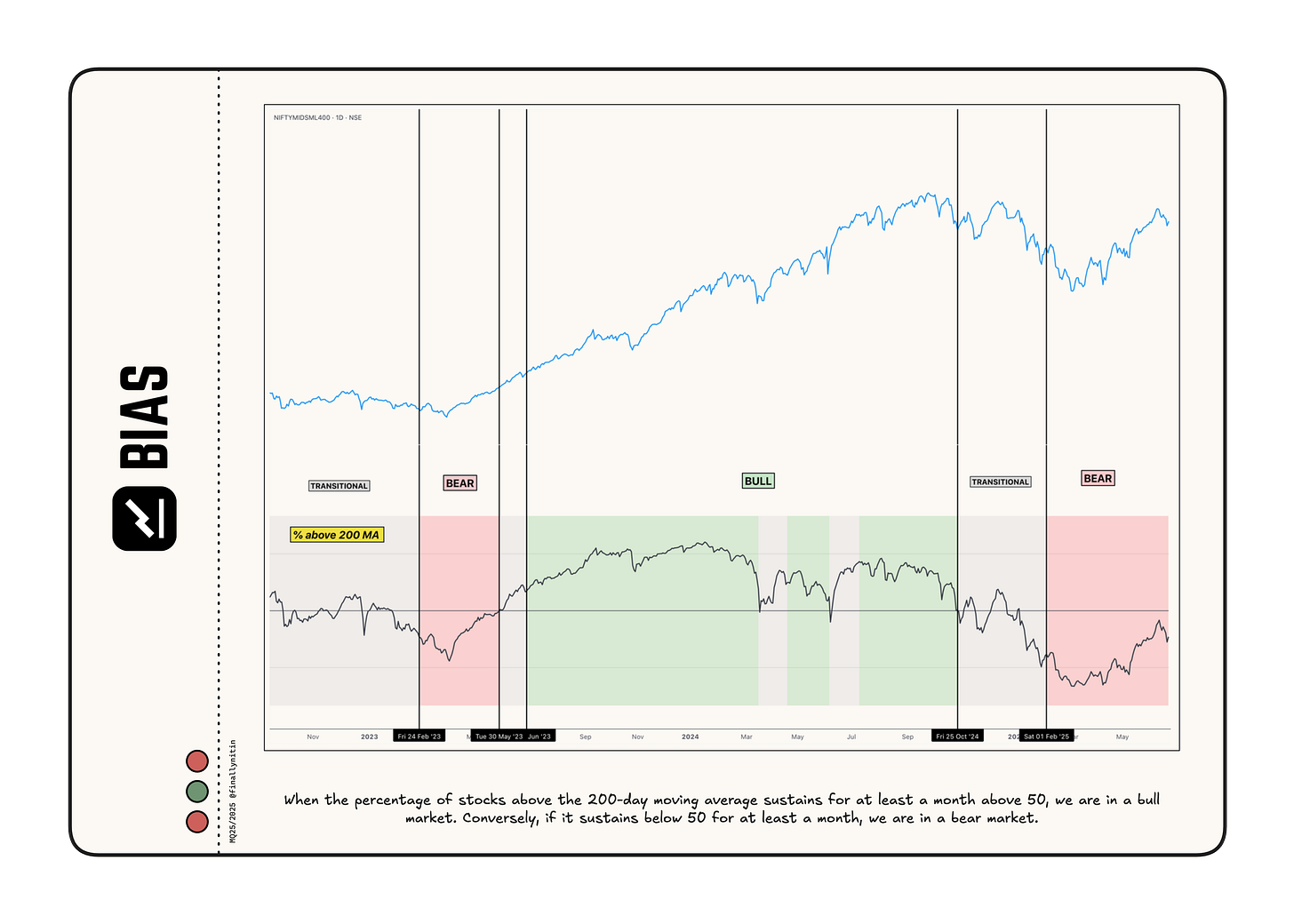

Bias → Bear Market

From a long-term perspective, we are still in a bear market.

Over 50% of stocks have remained below the 200-day simple moving average (SMA) for 24 weeks.

After a significant improvement after over three months in a bear phase, this week we saw a pullback, and now about 35 percent of stocks are positioned above their 200-day simple moving average.

When the percentage of stocks above the 200-day SMA rises above 50, we will enter a bear-to-bull transitional phase; if it remains above 50 for at least a month, we will be in a bull market.

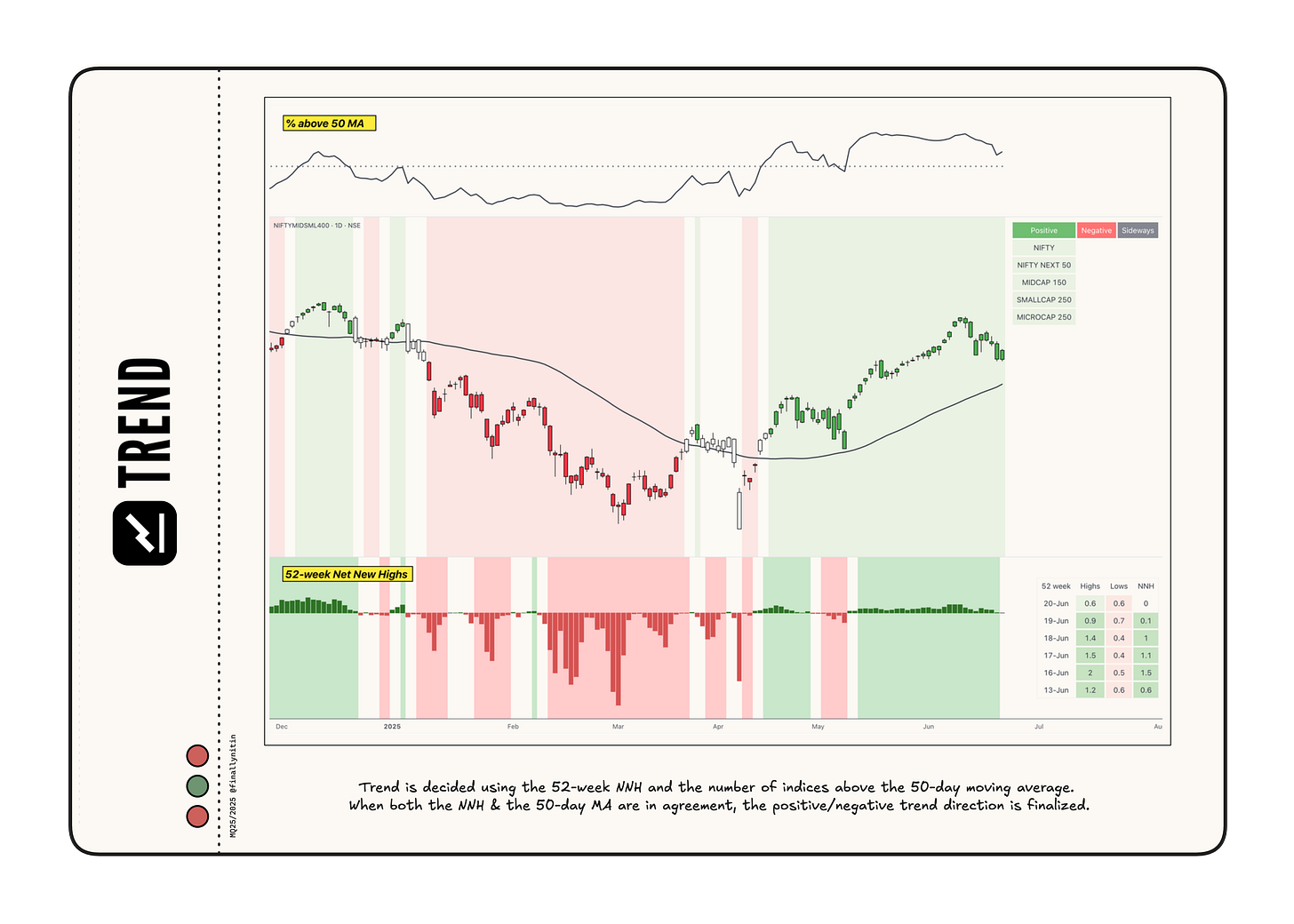

Trend → Uptrend

The market has been in an uptrend for the past six weeks.

52-week Net New Highs have remained consistently positive for the past three days, but are relatively worse than last week. They need to recover and then improve further so that we can enter a stronger uptrend.

For the past three days, all major indices have consistently remained above their 50-day moving averages, and about 65% of stocks have stayed above their 50-day moving averages.

The trend will turn negative again if the 52-week highs go below the 52-week lows and more than 50% of stocks fall below their 50-day moving averages.

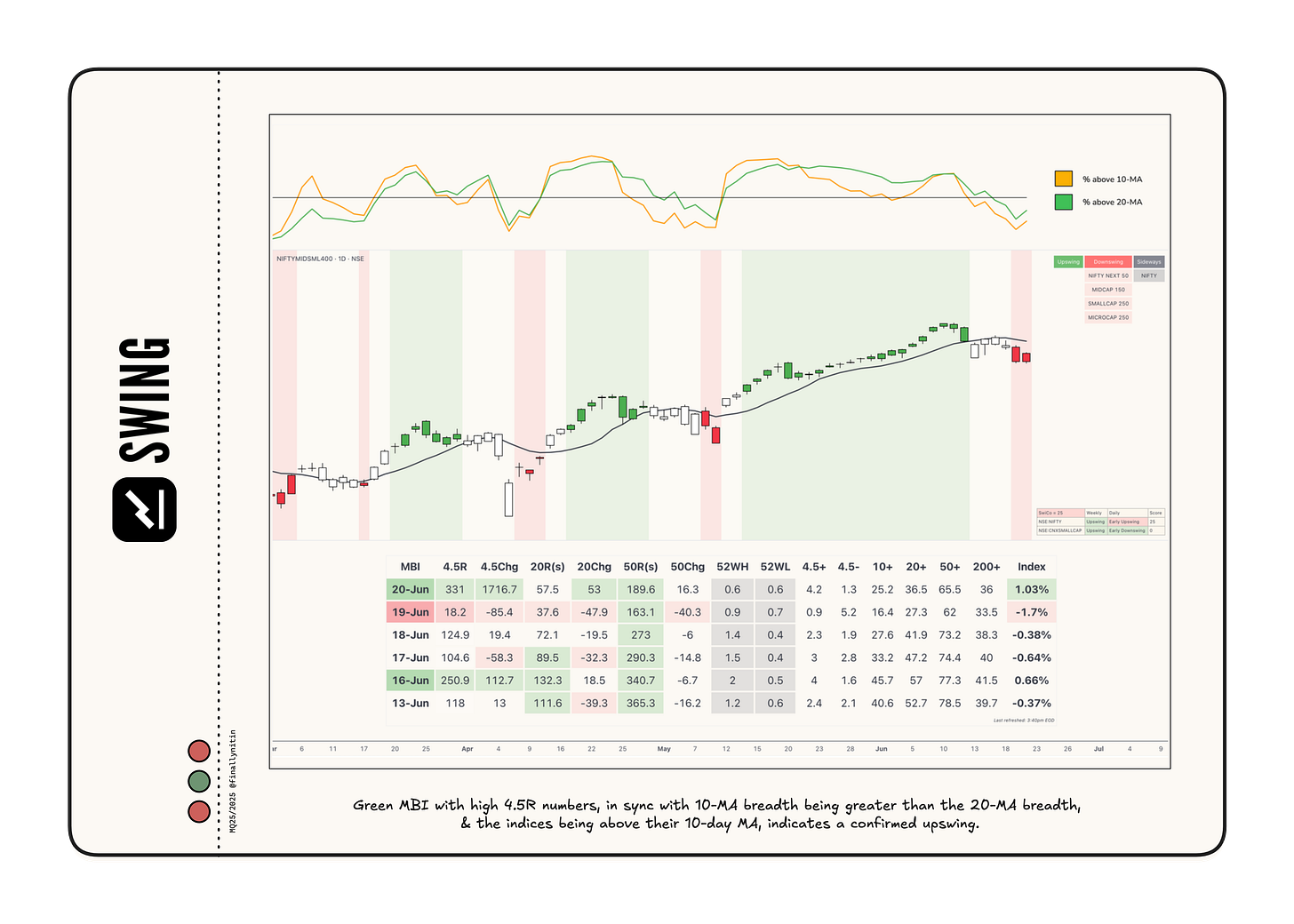

Swing → Downswing

After staying in an upswing for five weeks, the market is in a downswing now.

The MBI, continuing its worsening stance from last week, finally turned red on Thursday, only to bounce back and turn green on Friday. Even in this bounce-back, the 4.5R numbers didn’t even exceed 400. The upcoming week will determine whether the green MBI resumes with any meaningful strength.

Besides the Nifty 50, all other broad indices remained consistently below their 10-day moving averages. Only about 25% of stocks are trading above their 10-day moving averages, and fewer stocks are above their 10-day moving average than their 20-day moving average. We need a bullish day to position the 10 line above the 20, potentially leading to a fresh upswing.

Swing Confidence is at 25, indicating that the portfolio can maintain only the minimum allowable open risk.

Momentum → Positive and improving

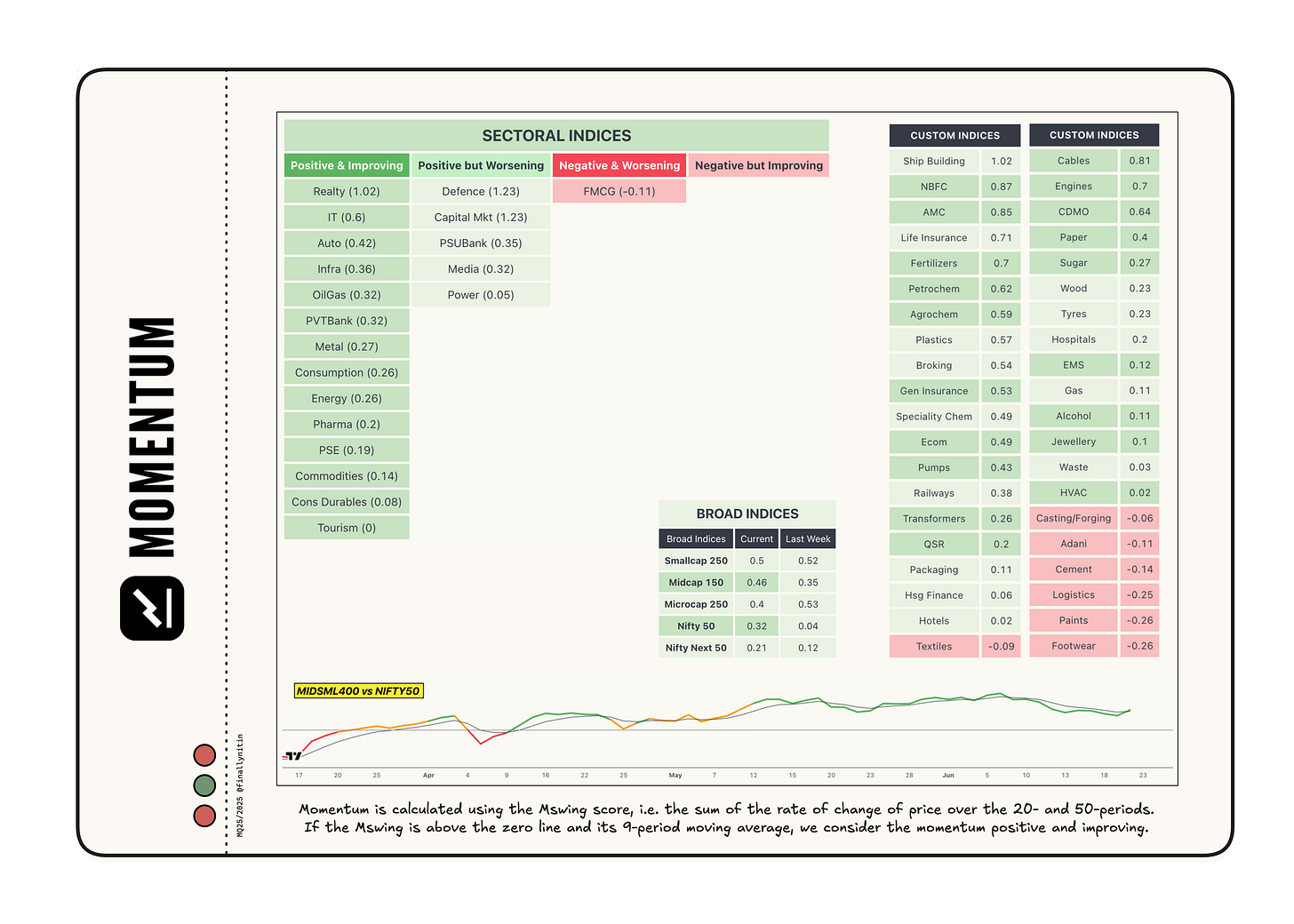

Most broad indices closed this week with a positive and improving momentum, as the momentum score stayed above the zero line and its 9-period moving average.

Most sectoral indices also have positive and improving momentum, with only the FMCG index having negative and worsening momentum. Defence, Capital markets, Realty, IT, and Auto are the top five indices regarding the momentum score.

Ship building, NBFC, AMC, Cables & Engines are notable custom indices with positive and improving momentum.

That’s all for this week. If you'd like to know when I publish something new, subscribe to my newsletter, and you'll receive the latest directly in your inbox.

Nitin Bhai pls write a substack on updated version of how to read market quadrant...It will be easier for us to relate to this as lots of tools has been updated continuously...Following you and learning a lot from you and chhirag bhai...thanks for being a guide in our trading jouney