We are witnessing improving momentum in an upswing under strain within an uptrending transitional market.

A hard-money environment with stock-specific follow throughs. Conservative swing portfolios can stay in cash, while aggressive ones should hold with strict trailing stop losses.

⦿ Bias: Transitional (bear to bull) market

⦿ Trend: Uptrend

⦿ Swing: Upswing under strain

⦿ Momentum: Positive and improving

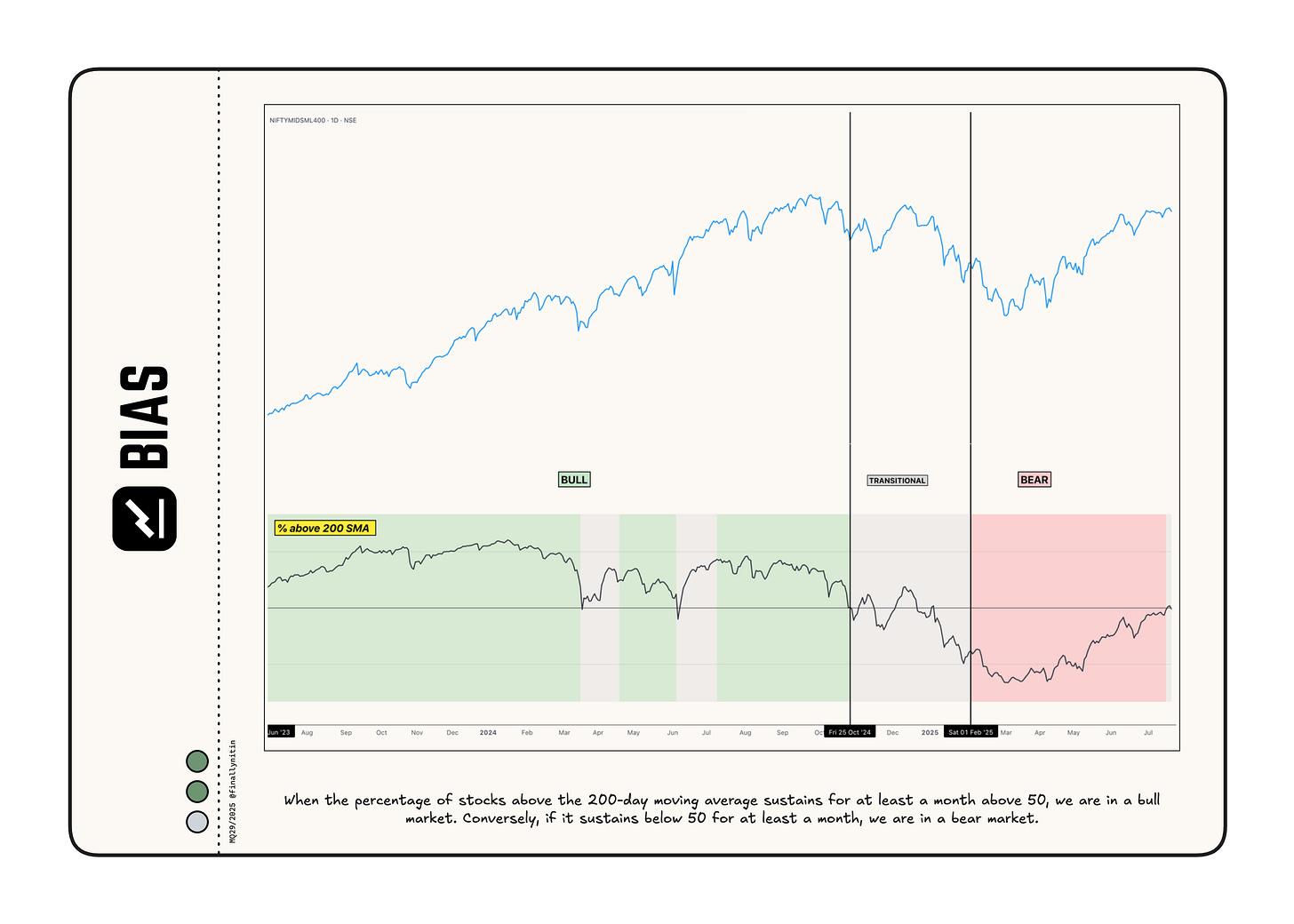

Bias → Transitional (Bear-to-Bull)

From a long-term perspective, we are now transitioning from a bear to a bull market.

After staying below the 200-day simple moving average (SMA) for 27 weeks, more than 50% of the stocks moved up the 200 SMA this week, and the market can now be said to have entered a bear-to-bull transitional phase.

We closed the week at almost the 50% mark, with approximately 49.5% of stocks positioned above their 200-day simple moving average.

When the percentage of stocks above the 200-day SMA remains above 50 for at least a month, we will be in a bull market. If, instead, it stays below 50 for a month, we will return to a bear market.

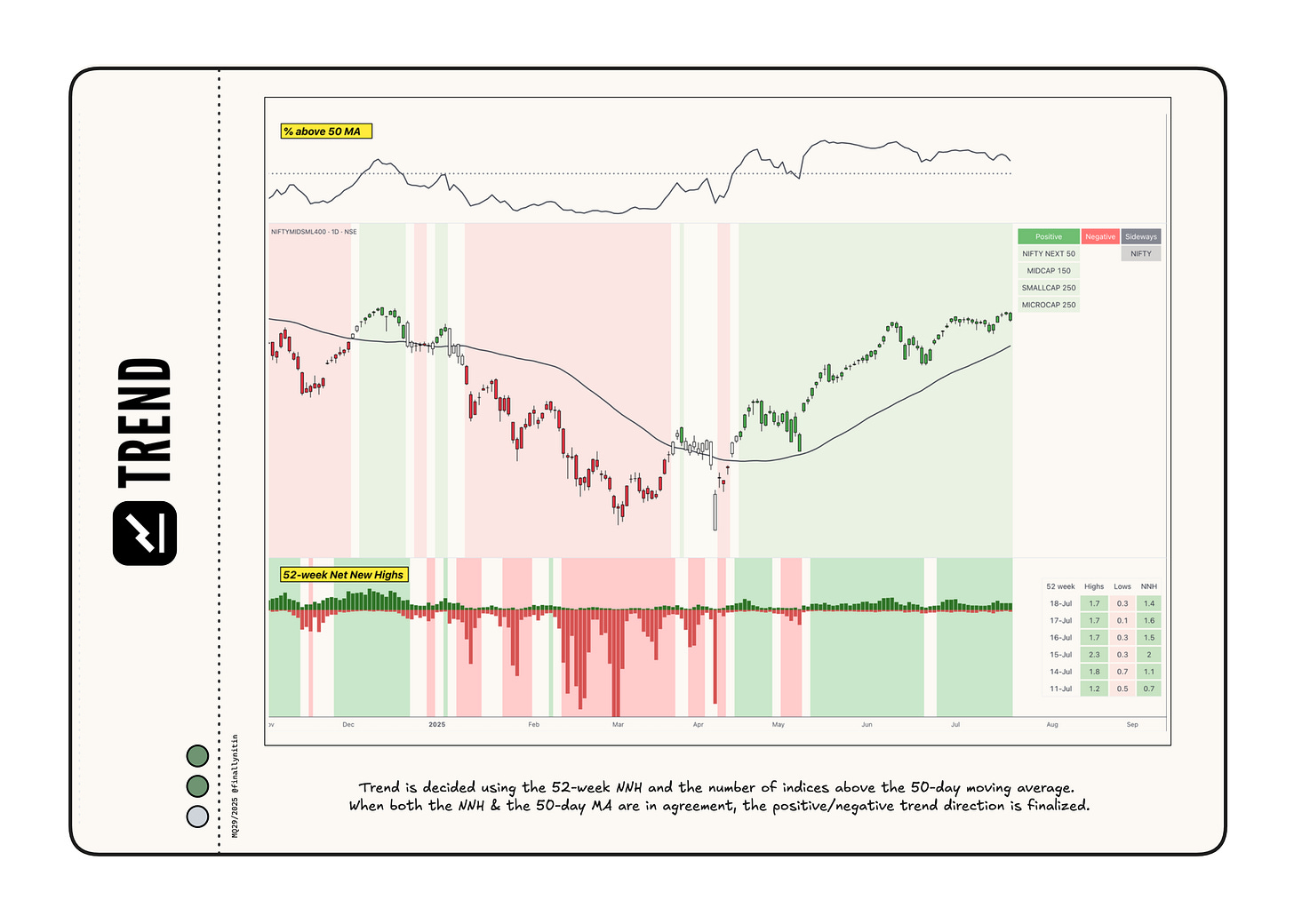

Trend → Uptrend

The market has been in an uptrend for the past 10 weeks.

52-week Net New Highs have remained consistently positive for the past three days. While the new 52-week highs appear to have stalled, the new 52-week lows worsened somewhat this week. The new 52-week highs need to move up so that we can enter a stronger uptrend.

Over the past three days, most major indices (except the Nifty 50) have consistently remained above their 50-day moving averages, with approximately 65% of stocks also staying above their 50-day moving averages.

The trend will turn negative again if the 52-week highs go below the 52-week lows and more than 50% of stocks fall below their 50-day moving averages.

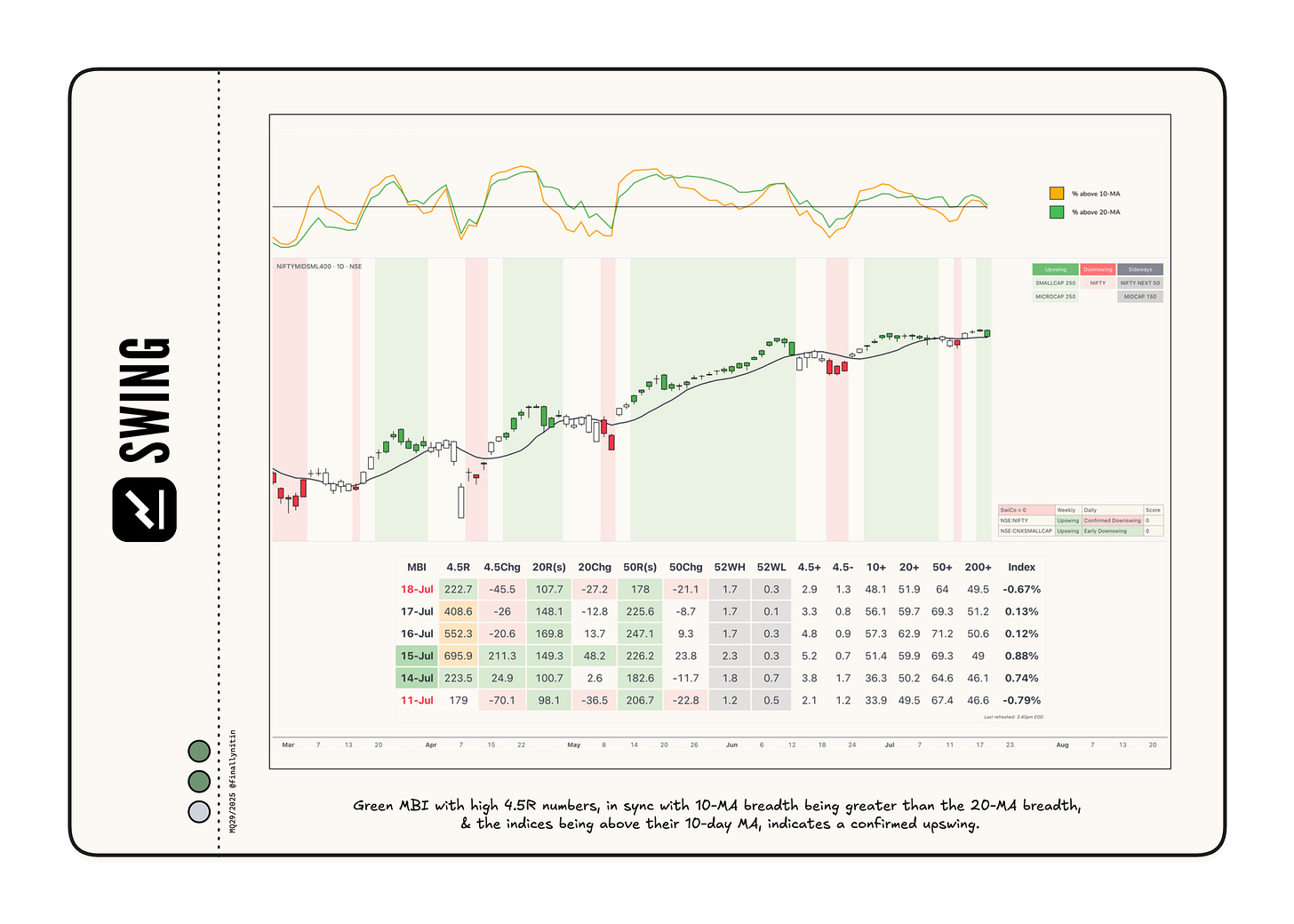

Swing → Upswing under strain

The market continues its half-hearted upswing.

The MBI, recovering from last week’s warning day, resumed its bullishness this week, with the upswing having three 400+ days. However, it eventually ended the week with a warning day. The upcoming week will be crucial in determining whether the MBI finally turns red or, like last week, if the warning day was again a blip.

Except for the Smallcap & the Microcap indices, none of the broad indices remained consistently above their 10-day moving averages. Less than 50% of stocks are trading above their 10-day moving averages, and, not favoring the bulls, fewer stocks are above their 10-day moving average than their 20-day moving average.

Swing Confidence has returned to 0, indicating that the portfolio should not take on any open risk.

Momentum → Positive & improving

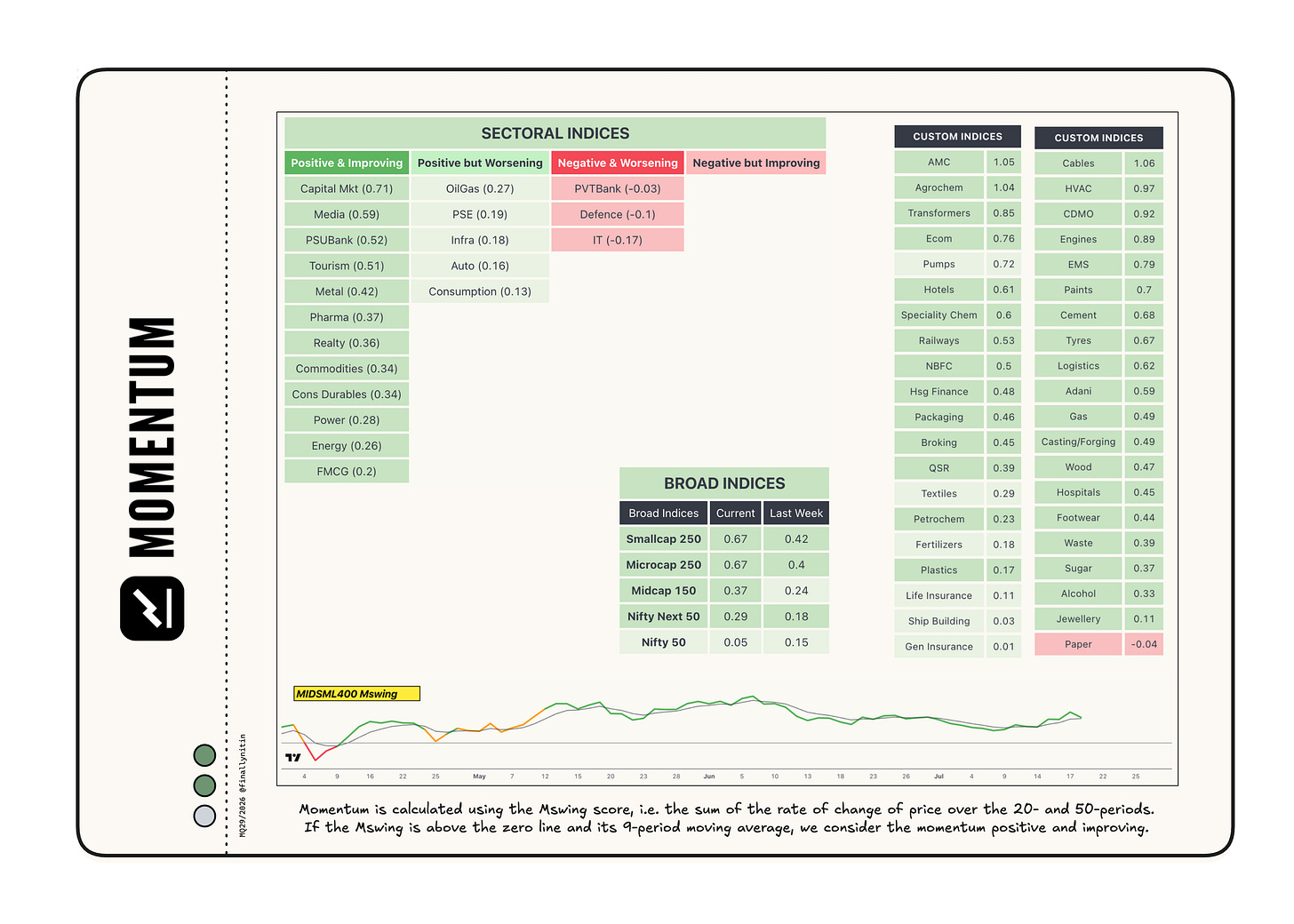

The majority of broad indices still have positive but (barely) improving momentum, as the momentum score stayed above the zero line and above its 9-period moving average.

Most sectoral indices also exhibit positive momentum. Defence, PvtBank & IT indices have negative and worsening momentum. Capital Bank, Media, PSUBank, Tourism, and Metal are the top indices in terms of the momentum score.

Agrochem, Cables, AMC, HVAC & Transformers are notable custom indices with positive and improving momentum.

That’s all for this week. If you'd like to know when I publish something new, subscribe to my newsletter, and you'll receive the latest directly in your inbox.