We are witnessing worsening momentum in a downswing within a sideways transitional market.

A hard-money environment with stock-specific follow throughs. Conservative swing portfolios should stay in cash.

⦿ Bias: Transitional (bear to bull) market

⦿ Trend: Sideways

⦿ Swing: Downswing

⦿ Momentum: Negative and worsening

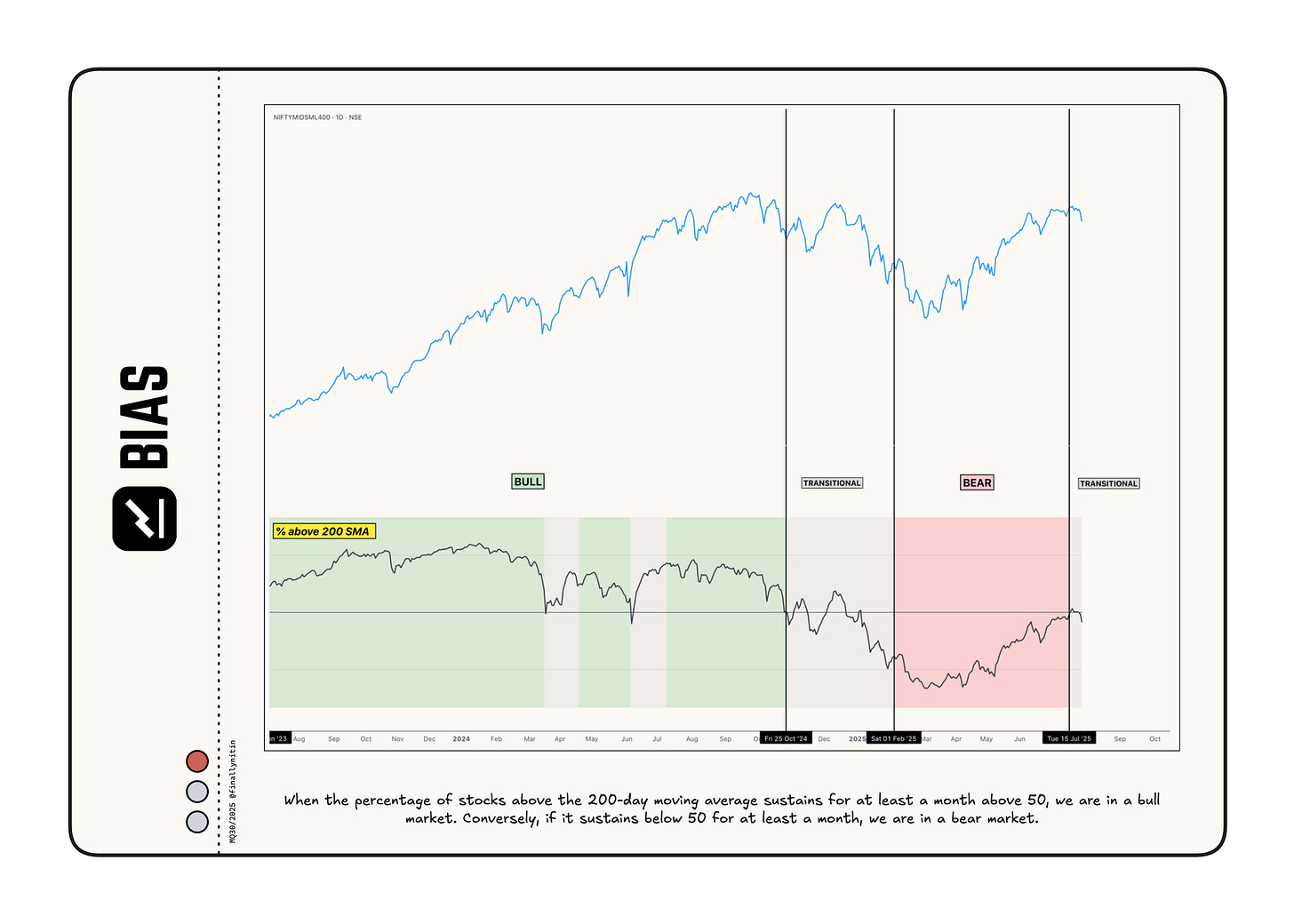

Bias → Transitional (Bear-to-Bull)

From a long-term perspective, we are now transitioning from a bear to a bull market.

After staying below the 200-day simple moving average (SMA) for 27 weeks, more than 50% of the stocks moved up the 200 SMA last week, and the market can now be said to have entered the second week of a bear-to-bull transitional phase.

We closed the week again below the 50% mark, with approximately 45% of stocks positioned above their 200-day simple moving average.

When the percentage of stocks above the 200-day SMA remains above 50 for at least a month, we will be in a bull market. If, instead, it stays below 50 for a month, we will return to a bear market.

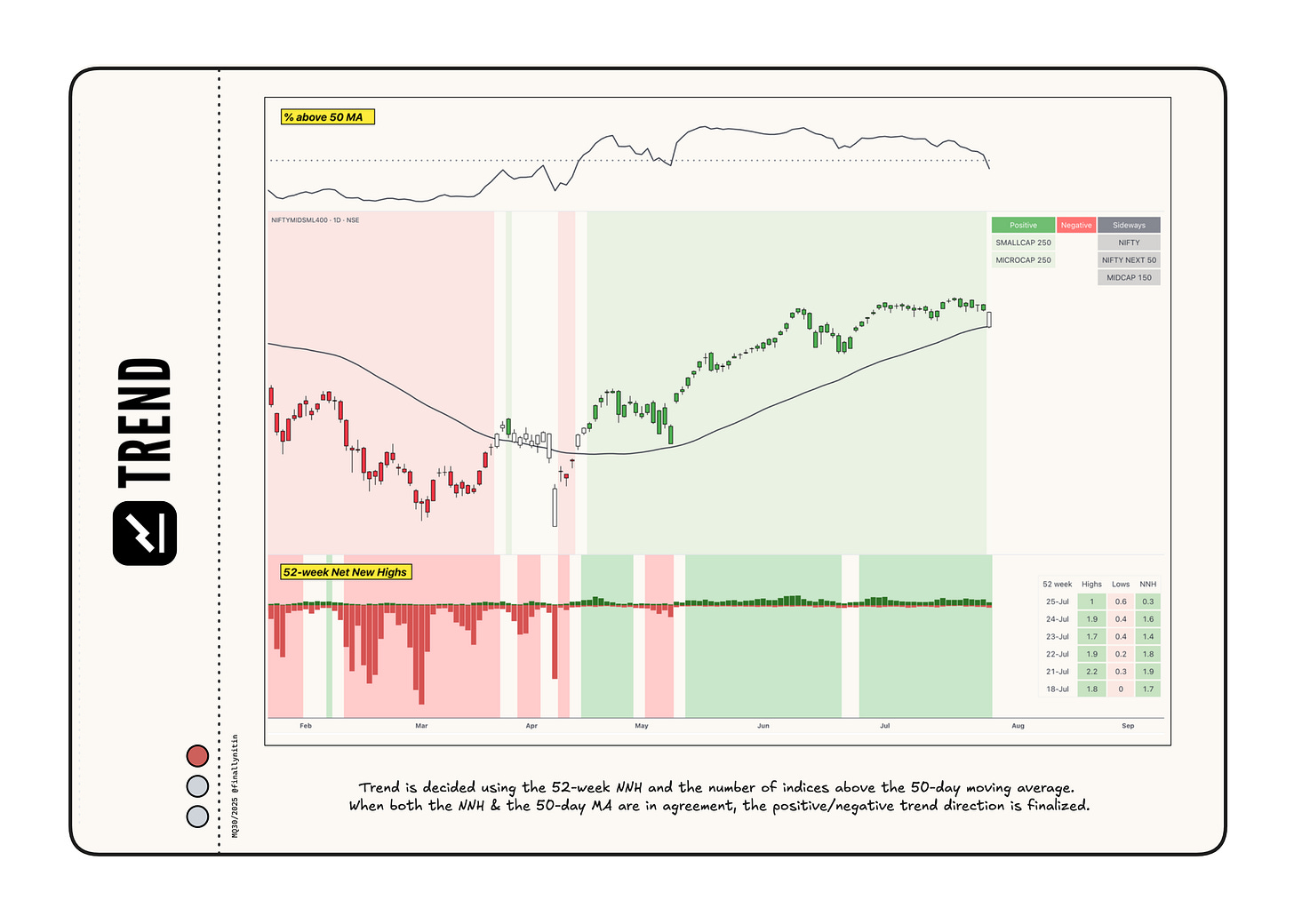

Trend → Sideways

After staying in an uptrend for the past 10 weeks, the market trend can now be described as sideways.

52-week Net New Highs have remained consistently positive for the past three days. While the new 52-week lows appear to have stalled, the new 52-week highs worsened further this week.

Over the past three days, most major indices have not remained consistently above or below their 50-day moving averages, with approximately only 40% of stocks staying above their 50-day moving averages.

The trend will turn negative again if the 52-week highs go below the 52-week lows and more than 50% of stocks fall below their 50-day moving averages.

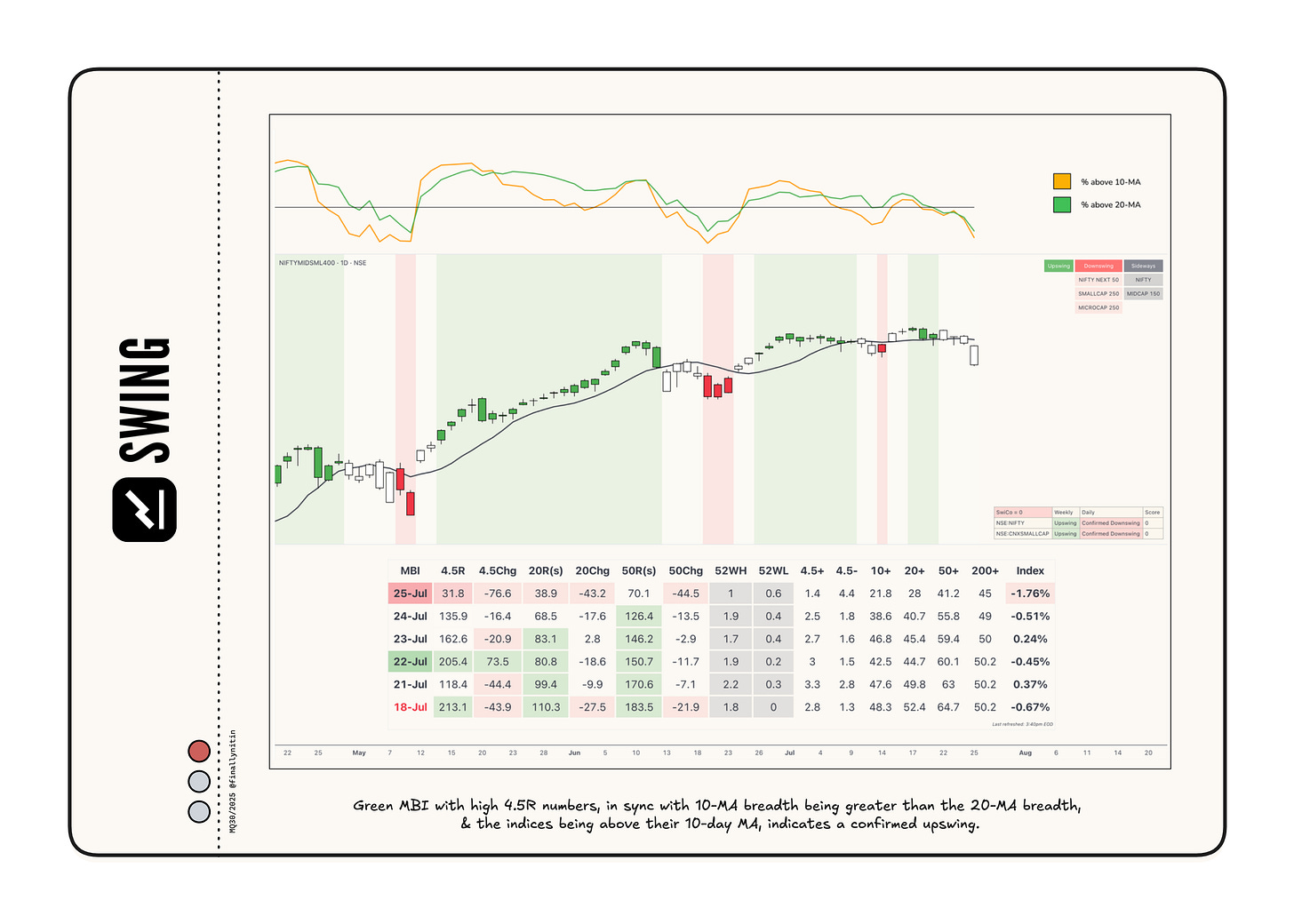

Swing → Downswing

After a half-hearted upswing for quite some time, the market is now in a downswing.

The MBI, recovering from last week’s warning day, resumed its tepid bullishness this week and eventually ended the week in the red.

Most broad indices remained consistently below their 10-day moving averages. Less than 50% of stocks are trading above their 10-day moving averages, and, not favoring the bulls, fewer stocks are above their 10-day moving average than their 20-day moving average.

Swing Confidence stays 0, indicating that the portfolio should not take on any open risk.

Momentum → Negative & worsening

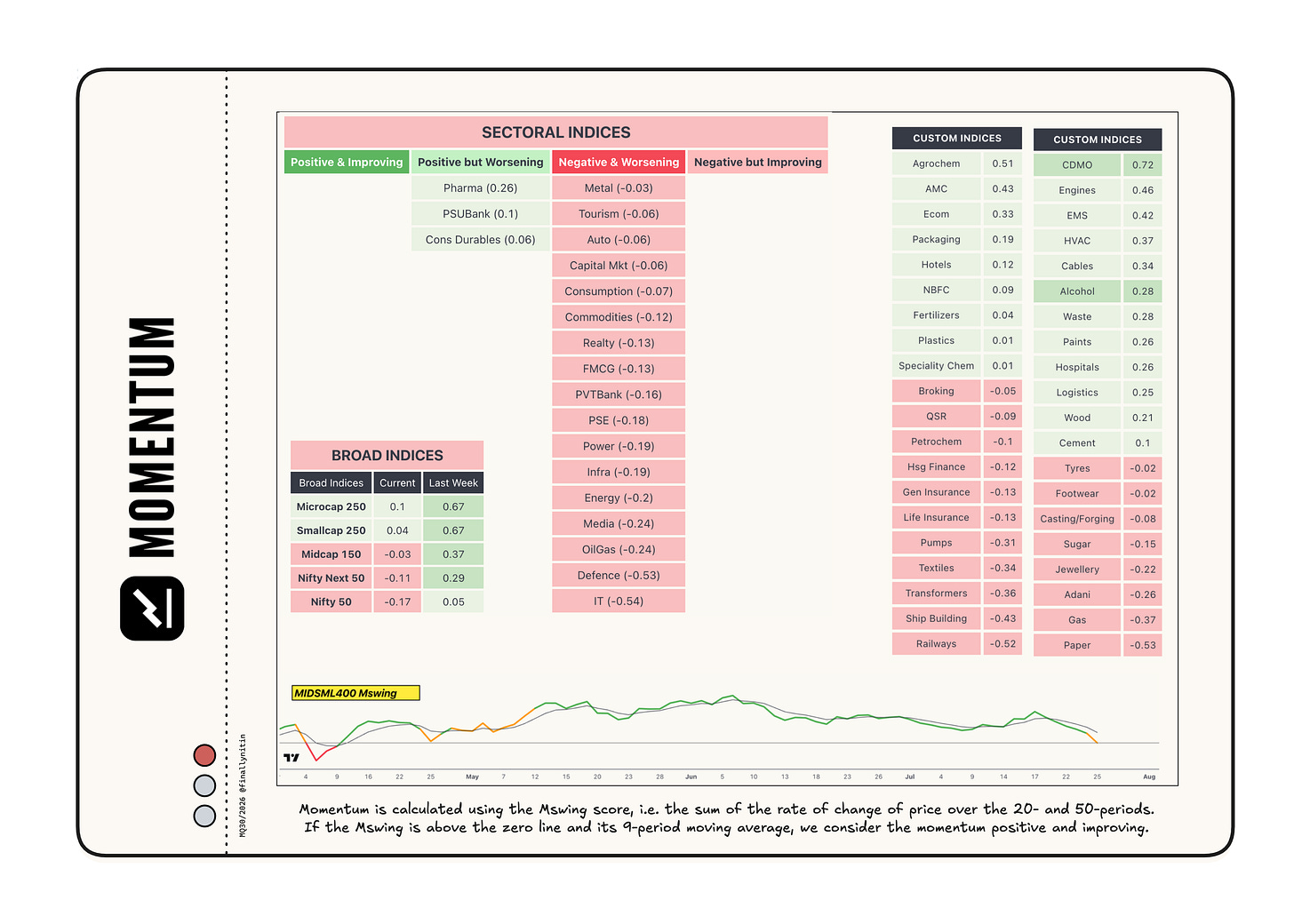

The majority of broad indices now have negative and worsening momentum, as the momentum score is below the zero line and its 9-period moving average.

Most sectoral indices also exhibit negative and worsening momentum. Pharma, PSUbank & Consumer durables are the only indices with positive momentum.

Agrochem, AMC, CDMO & Engines are notable custom indices with positive momentum.

That’s all for this week. If you'd like to know when I publish something new, subscribe to my newsletter, and you'll receive the latest directly in your inbox.