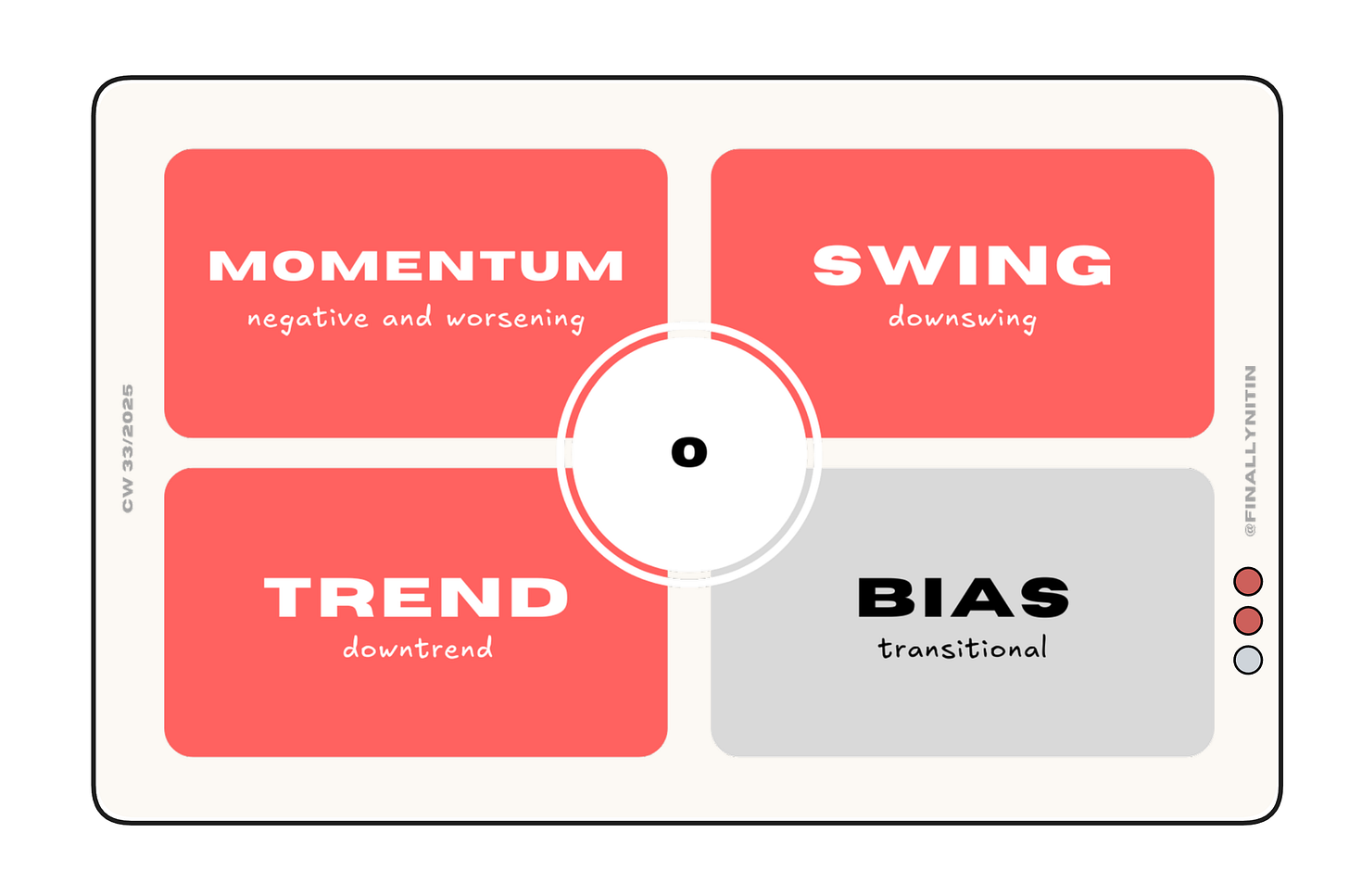

We are witnessing worsening momentum in a downswing within a downtrending transitional market.

A no-money environment with very limited stock-specific follow throughs. Conservative swing portfolios should stay in cash, as they have been for the past couple of weeks.

⦿ Bias: Transitional

⦿ Trend: Downtrend

⦿ Swing: Downswing

⦿ Momentum: Negative and worsening

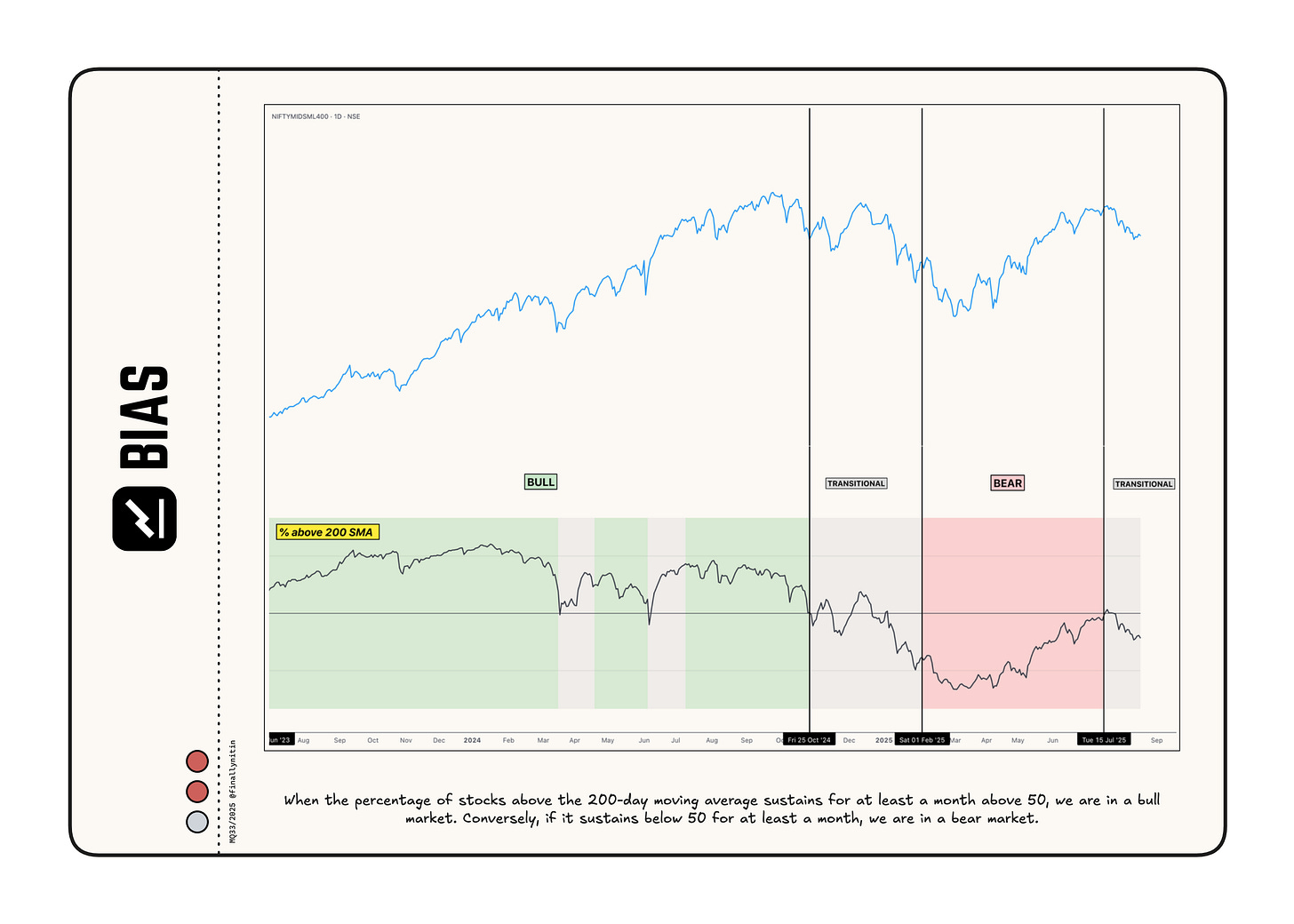

Bias → Transitional

From a long-term perspective, we are now transitioning back to a bear market.

After staying below the 200-day simple moving average (SMA) for 27 weeks, more than 50% of the stocks moved up the 200 SMA last month for just a week, and the market entered a transitional phase. The market has now entered the 4th week, with more than 50% of the stocks staying below their 200 SMA. If we end this week below 50%, then we are back to a bear market.

Less than 40% of stocks are positioned above their 200-day simple moving average.

When the percentage of stocks above the 200-day SMA remains above 50 for at least a month, we will be in a bull market. If, instead, it stays below 50 for a month, we will return to a bear market.

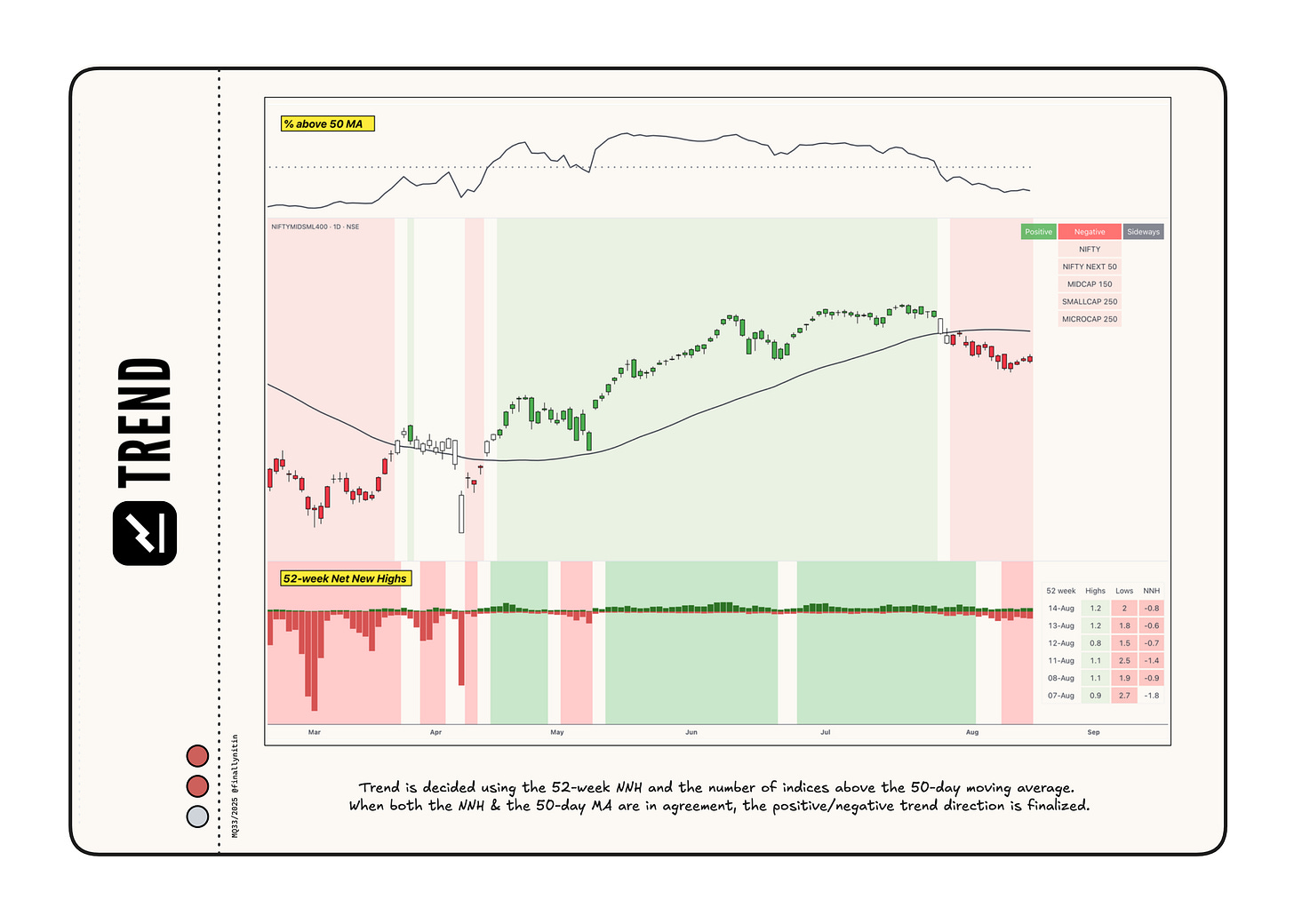

Trend → Downtrend

The market has been in a confirmed downtrend for two weeks now.

52-week Net New Highs have remained consistently negative for the past three days.

Over the past three days, all major indices have remained consistently below their 50-day moving averages, with only about 25% of stocks staying above their 50-day moving averages.

The trend will turn positive again if the 52-week highs go above the 52-week lows and more than 50% of stocks move above their 50-day moving averages.

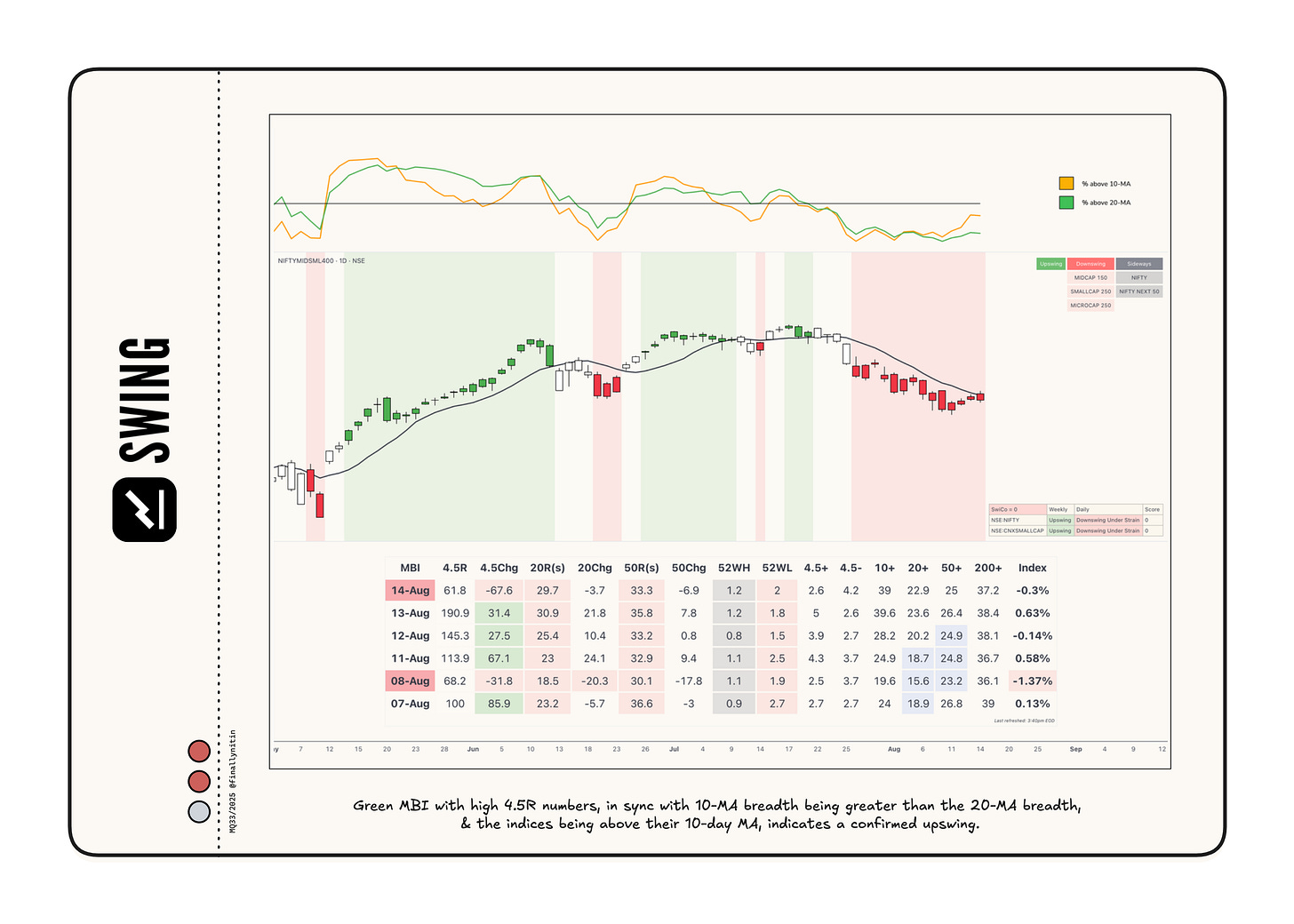

Swing → Downswing

The market has been in a downswing for the past three weeks.

The MBI stayed red throughout this truncated week. Due to a couple of half-hearted attempts to move up during the week, we are no longer near oversold levels.

Most broad indices remained consistently below their 10-day moving averages. Less than 40% of stocks are trading above their 10-day moving averages, while less than 25% of stocks are trading above their 20-day moving averages. This is a bullish formation (10 > 20) that can be viewed as the very first sign of a regime change, but without momentum, it might as well fizzle out.

Swing Confidence stays 0, indicating that the portfolio should not take on any open risk.

Momentum → Negative & worsening

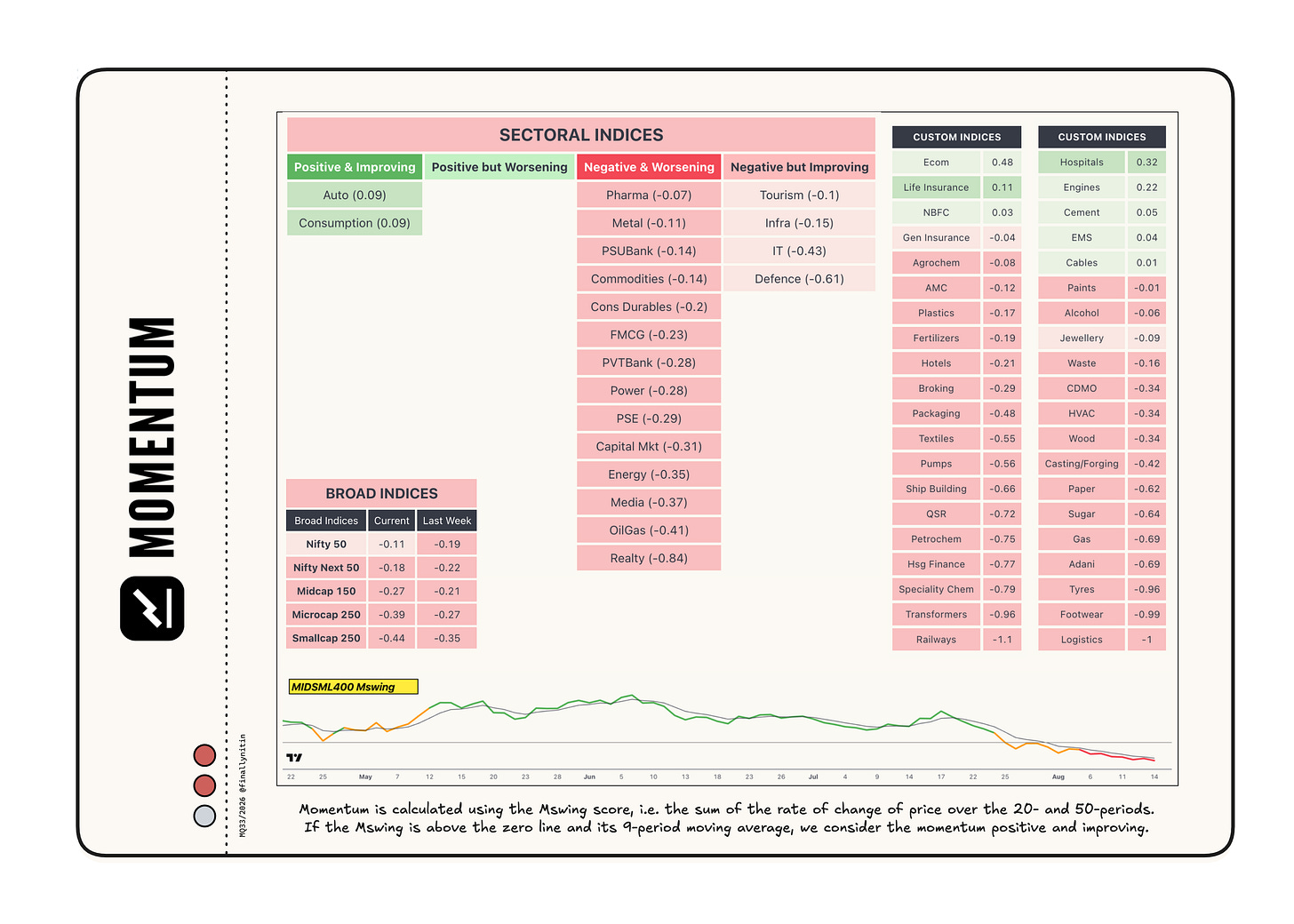

All broad indices continue to have negative and worsening momentum, as the momentum score is below the zero line and its 9-period moving average.

Most sectoral indices also exhibit negative and worsening momentum. Auto & consumption have positive & improving momentum.

Hospitals, Ecom, Engines, and Life insurance are notable custom indices with positive momentum.

That’s all for this week. If you'd like to know when I publish something new, subscribe to my newsletter, and you'll receive the latest directly in your inbox.