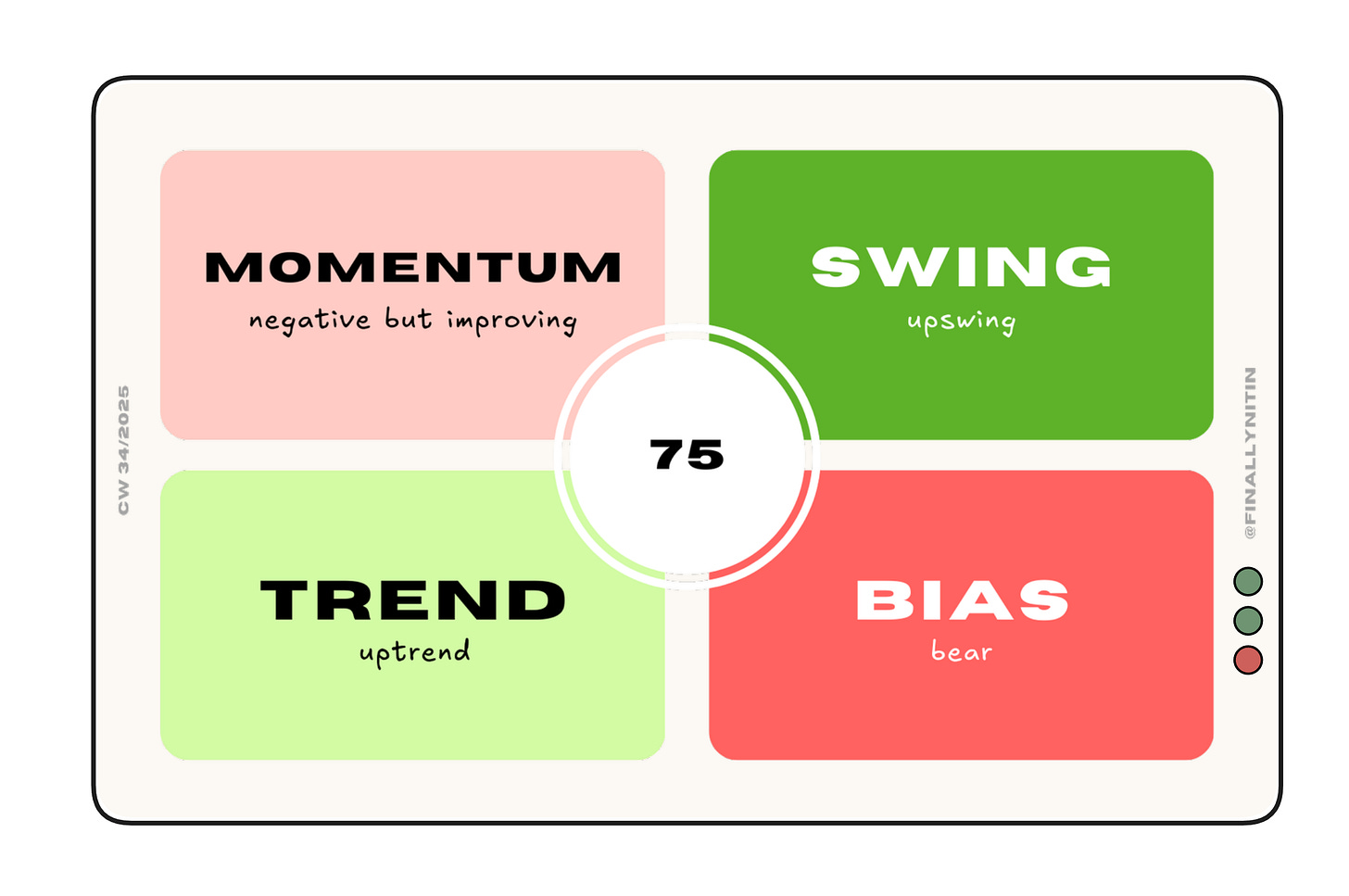

We are witnessing improving momentum in an upswing within a weakly uptrending bear market.

A hard-money environment with limited stock-specific follow throughs. Swing portfolios can take high-conviction positions with strict stop losses.

⦿ Bias: Bear

⦿ Trend: (Weak) Uptrend

⦿ Swing: Upswing

⦿ Momentum: Negative but improving

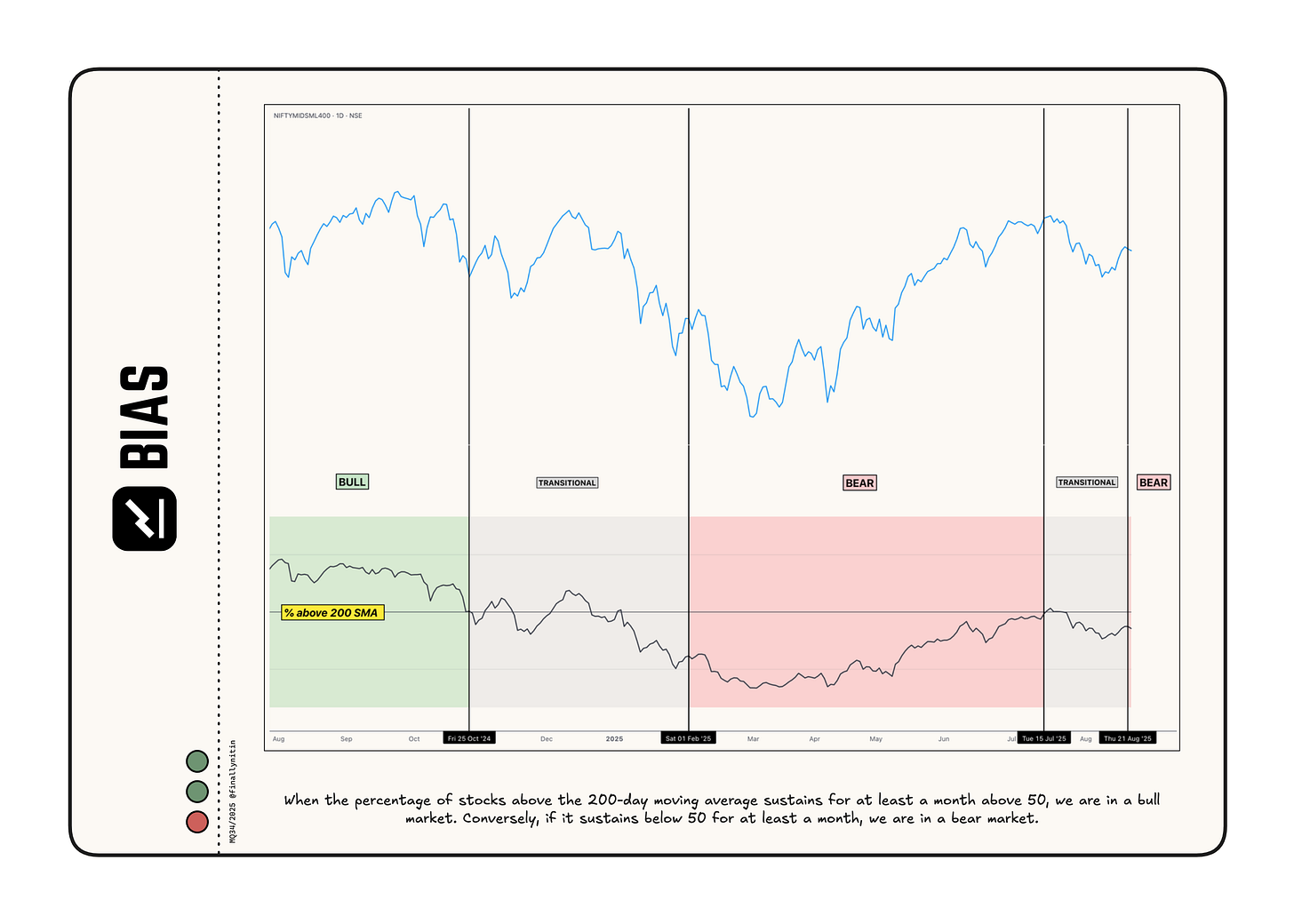

Bias → Bear

From a long-term perspective, we have now transitioned back to a bear market.

After staying below the 200-day simple moving average (SMA) for 27 weeks, more than 50% of the stocks moved up the 200 SMA last month for just a week, and the market entered a transitional phase. For the past four weeks, more than 50% of the stocks have stayed below their 200 SMA. Hence, we are back to a bear market.

About 40% of stocks are positioned above their 200-day simple moving average.

When more than 50% of stocks go above their 200-day SMA, we will again enter a transitional market. If this percentage stays above 50 for a month, we will finally enter a bull market.

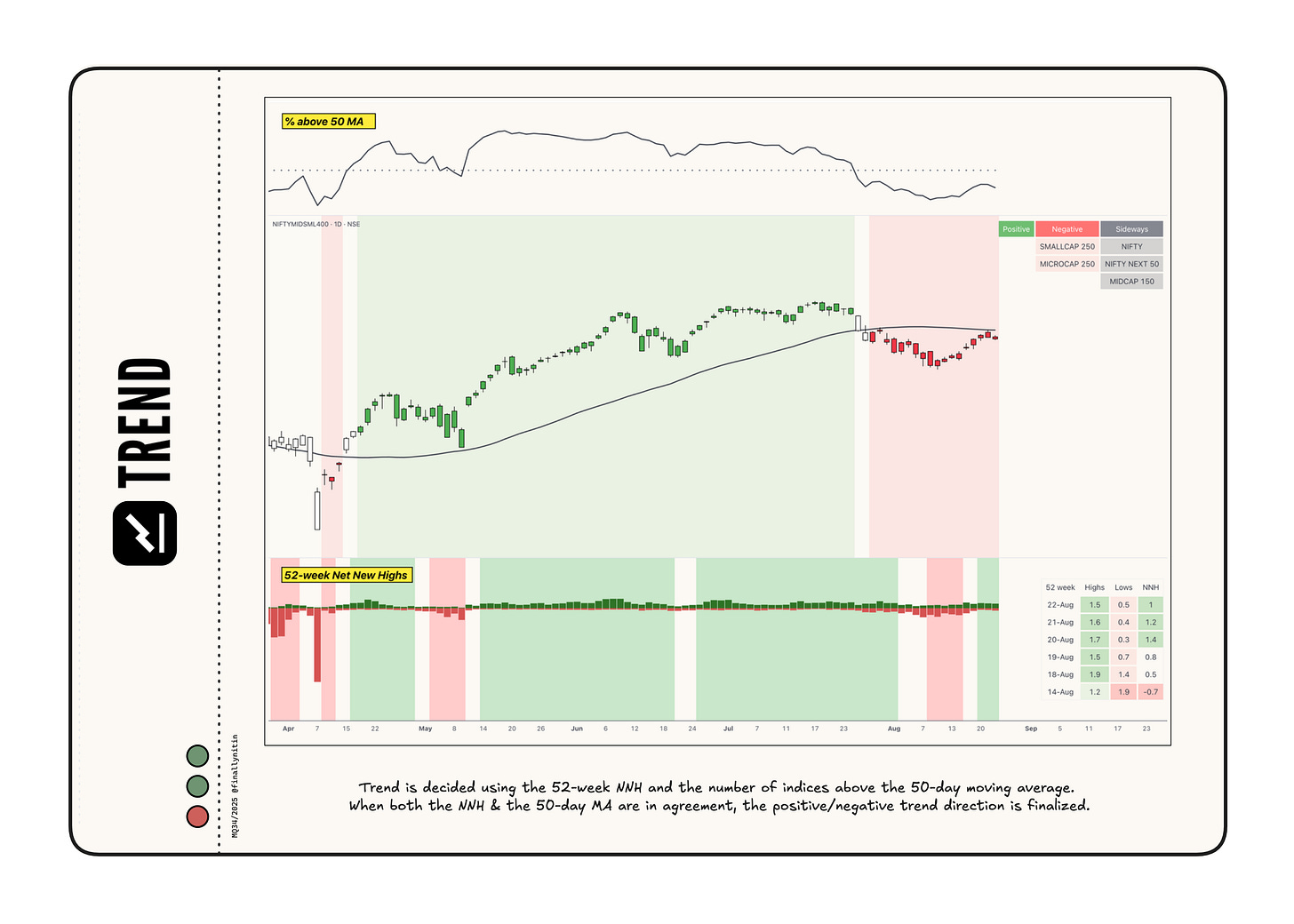

Trend → Weak Uptrend

After a confirmed downtrend for two weeks, the market is now in a weak uptrend.

52-week Net New Highs have remained consistently positive for the past three days.

Over the past three days, no major index has remained consistently above its 50-day moving average, with only about 35% of stocks staying above their 50-day moving averages.

The uptrend will be confirmed if the 52-week highs continue to stay above the 52-week lows and more than 50% of stocks move above their 50-day moving averages.

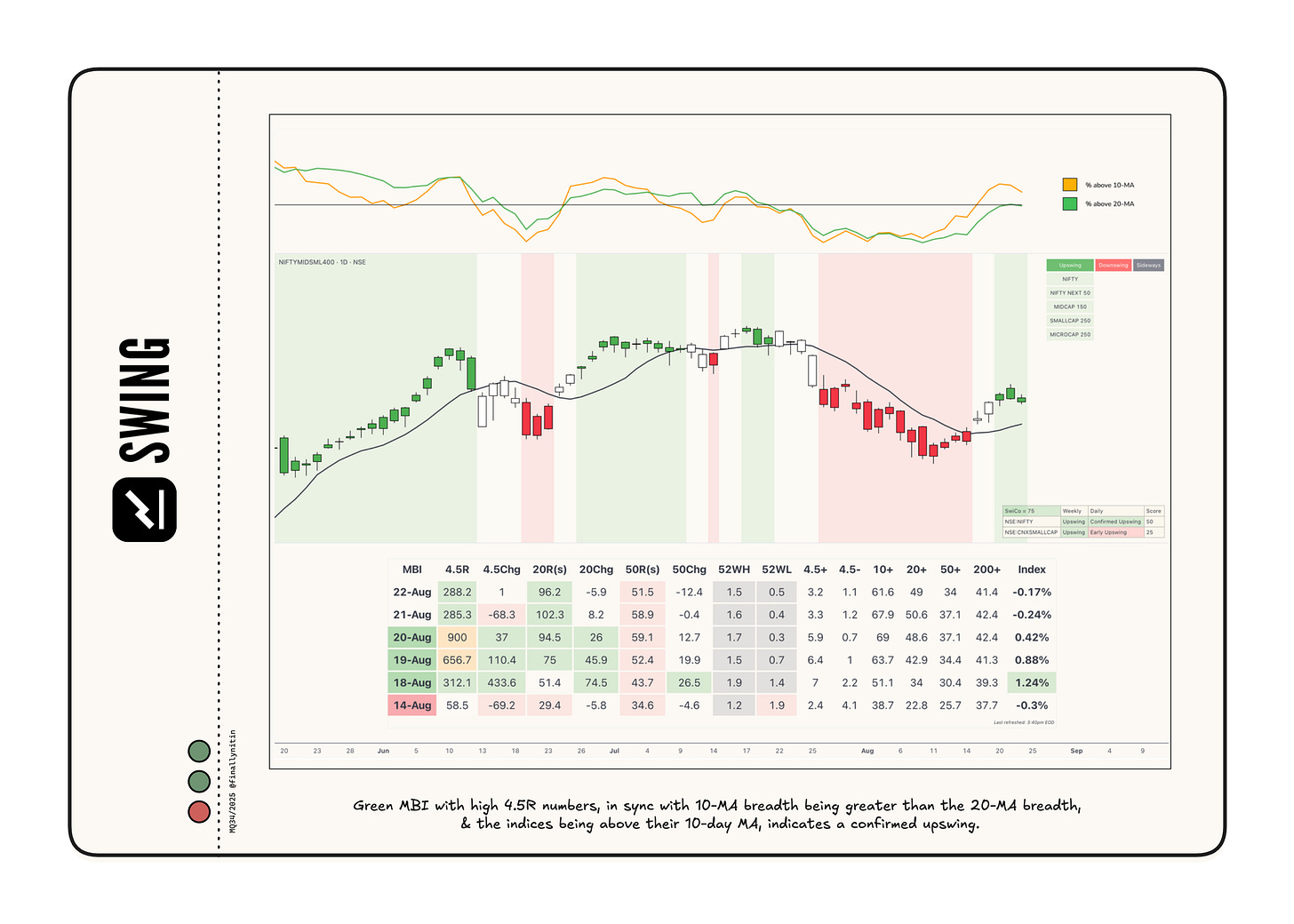

Swing → Upswing

After staying in a downswing for the past three weeks, the market is now in a confirmed upswing.

The MBI stayed green throughout the week. Although we had two strong days, we have yet to see a day with 4.5R over 1000.

Most broad indices remained consistently above their 10-day moving averages. About 60% of stocks are trading above their 10-day moving averages, while about 50% of stocks are trading above their 20-day moving averages. This is a bullish formation (10 > 20) that now needs some momentum to sustain.

Swing Confidence is 75, indicating that the portfolio can take less than the maximum permissible open risk.

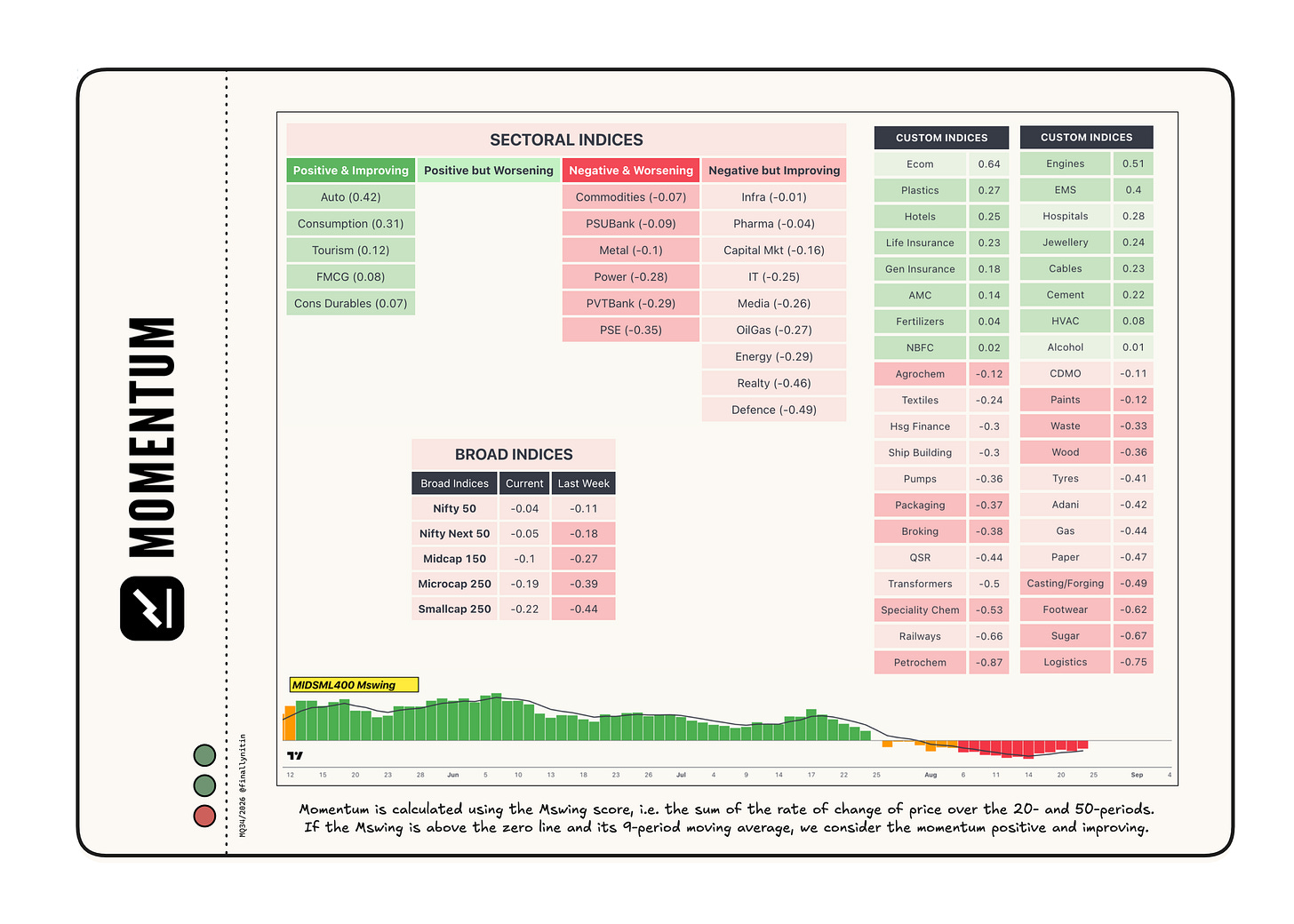

Momentum → Negative but improving

All broad indices now have negative but improving momentum, as the momentum score is below the zero line but above its 9-period moving average.

Most sectoral indices also exhibit improving momentum. Auto, Consumption, Tourism, and FMCG have positive & improving momentum.

Ecom, Engines, Plastics, Hotels, and Hospitals are notable custom indices with positive momentum.

That’s all for this week. If you'd like to know when I publish something new, subscribe to my newsletter, and you'll receive the latest directly in your inbox.

Good Read. Please make a youtube video to have deeper understading.