We are witnessing improving momentum in a weak upswing within a sideways bear market.

A hard-money environment with stock-specific follow throughs. Conservative swing portfolios can hold relatively strong stocks with strict stop losses.

⦿ Bias: Bear

⦿ Trend: Sideways

⦿ Swing: Weak upswing

⦿ Momentum: Improving

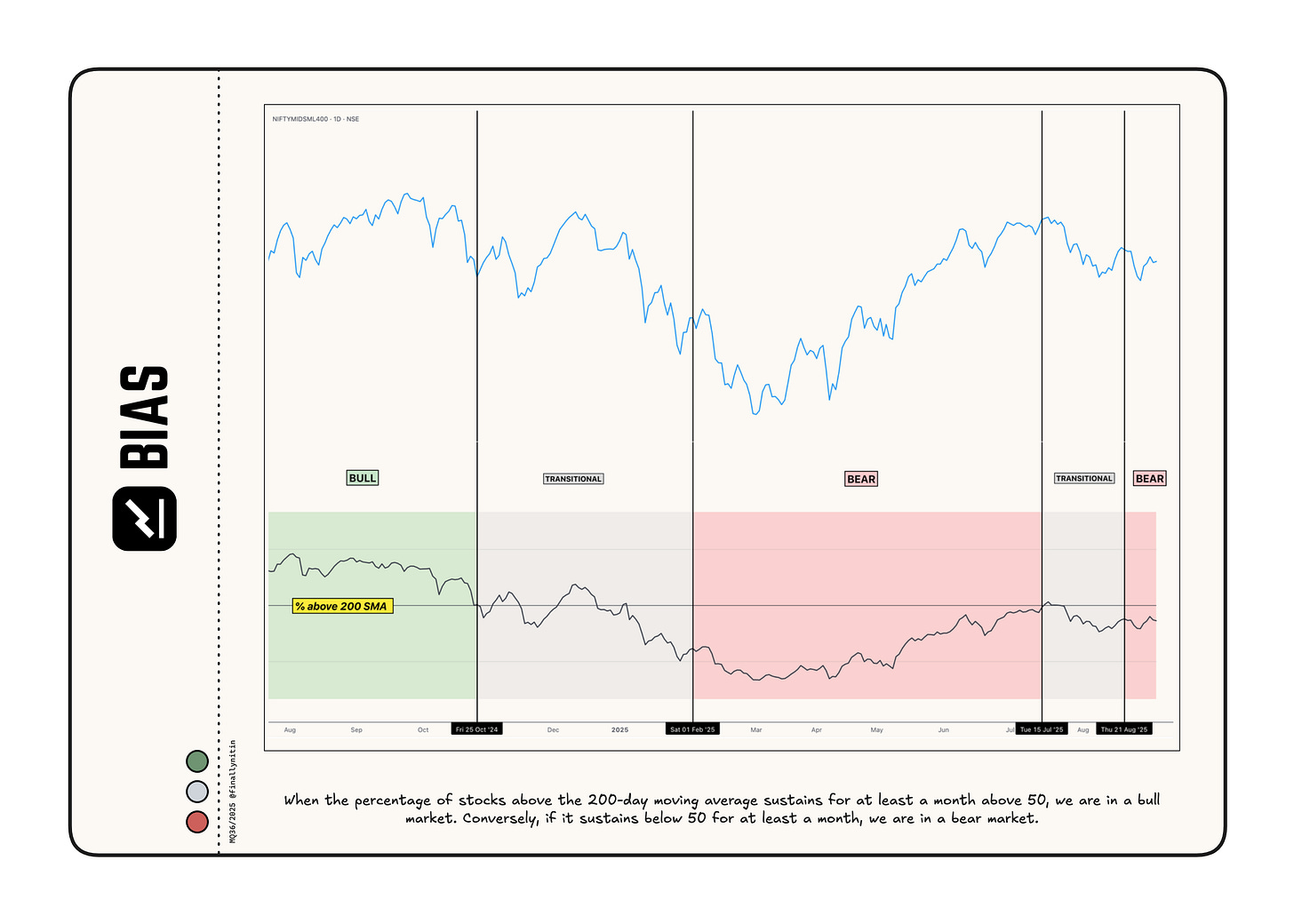

Bias → Bear

From a long-term perspective, we are in a bear market.

For the past two weeks, more than 50% of stocks have remained below their 200-day simple moving average (SMA). Hence, we stay in a bear market.

About 42% of stocks are positioned above their 200-day simple moving average.

When more than 50% of stocks go above their 200-day SMA, we will again enter a transitional market. If this percentage stays above 50 for a month, we will finally enter a bull market.

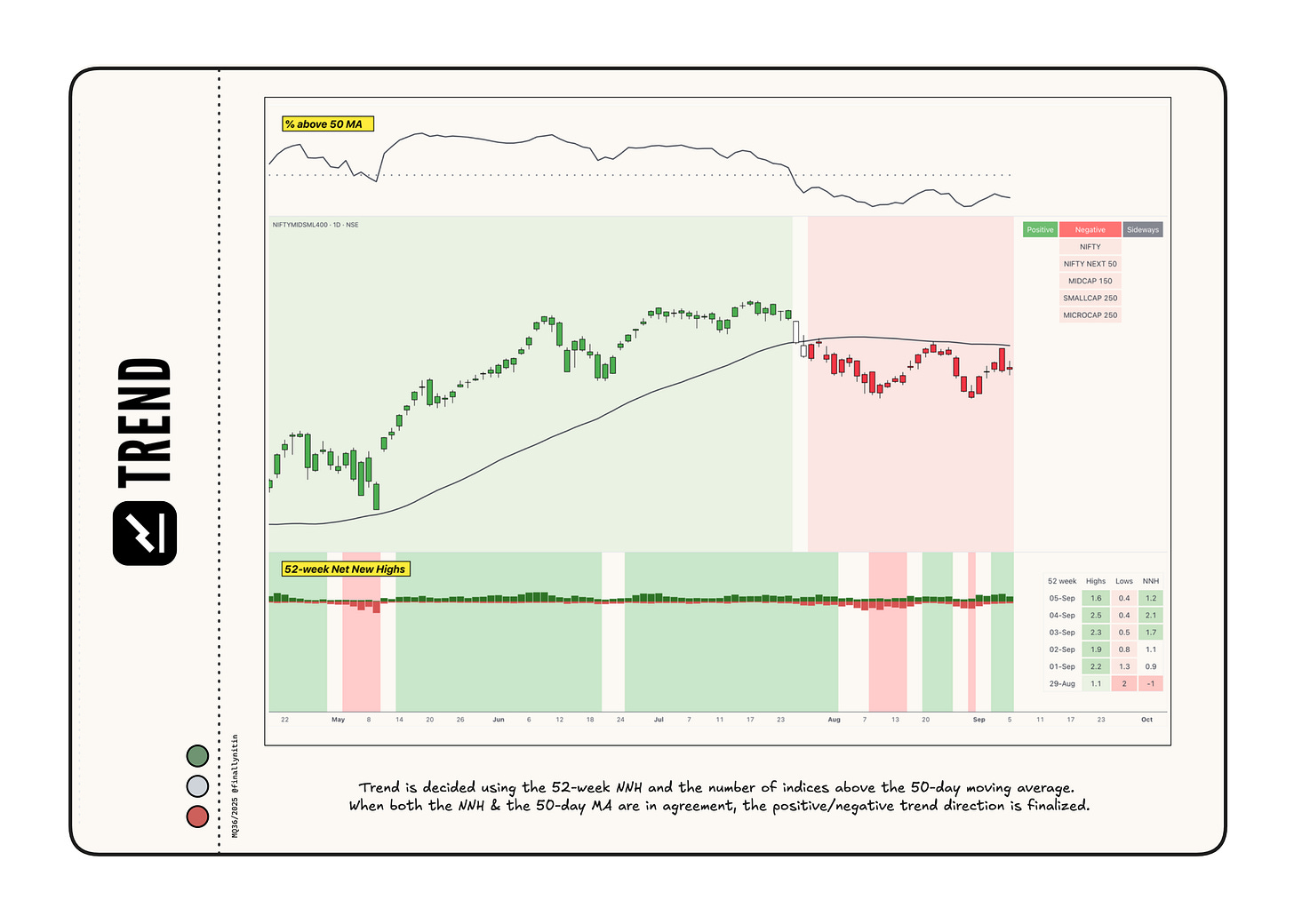

Trend → Sideways / weak uptrend

Following a brief downtrend last week, the market trend can now be described as sideways.

52-week Net New Highs have remained consistently positive for the past three days.

Over the past three days, all major indices have remained consistently below their 50-day moving average, with less than one-third of all stocks staying above their 50-day moving averages.

The market will enter a confirmed uptrend if the 52-week highs consistently remain above the 52-week lows and more than 50% of stocks move above their 50-day moving averages.

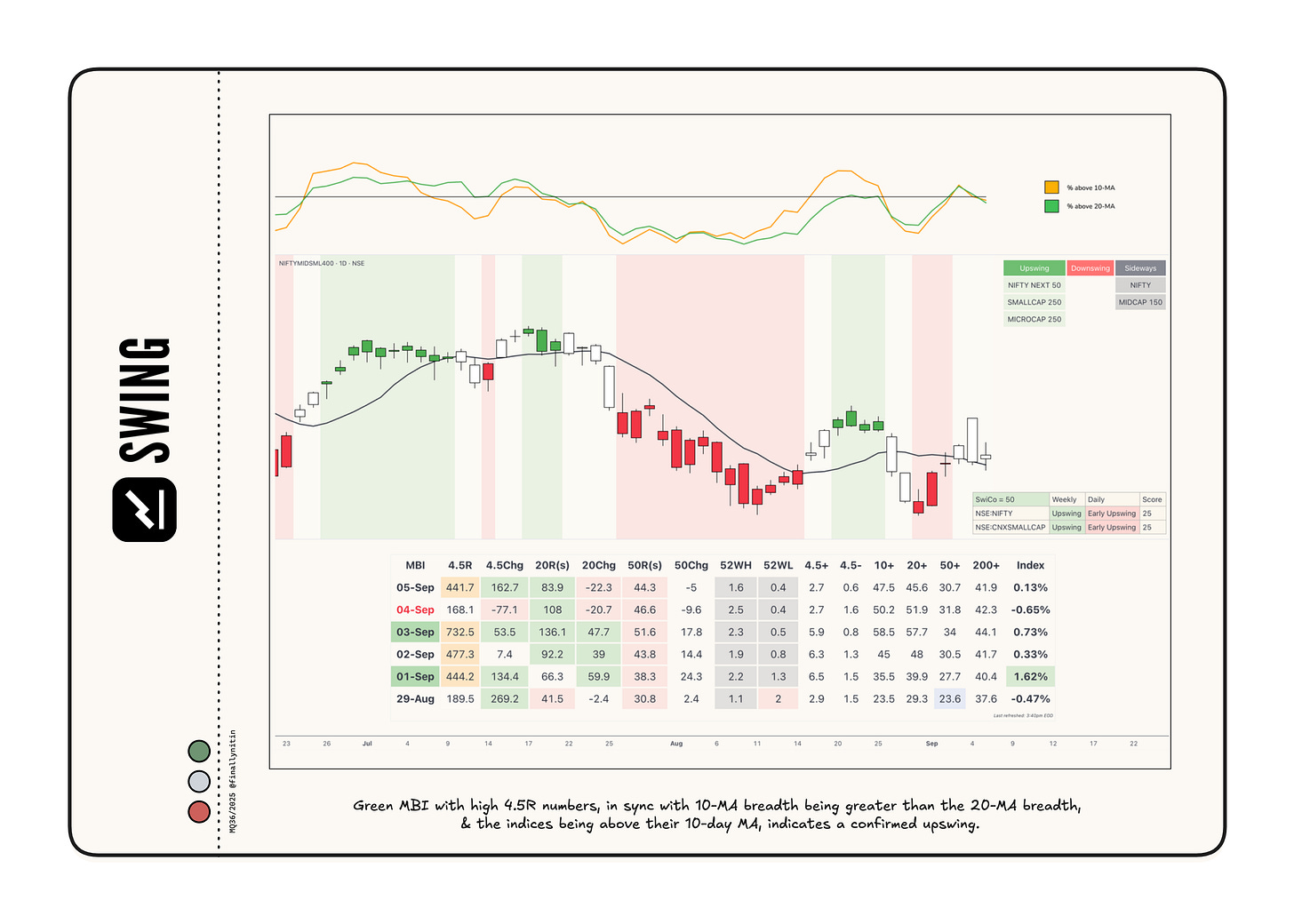

Swing → Weak upswing

After a downswing that lasted just a week, the market is back to a weak (or a very early) upswing.

The MBI stayed green throughout this week, with the 4.5R numbers exceeding 400 multiple times. We also had a warning day yesterday, but the week has managed to end in the green.

Most broad indices remained consistently above their 10-day moving averages. Less than 50% of stocks are trading above their 10-day moving averages, and, not favoring the bulls, fewer stocks are above their 10-day moving average than their 20-day moving average.

Swing Confidence is 50, indicating that the portfolio can take only half of the maximum permissible open risk.

Momentum → Improving

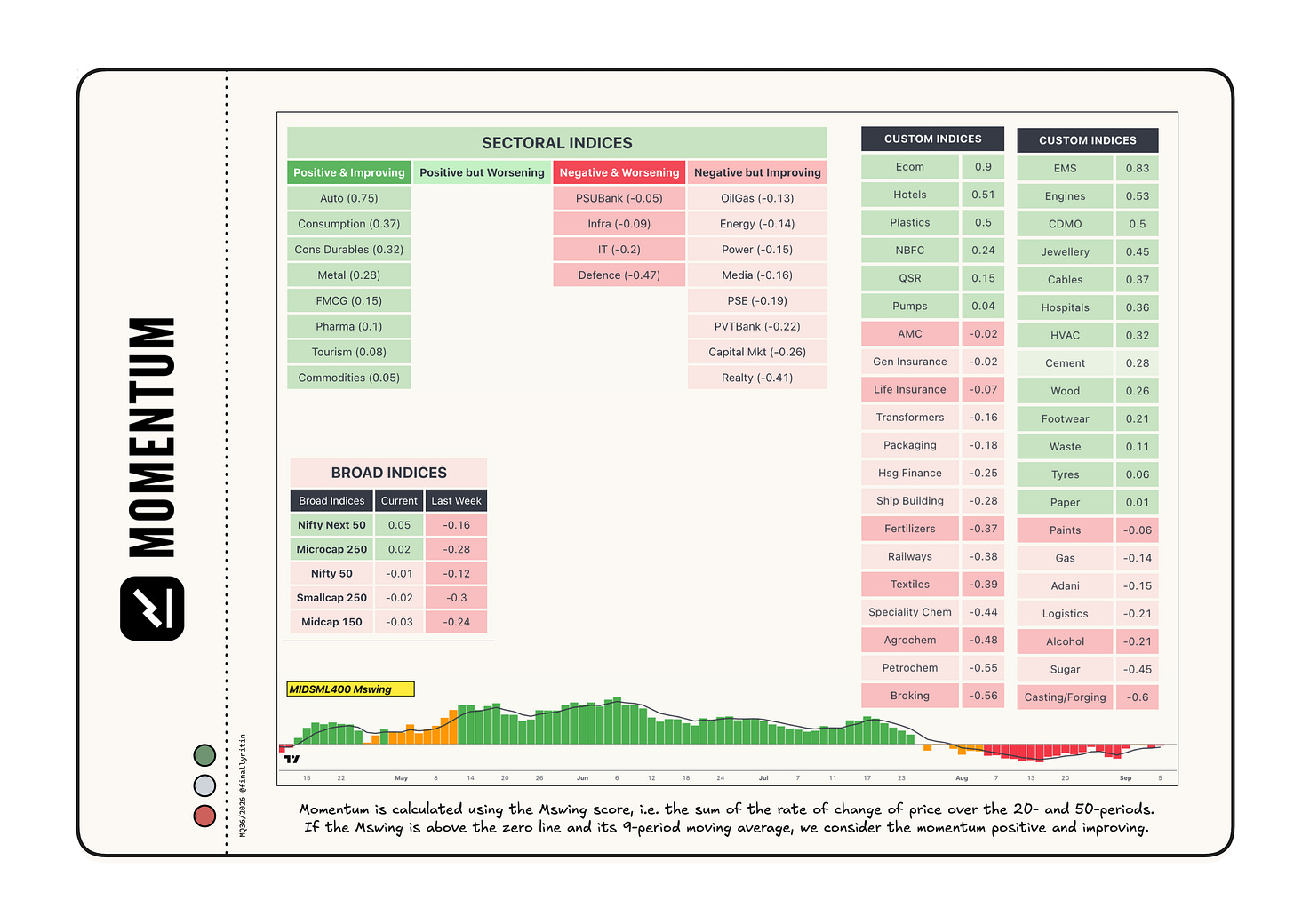

Most broad indices now have negative but improving momentum, as the momentum score is below the zero line but above its 9-period moving average.

Most sectoral indices also exhibit improving momentum. Auto, Consumer durables, Metal, and FMCG have positive & improving momentum.

Ecom, EMS, Engines, Hotels, and Plastics are notable custom indices with positive momentum.

That’s all for this week. If you'd like to know when I publish something new, subscribe to my newsletter, and you'll receive the latest directly in your inbox.