We are witnessing improving momentum in an early upswing within a sideways transitional market.

The environment has been improving over the past 2 days. High relative strength stocks that were holding their ground while the indices declined have now resumed their upward move. Watchlist feedback has gotten better, but with squats & faded moves equally visible. A follow-through on Monday would confidently turn most short-term indicators green.

Conservative portfolios should keep holding relatively strong stocks with no (or minimal) open risk.

⦿ Bias: Transitional

⦿ Trend: Sideways

⦿ Swing: Upswing

⦿ Momentum: Improving

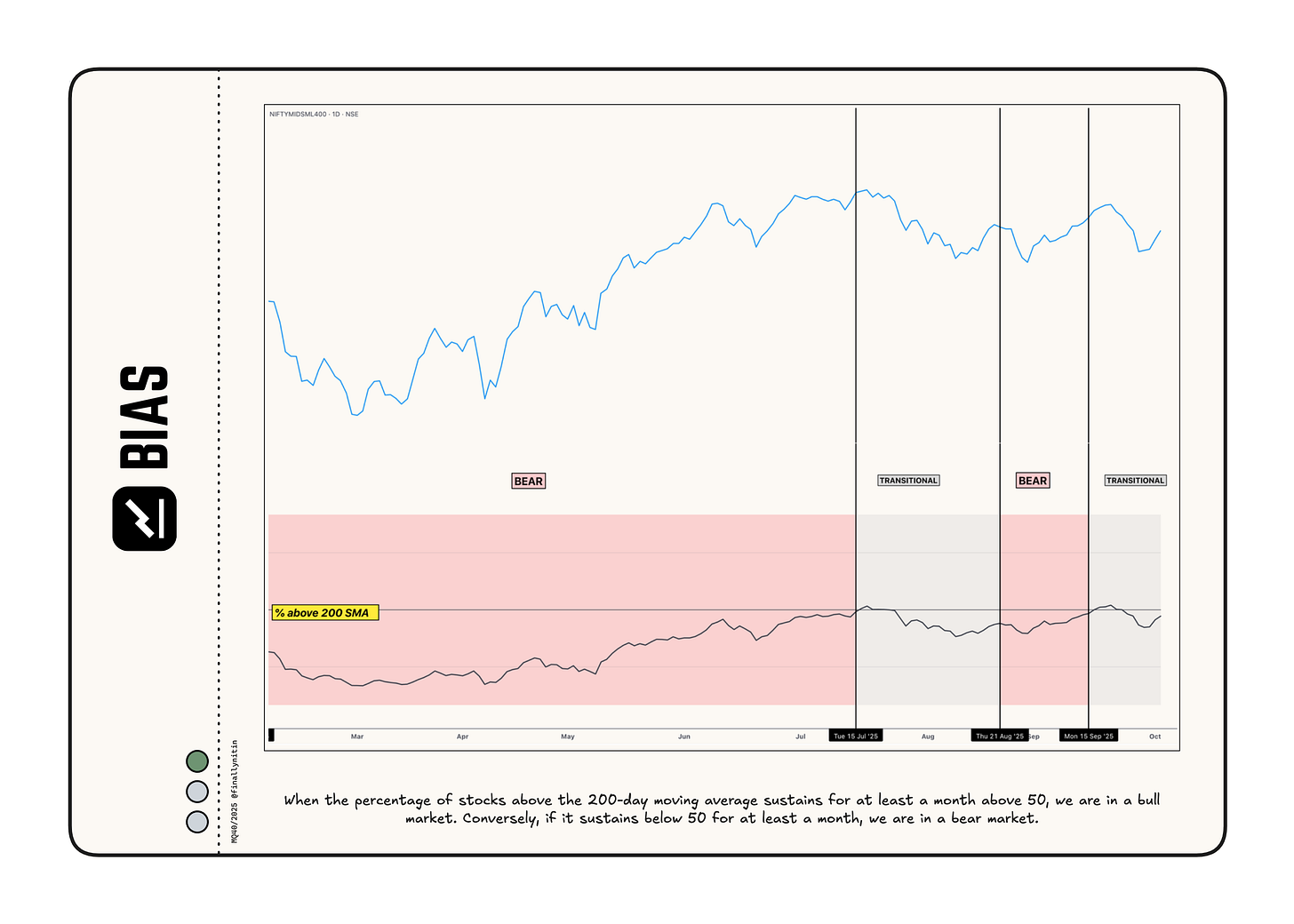

Bias → Transitional

From a long-term perspective, we are now in a transitional phase.

After staying below the 200-day simple moving average (SMA) for 7 weeks, more than 50% of the stocks moved up the 200 SMA two weeks back, and the market entered a bear-to-bull transitional phase. For the past 2 weeks, more than 50% of the stocks have stayed below their 200 SMA.

About 46% of stocks are positioned above their 200-day simple moving average. While this is an improvement from last week, we are still below the 50% mark.

When the percentage of stocks above the 200-day SMA remains above 50 for at least a month, we will be in a bull market. If, instead, it stays below 50 for a month, we will return to a bear market.

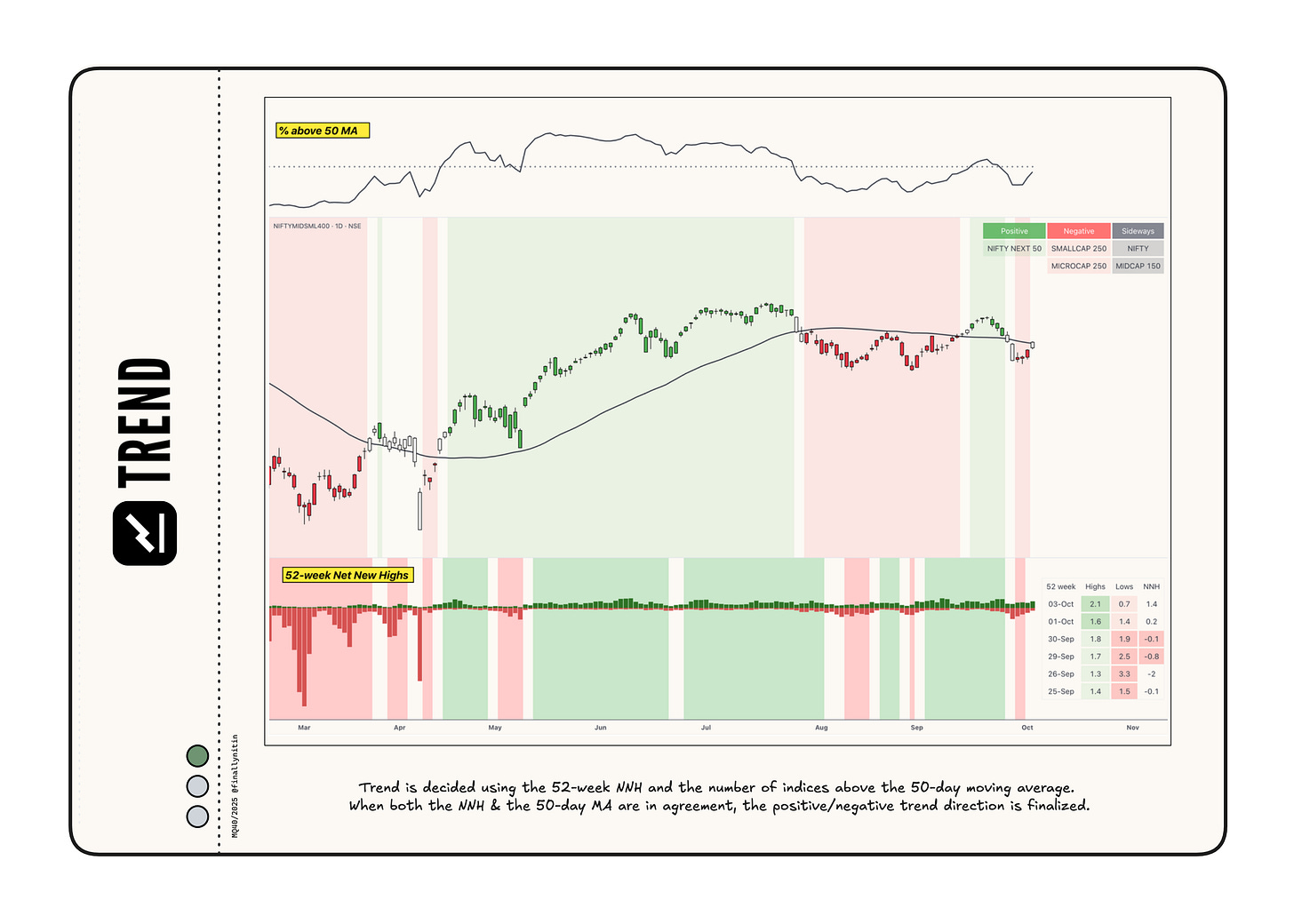

Trend → Sideways

The market trend has stayed sideways for the past two weeks.

52-week Net New Highs have not remained consistently positive or negative for the past three days. One more positive day will turn the NNH green.

Over the past three days, major indices have not remained consistently above/below their 50-day moving averages, with approximately 44% of all stocks remaining above their 50-day moving averages.

The market will enter a confirmed uptrend if the 52-week highs consistently remain above the 52-week lows and more than 50% of stocks stay above their 50-day moving averages.

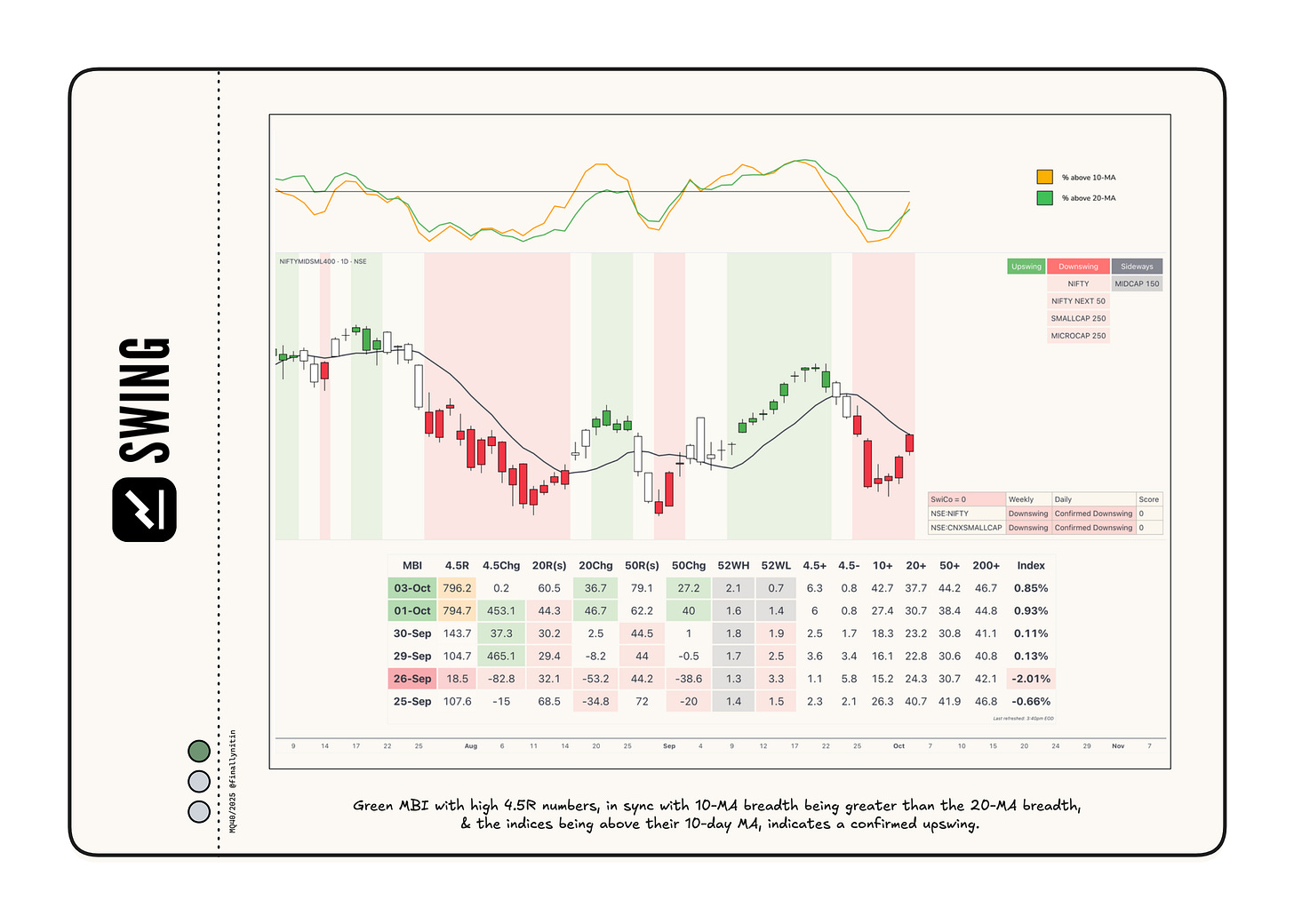

Swing → Upswing

The market is currently in an early upswing.

After turning red last week, the indices consolidated for two days, and the MBI has remained green for the past two days. Both green days occurred consecutively, with over 400 counts on the 4.5R.

Most broad indices remained consistently below their 10-day moving averages. Approximately 40% of stocks are trading above their 10-day moving averages, and, favoring the bulls, the 10% breadth has crossed above the 20% breadth.

Swing Confidence is 0, indicating that the portfolio should still not take on any open risk.

Momentum → Positive & improving

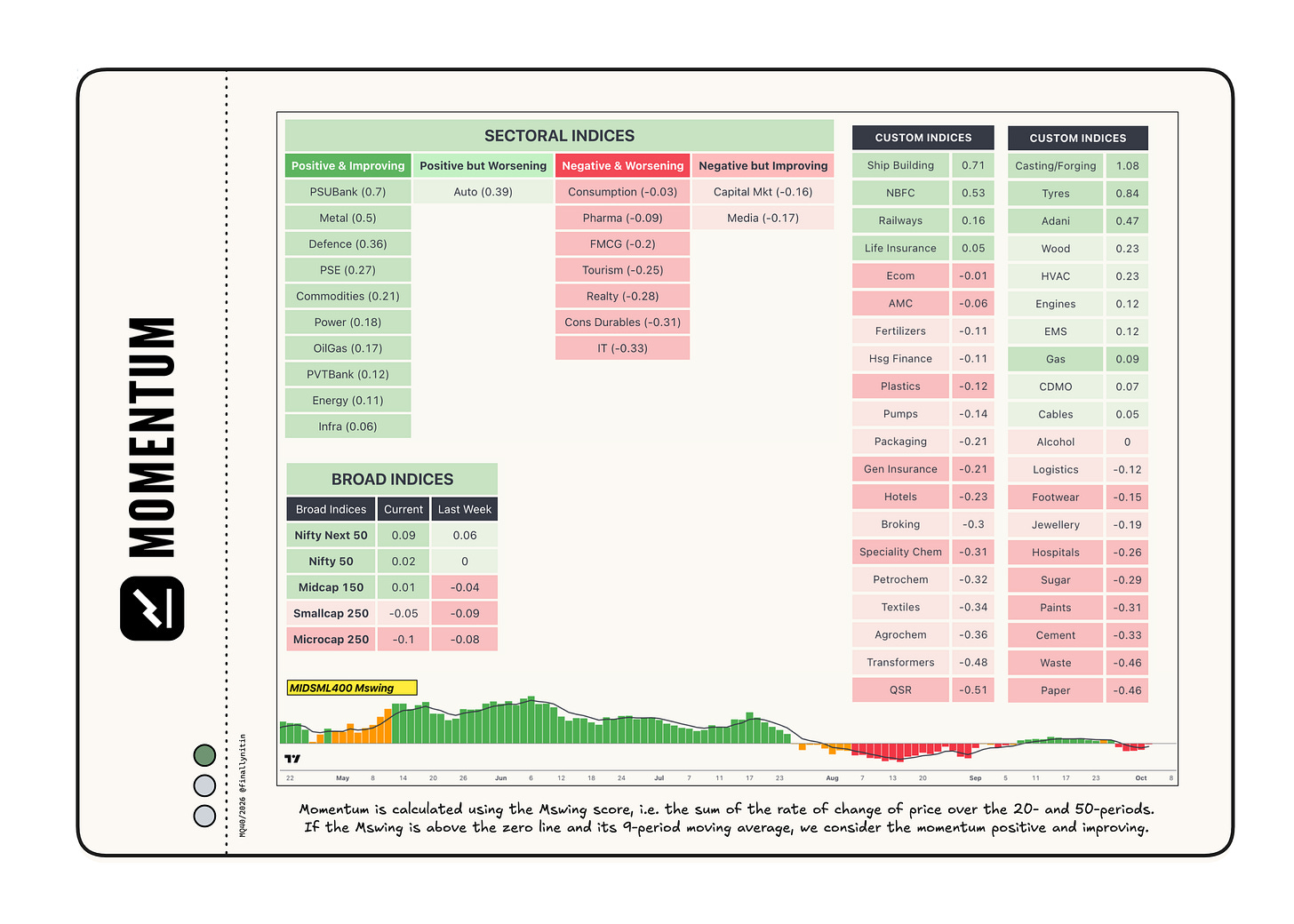

Most broad indices now have positive & improving momentum, as the momentum score for Nifty 50, Next 50 & Midcap 150 is above the zero line and its 9-period moving average.

Most sectoral indices also exhibit positive & improving momentum. PSUbank, Metal, Defence, Commodities, and PSE have positive & improving momentum.

Shipbuilding, NBFC, Tyres, Casting/forging, and the Adani group are notable custom indices with positive momentum.

That’s all for this week. If you'd like to know when I publish something new, subscribe to my newsletter, and you'll receive the latest directly in your inbox.