We are witnessing weakly positive momentum in a weak upswing within a weakly uptrending bear market.

A hard-money environment with very selective breakouts surviving. Watchlist feedback has lots of squats & faded moves.

Conservative swing portfolios should preferably be in all-cash, or at the most, holding relatively strong stocks with no (or minimal) open risk. Not an environment for fresh entries.

⦿ Bias: Bear

⦿ Trend: Uptrend (weak)

⦿ Swing: Upswing (weak)

⦿ Momentum: Positive (weak)

Bias → Bear

From a long-term perspective, from a transitional phase, we are back to a bear market.

For the past 4 weeks, more than 50% of stocks have remained below their 200 SMA. Hence, we are back to a bear market.

About 48% of stocks are positioned above their 200-day simple moving average. This week's numbers are similar to last week's, and we remain below the 50% mark.

When the percentage of stocks above the 200-day SMA remains above 50 for at least a month, we will be in a bull market. If it stays below 50 for a month, we will remain in a bear market.

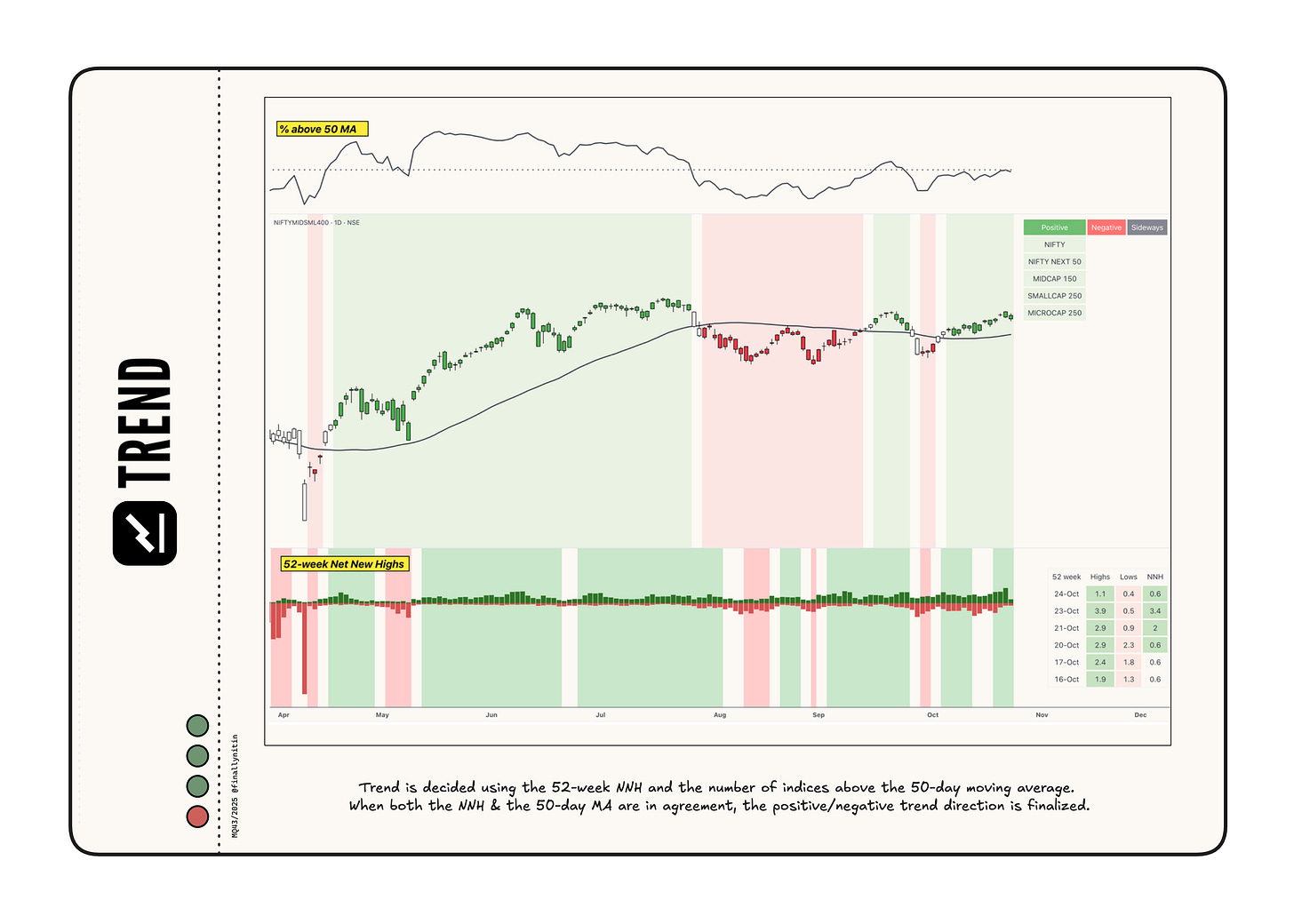

Trend → Uptrend (weak)

The market is in a weak uptrend.

52-week Net New Highs have remained consistently positive for the past three days. It’s worth noting that while the NNH values are positive, they have remained very low throughout the year. Hence, the trend, although an uptrend on paper, feels more like a sideways phase with not many stocks giving sustainable/tradable upmoves.

Over the past three days, major indices have remained consistently above their 50-day moving averages, while less than 50% of all stocks have remained above theirs.

The market will enter a confirmed uptrend if the 52-week highs consistently remain above the 52-week lows and more than 50% of stocks stay above their 50-day moving averages.

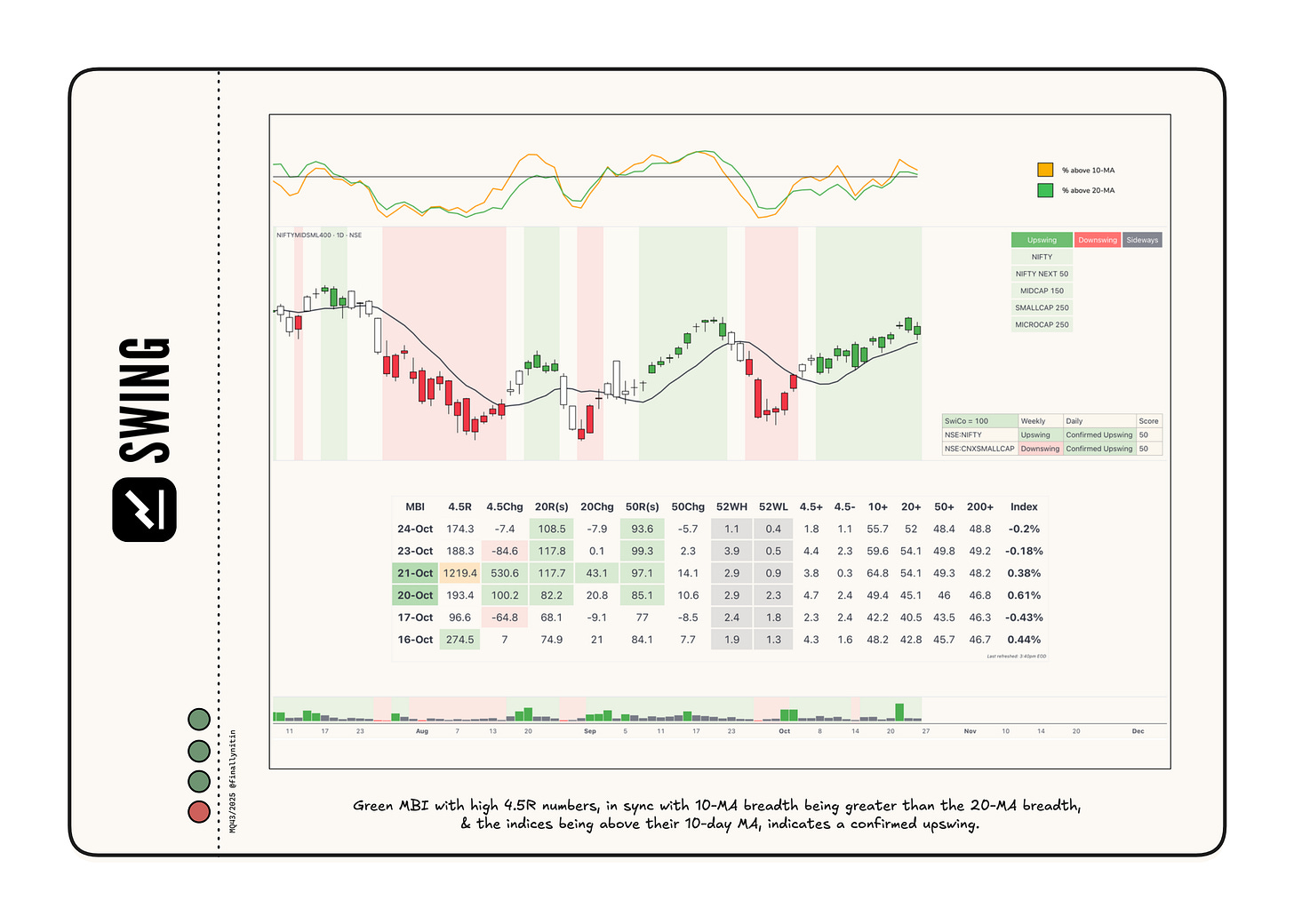

Swing → Upswing (weak)

The market is in a weak upswing.

Since last week, the MBI has stayed green. For the past three weeks, the 4.5R numbers have exceeded 400 only once. Low 4.5R numbers with a green MBI is a market environment that will have tradable-looking setups but with a very low probability of sustaining or giving a follow-through.

Broad indices remained consistently above their 10-day moving averages. Approximately 55% of stocks are trading above their 10-day moving averages, and, favoring the bulls, the 10% breadth is still above the 20% breadth.

Swing Confidence is 100, indicating that the portfolio can take the maximum permissible open risk.

Momentum → Improving

Most broad indices now have the momentum score above the zero line and its 9-period moving average. The numbers are still relatively weak.

Many sectoral indices are exhibiting positive & improving momentum. Capital market, PVTBank, Realty, Metal, and Auto have positive & improving momentum.

NBFC, Broking, Tyres, and Casting/forging are notable custom indices with positive momentum.

That’s all for this week. If you'd like to know when I publish something new, subscribe to my newsletter, and you'll receive the latest directly in your inbox.