→ No-money market transitioning into a hard-money market.

→ Anticipating a counter-trend rally approaching the 50-day moving average.

→ Traders sitting in cash should still await a bullish confirmation before initiating pilot positions.

⦿ Swing: Downswing Under Strain

⦿ Momentum: Negative & worsening

⦿ Breadth: Weak

⦿ Bias: Neutral

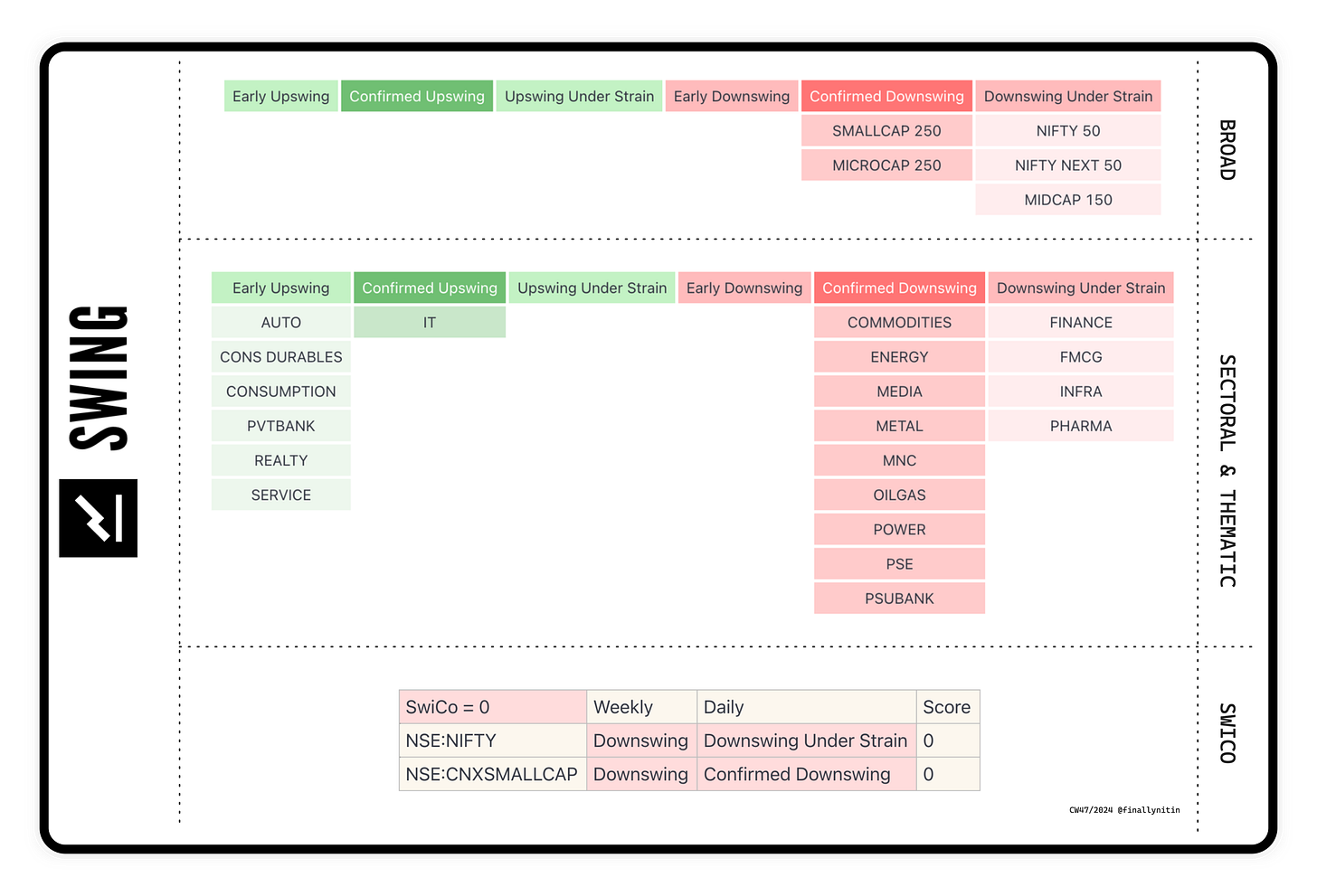

Swing → Downswing Under Strain

Most broad indices are in a downswing under strain. The Smallcap 250 & the Microcap 250 are still in a confirmed downswing.,

IT is the only sectoral index in a confirmed upswing. Consumption, Consumer Durables, PVT bank & Realty are emerging as the earliest indices to enter an Early Upswing.

Swing Confidence is 0, which means that the portfolio should still not be having any open risk.

Momentum → Negative & worsening

Most broad indices are having negative & worsening momentum. Only the Nifty 50, with its strong move today, is now having negative & improving momentum.

IT is the only index with positive momentum.

The momentum, while still negative, has begun to improve in Consumption, Consumer Durables, PVT bank & Realty.

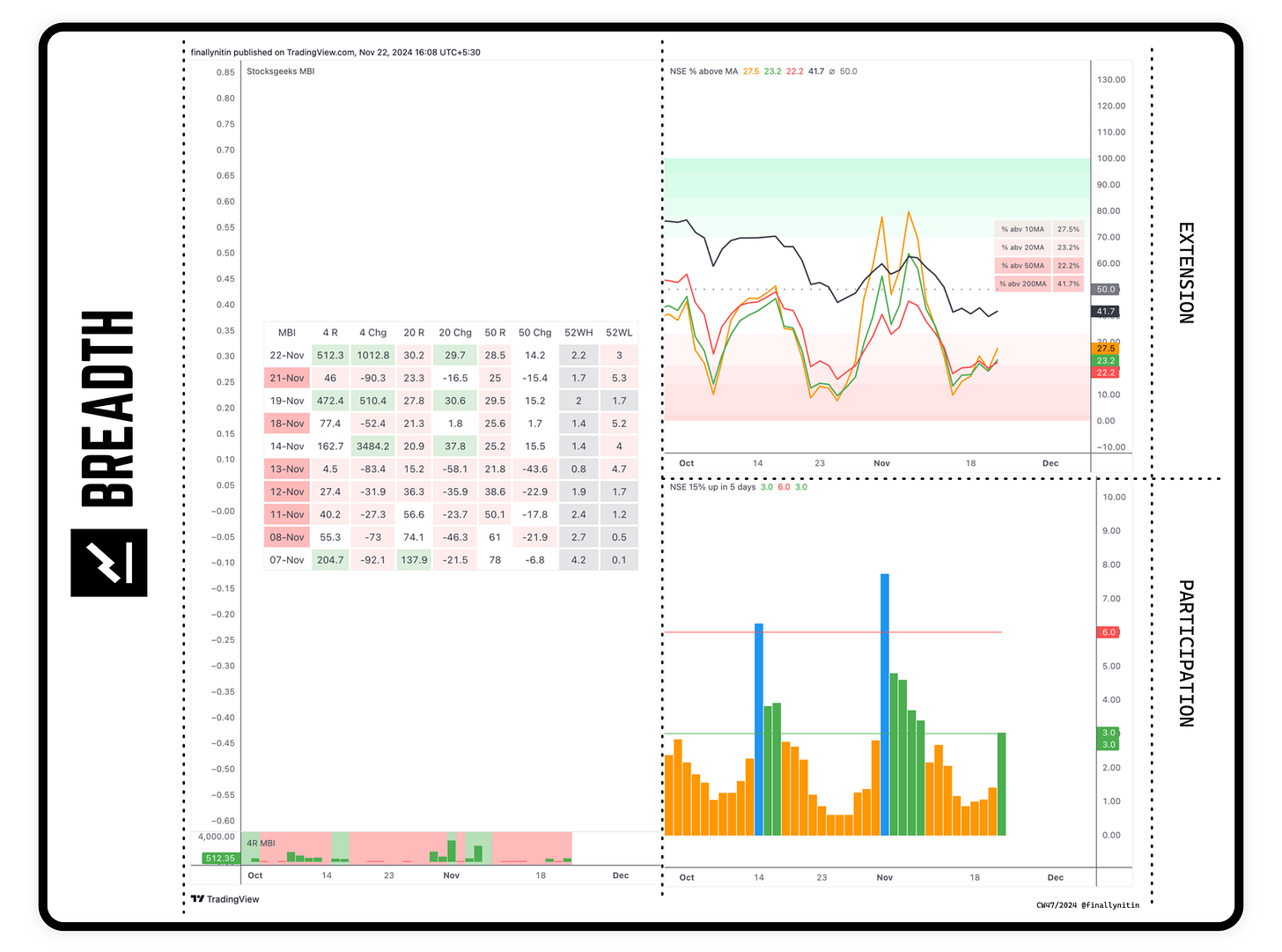

Breadth → Weak (& not oversold)

█ Breadth with regard to extension: The % of stocks above the 10-day MA & 20-day MA keep sustaining way below the 50% bullish threshold. The weak bounce at the end of the week has again ensured that the numbers do not stay oversold.

The % of stocks above the 50-day MA are sustaining below the 50% bullish threshold for the 8th week now.

The % of stocks above the 200-day MA are sustaining below 50 for the second week now. Sustenance of these levels for at least one month can confirm the transition of the ongoing bull market into a bear one.

█ Breadth with regard to participation: Stocks 15% up in 5 days stayed dry during the entire week, but gave a bounce on the last trading day of the week. We need a strong follow-through here to really believe that the bulls are coming back.

Stocksgeeks MBI continues its red trend. The 4R burst we got today left a lot to be desired, as strong bounces can take this number easily to 4 digits. Both the 20R and 50R numbers have continued in the red, indicating continuation of the downtrend. Till the MBI day trend turns green, or we get a strong 4R count, it’s prudent to not participate.

Bias → Neutral

Currently, the bias is still neutral, after turning red for just a day in this week.

52-week Net New Highs are not yet negative for past 3 consecutive days.

For the second week now, the Monthly (20-day) NNH are negative for past 3 consecutive days.

All broad indices are below the 50-day MA for past 3 consecutive days.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.