→ Hard-money market ready to transition into either direction

→ Anticipating a pullback, or at least some consolidation before a bullish continuation

→ Deployed portfolios should keep holding, while all-cash traders should wait a bit for more confirmation

⦿ Swing: Early Upswing

⦿ Momentum: Positive & improving

⦿ Breadth: Improving

⦿ Bias: Positive

Swing → Early Upswing

Most broad indices are in an early upswing. The Nifty 50 & Nifty next 50 are in a confirmed upswing.

Finance, IT, Realty & Service indices are looking the strongest in the list of many sectoral indices in a confirmed upswing.

Swing Confidence is 75, which means that the portfolio can take less than the maximum permissible open risk.

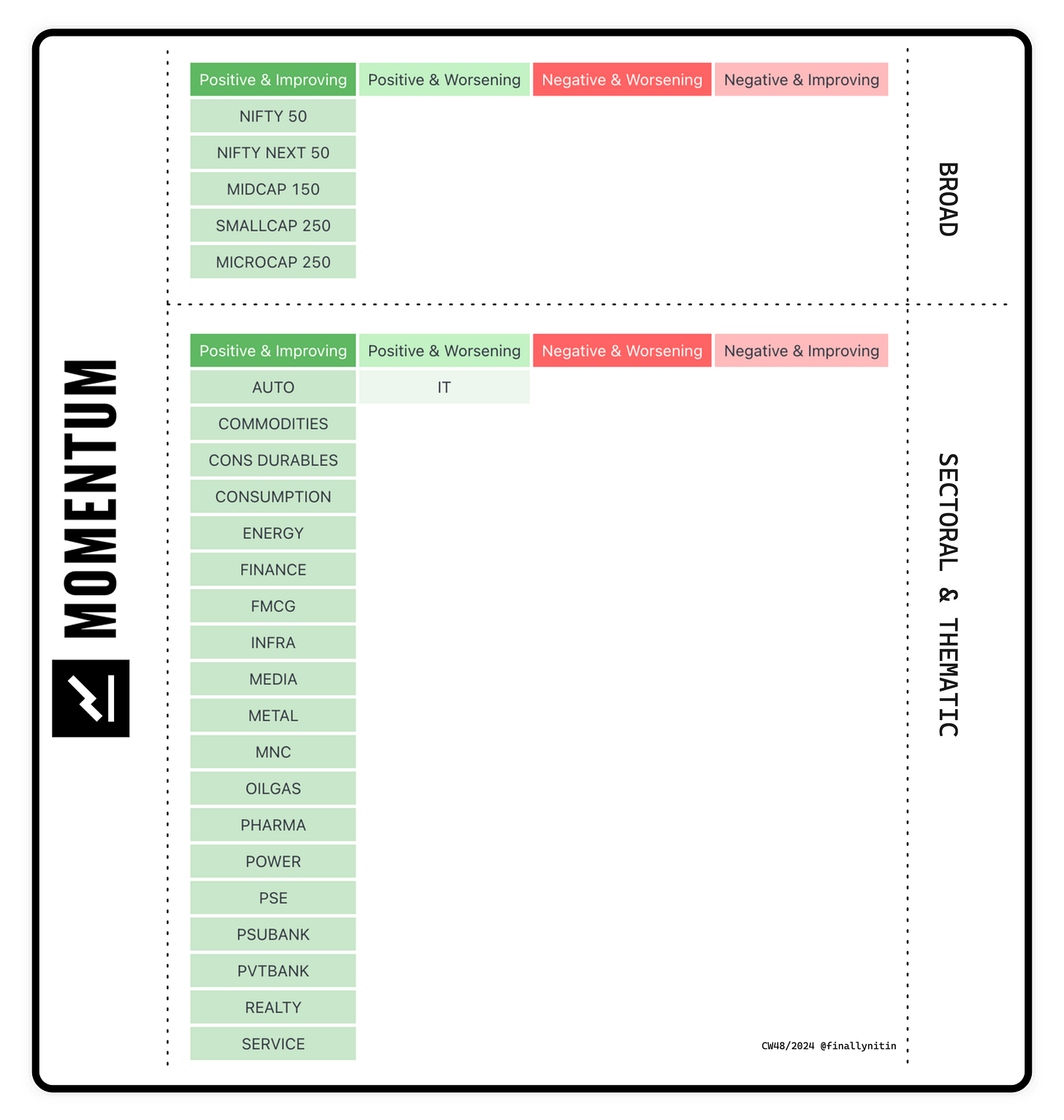

Momentum → Positive & improving

Almost all broad & sectoral indices are having positive & improving momentum.

IT is the only index with positive but worsening momentum.

There is no index with negative momentum.

Breadth → Improving

█ Breadth with regard to extension: The % of stocks above the 10-day MA & 20-day MA are now strongly above the 50% bullish threshold. Another bullish day could see the shorter-term MAs getting close to oversold levels.

The % of stocks above the 50-day MA are sustaining below the 50% bullish threshold for the 9th week now. They are, however, are quite close to crossing over the midline.

The % of stocks above the 200-day MA have reclaimed the 50% threshold after staying below it for past 2 weeks. Had they stayed below 50 for at least one whole month, the transition of the ongoing bull market would have been confirmed into a bear one. But the bulls have got a new life here.

█ Breadth with regard to participation: Stocks 15% up in 5 days have been in the green all this week. Strong follow-throughs here have announced the return of the bulls.

Stocksgeeks MBI changed its trend & turned green mid-week. The 4R bursts were in late triple digits, but we have had stronger rallies in the past where this number had easily reached 4 digits. While the 20R is now green, the 50R numbers are stil red, indicating that we are still not completely out of the woods yet.

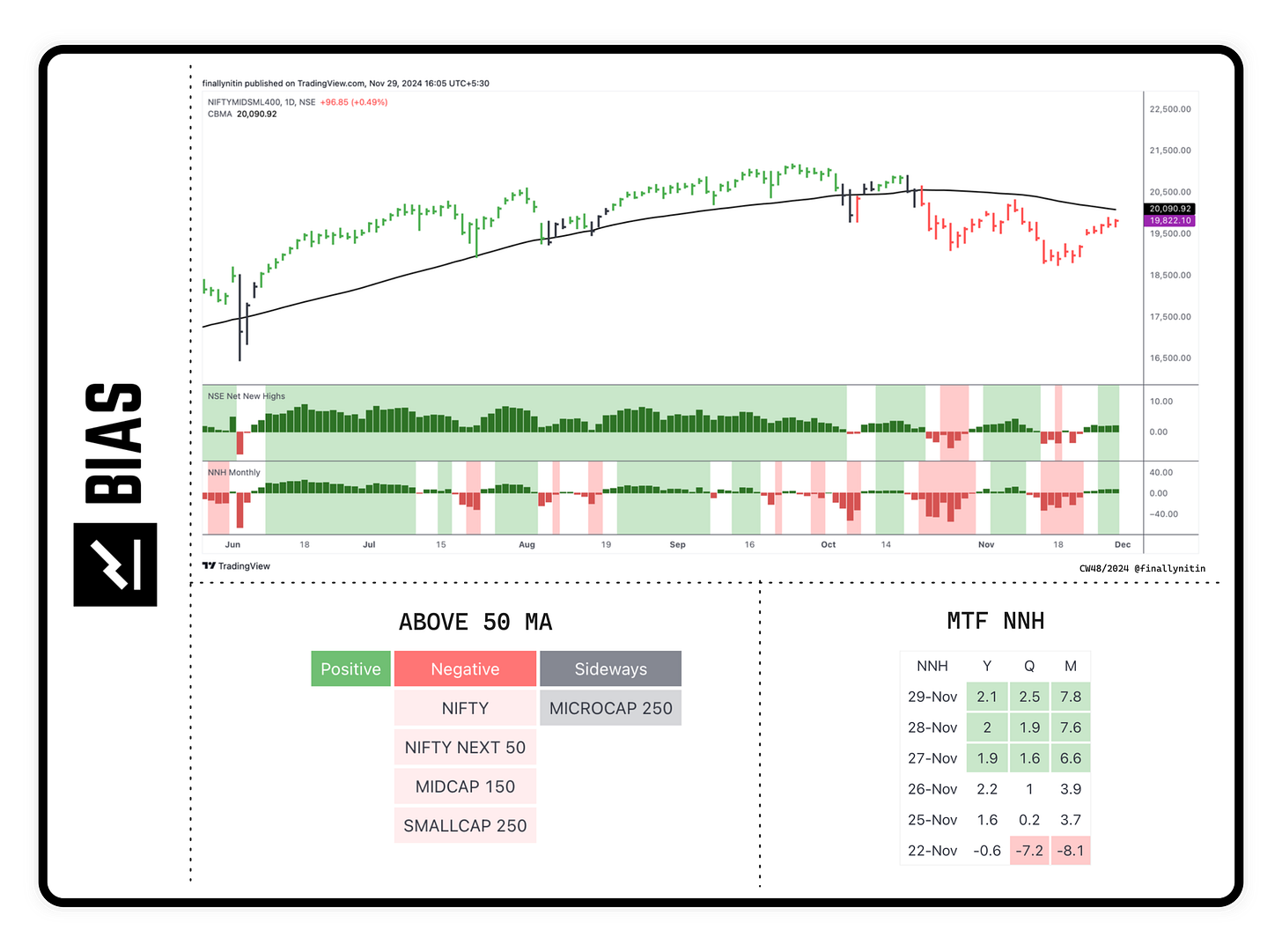

Bias → Positive

Currently, the bias is positive, after staying neutral last week.

52-week Net New Highs are positive for past 3 consecutive days.

The Monthly (20-day) NNH are also positive for past 3 consecutive days.

Most broad indices are still below the 50-day MA for past 3 consecutive days. The Microcap index is now sideways.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.