→ Hard-money market transitioning into an easy-money market

→ Anticipating a pullback, or at least some consolidation before a bullish continuation

→ Swing portfolios should keep holding with strict trailing stoplosses.

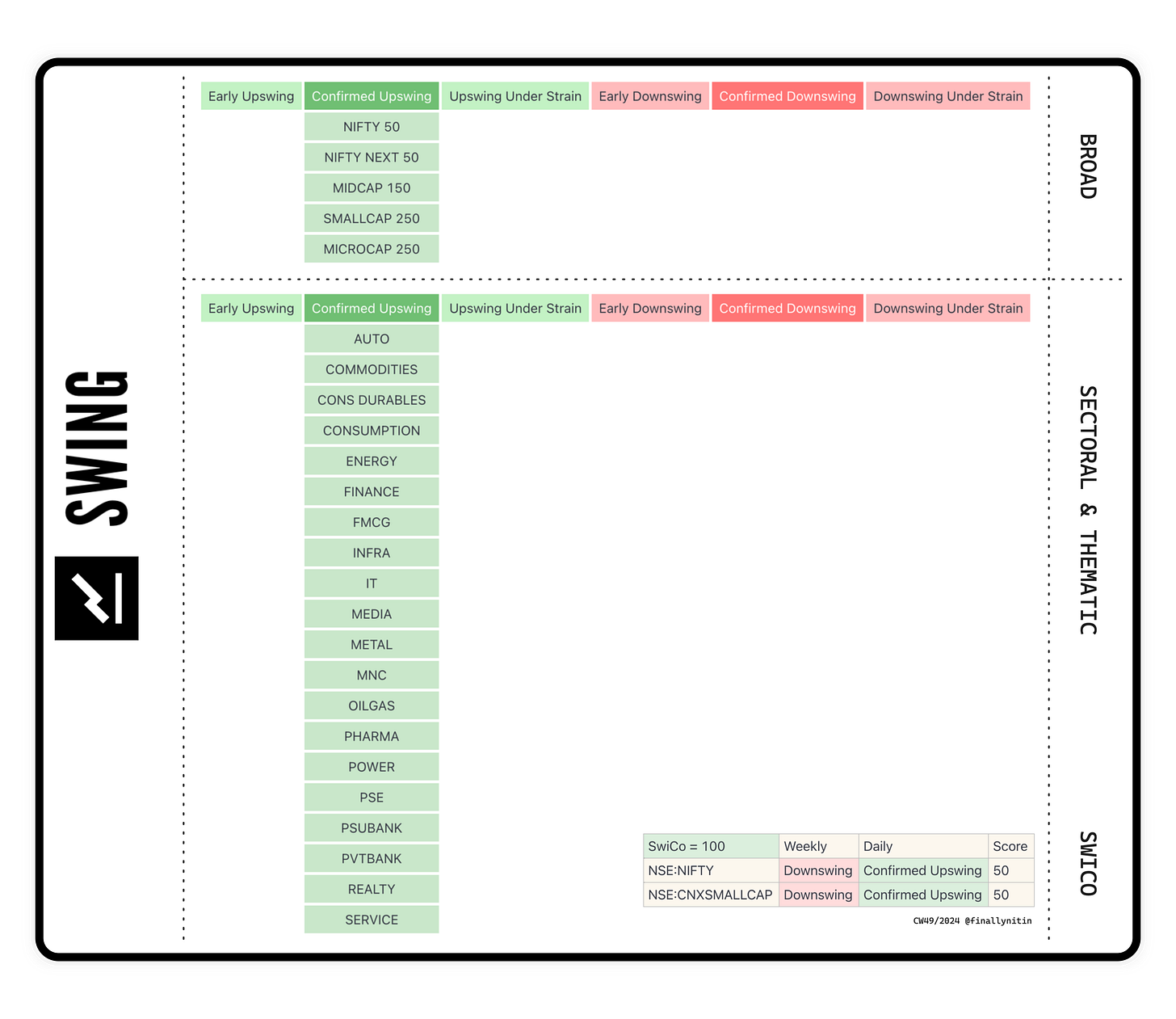

⦿ Swing: Confirmed Upswing

⦿ Momentum: Positive & improving

⦿ Breadth: Strong

⦿ Bias: Positive

Swing → Confirmed Upswing

All broad & sectoral indices are in a confirmed upswing.

IT, PSUbank, Consumer durables, Finance & Healthcare are looking the strongest in the list of many sectoral indices in a confirmed upswing.

Swing Confidence is 100, which means that the portfolio can take the maximum permissible open risk.

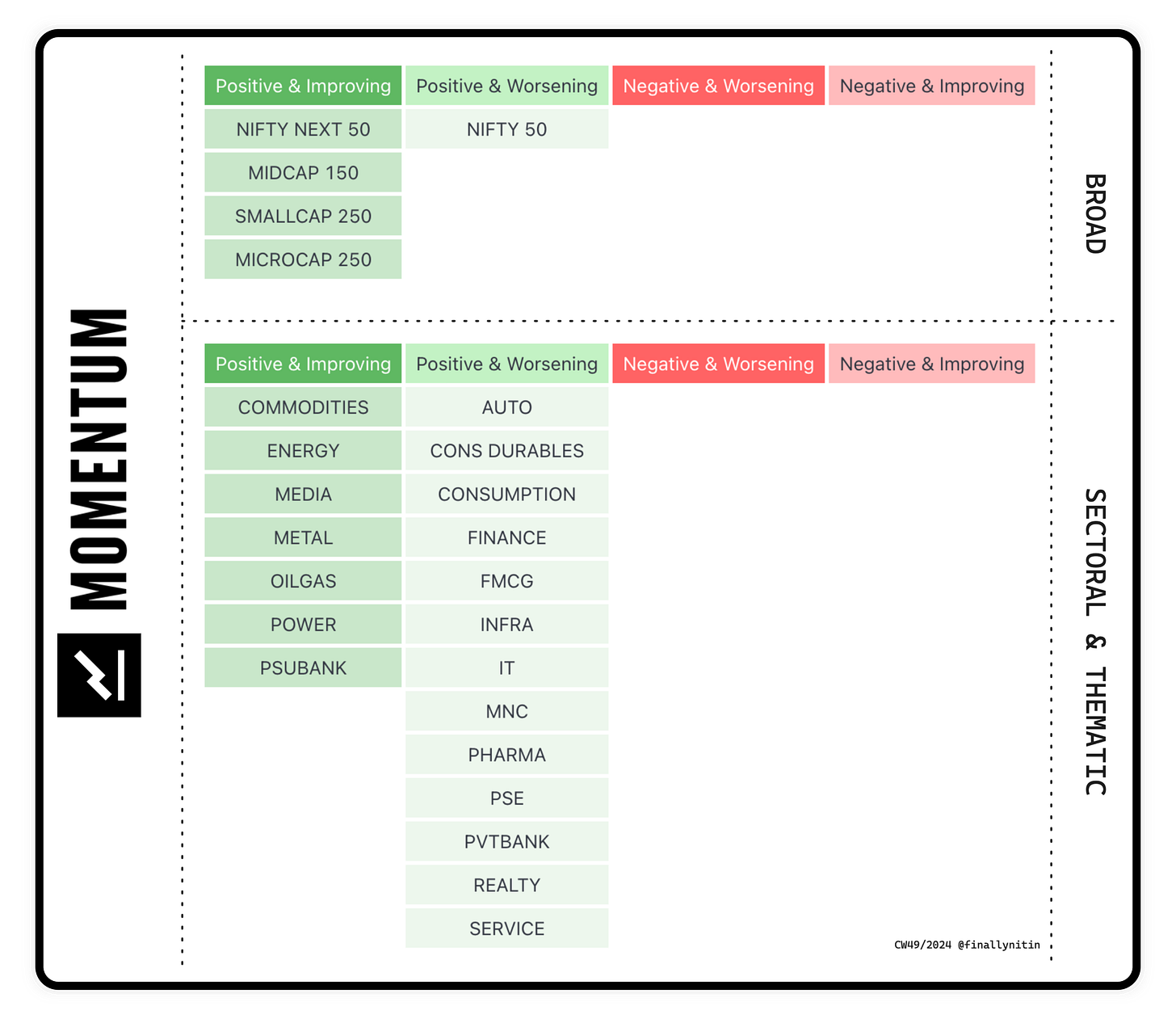

Momentum → Positive & improving

Almost all broad indices are having positive & improving momentum. Nifty 50 still has positive & worsening momentum.

Amongst sectoral indices, Commodities, Energy, Media, Metal, Power & PSUbank indices are having positive & improving momentum.

There is no index with negative momentum.

Breadth → Strong

█ Breadth with regard to extension: The % of stocks above the 10-day MA & 20-day MA are now nearing overbought levels.

The % of stocks above the 50-day MA have finally moved above the 50% bullish threshold, after sustaining below it for 9 weeks.

The % of stocks above the 200-day MA are now above the 50% threshold for 2 weeks now. The bull market lives on.

█ Breadth with regard to participation: Stocks 15% up in 5 days have been in the green all this week. We also had a >6.0 burst on Monday. This shows that the broader market is participating in this upmove.

Stocksgeeks MBI stayed in the green all this week, with all numbers >500. We even had 2 days when the 4R bursts were in 4 digits. There was no reason not to participate in such a rally this week. Both the 20R & 50R numbers are now green, indicating that we are back in an uptrend on all timeframes now.

Bias → Positive

Currently, the bias is positive for 2 weeks now.

52-week Net New Highs are positive for past 3 consecutive days.

The Monthly (20-day) NNH are also positive for past 3 consecutive days.

Most broad indices are now above the 50-day MA for past 3 consecutive days. The Nifty 50 index is now sideways.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.

Superb content as always. Thank you Bhai

Namaste Sir 🙏 Can you kindly elaborate "maximum permissible risk". It will be great help. Thank You 🙏