→ Hard-money market

→ Anticipating a follow-through day before a bullish continuation

→ Swing portfolios should keep holding & wait for some reduction in volatility before initiating new positions.

⦿ Bias: Positive

⦿ Breadth: Strong but weakening

⦿ Momentum: Positive but worsening

⦿ Swing: Confirmed Upswing

Bias → Positive

Currently, the bias is positive for 3 weeks now.

52-week Net New Highs are positive for past 3 consecutive days.

The Monthly (20-day) NNH are also positive for past 3 consecutive days.

All broad indices are now above the 50-day MA for past 3 consecutive days.

Breadth → Strong but weakening

█ Breadth with regard to extension: The % of stocks above the 10-day MA & 20-day MA, which were nearing overbought levels last week, have cooled down significantly. The % of stocks above the 5-day MA have gone below the 50% bullish threshold. Now the bulls need the % of stocks above the 10-day MA to again cross above the % of stocks above the 20-day MA.

The % of stocks above the 50-day MA have stayed above the 50% bullish threshold for 2 weeks now.

The % of stocks above the 200-day MA are now above the 50% threshold for 3 weeks now.

█ Breadth with regard to participation: Stocks 15% up in 5 days have stayed in the green all this week, but there was no >6.0 burst this week. This shows that the broader market participation is decreasing.

Stocksgeeks MBI stayed in the green but with relatively smaller 4R numbers. While the MBI didn’t turn red, on Thursday (12-Dec), we got a warning day, that was followed by a big shakeout day on Friday. The numbers at the end of the week are still on the lower side. We need a follow-through day with strong 4R numbers to trust the bulls. The 20R & 50R numbers stay green, indicating that we are still in an uptrend on all timeframes for now.

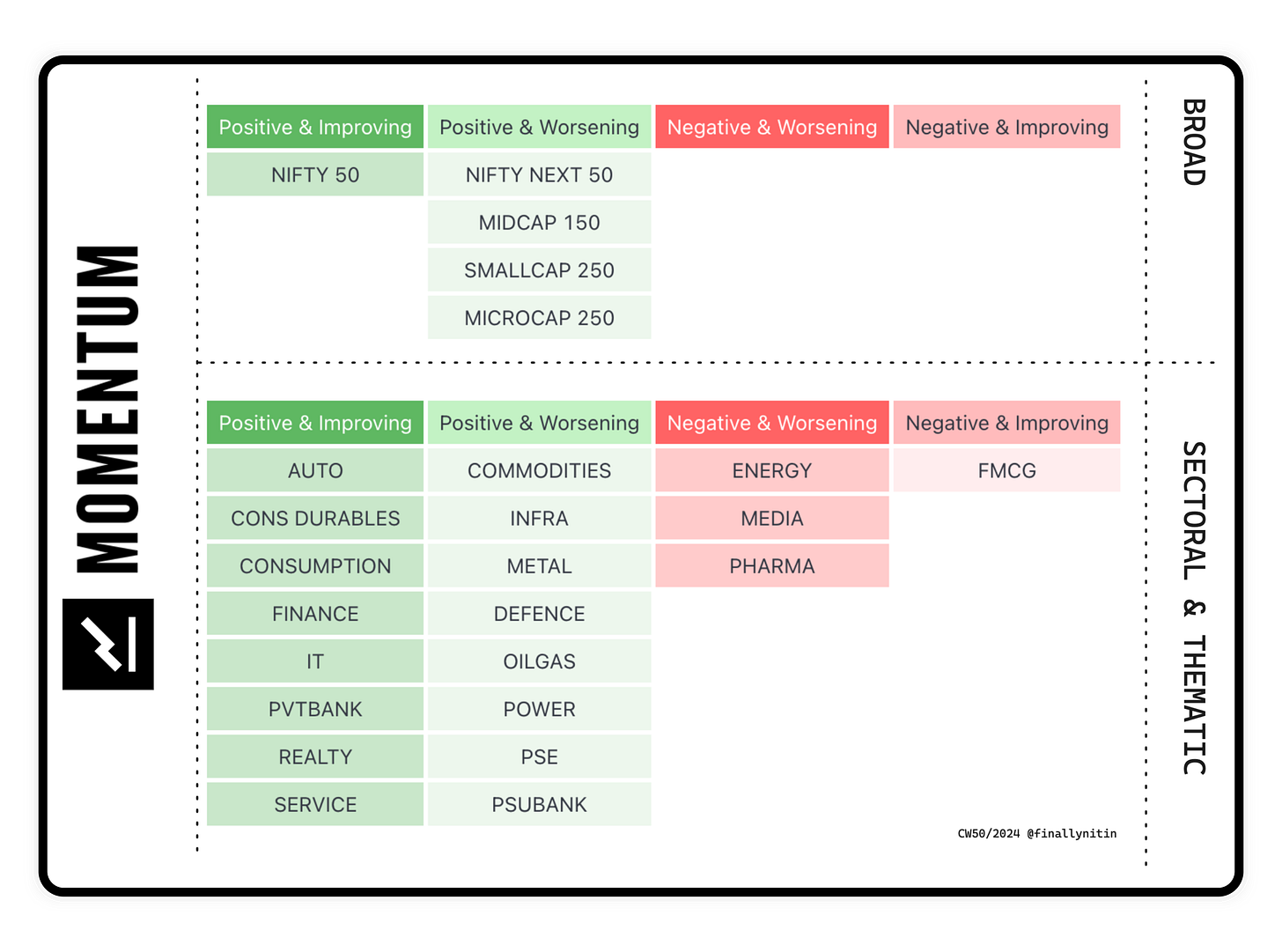

Momentum → Positive but worsening

Almost all broad indices are having positive but worsening momentum. Nifty 50 has positive & improving momentum.

Amongst sectoral indices, IT, Consumer durables, & Finance are notable indices having positive & improving momentum.

Energy, Media & Pharma are indices with negative & worsening momentum.

Swing → Confirmed Upswing

Most broad & sectoral indices are still in a confirmed upswing.

IT, PVTbank, Consumer durables, Finance, Infra & Service are looking the strongest in the list of many sectoral indices in a confirmed upswing.

Swing Confidence is 50, which means that the portfolio can take half the maximum permissible open risk.

Sectoral Rotation

IT & Consumer durables continue as the leaders.

Pharma, Media & FMCG are getting weak.

Realty, Infra & Service indices are improving.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.