→ No-money market

→ Anticipating a range expansion.

→ Swing portfolios should be in all-cash, but ready for new positions, if & when conditions turn favourable, or for reversal trading if market keep going south to become oversold.

⦿ Bias: Negative

⦿ Breadth: Weak

⦿ Momentum: Negative but improving

⦿ Swing: Confirmed Downswing

Bias → Negative

After turning neutral last week, currently the bias is negative.

52-week Net New Highs are negative for past 3 consecutive days.

The Monthly (20-day) NNH are also negative for past 3 consecutive days.

Only the Microcap index is above the 50-day MA for past 3 consecutive days. Most indices are below their 50-day MA.

Breadth → Weak

█ Breadth with regard to extension: The % of stocks above the 10-day MA & 20-day MA are sustaining below the 50% mark, & are still not oversold. Till the 10-day MA line stays below the 20-day MA line, we are in a bearish swing.

The % of stocks above the 50-day MA stay below the 50% bullish threshold for 2 weeks now.

The % of stocks above the 200-day MA are now (barely) below the 50% threshold.

█ Breadth with regard to participation: Stocks 15% up in 5 days have again stayed low all this week, even lower than last week, which shows that the broader market participation has dried down further.

Stocksgeeks MBI had already turned red at the end of last week, & stayed in that mood all this week, with another red day on Thursday. 4R numbers have been very low, & the probability of trades working in such an environment is quite dismal. One should keep sitting out till either the MBI turns green with strong numbers, or till we get oversold. The 20R & 50R numbers also stayed red, indicating that the downtrend is continuing on all timeframes. It is interesting to see that throughout all this, the index has barely moved.

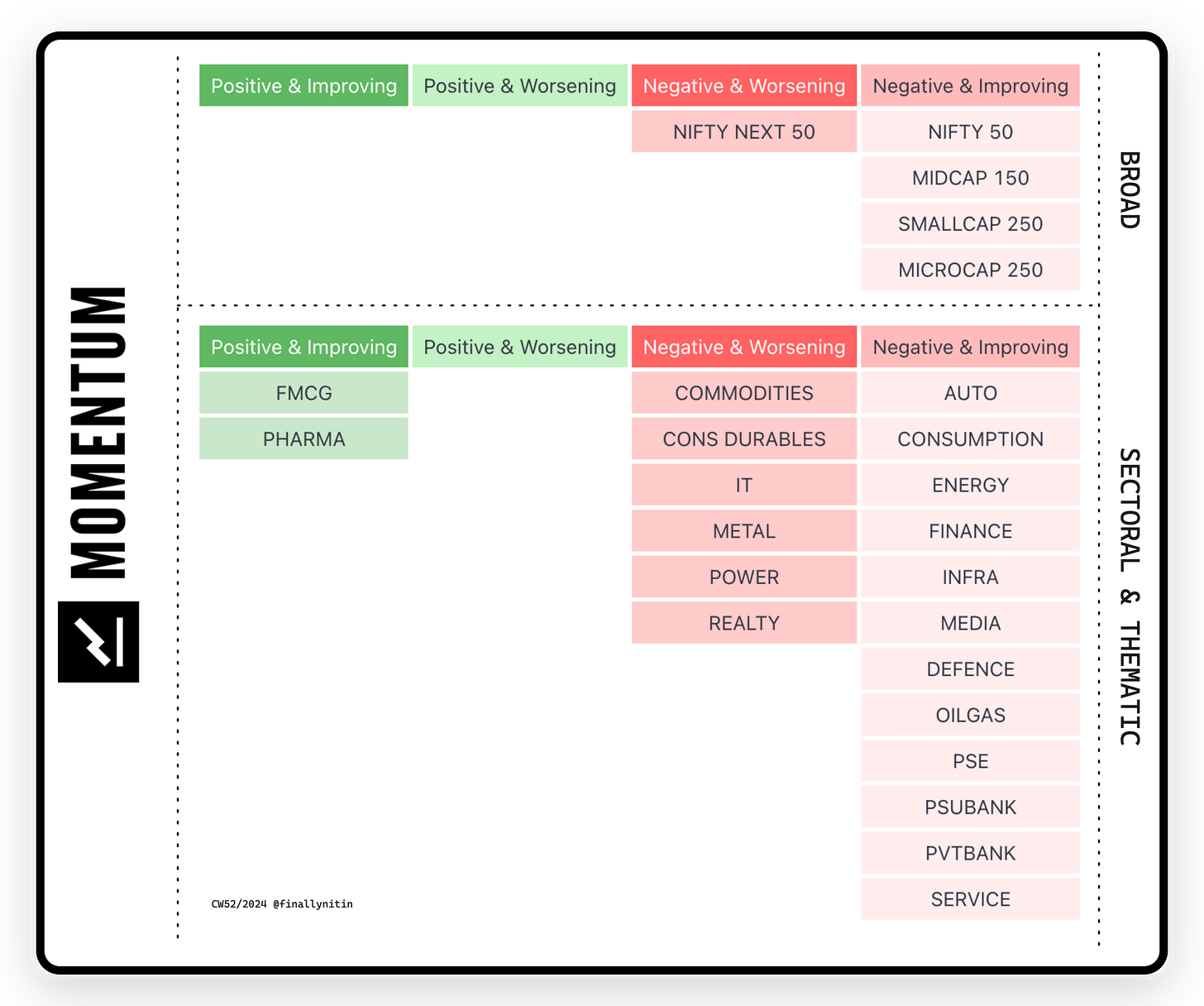

Momentum → Negative but improving

Most broad & sectoral indices are having negative but improving momentum.

Auto & Consumption are notable sectoral indices with negative but improving momentum.

The only indices having positive & improving momentum are Pharma/Healthcare & FMCG.

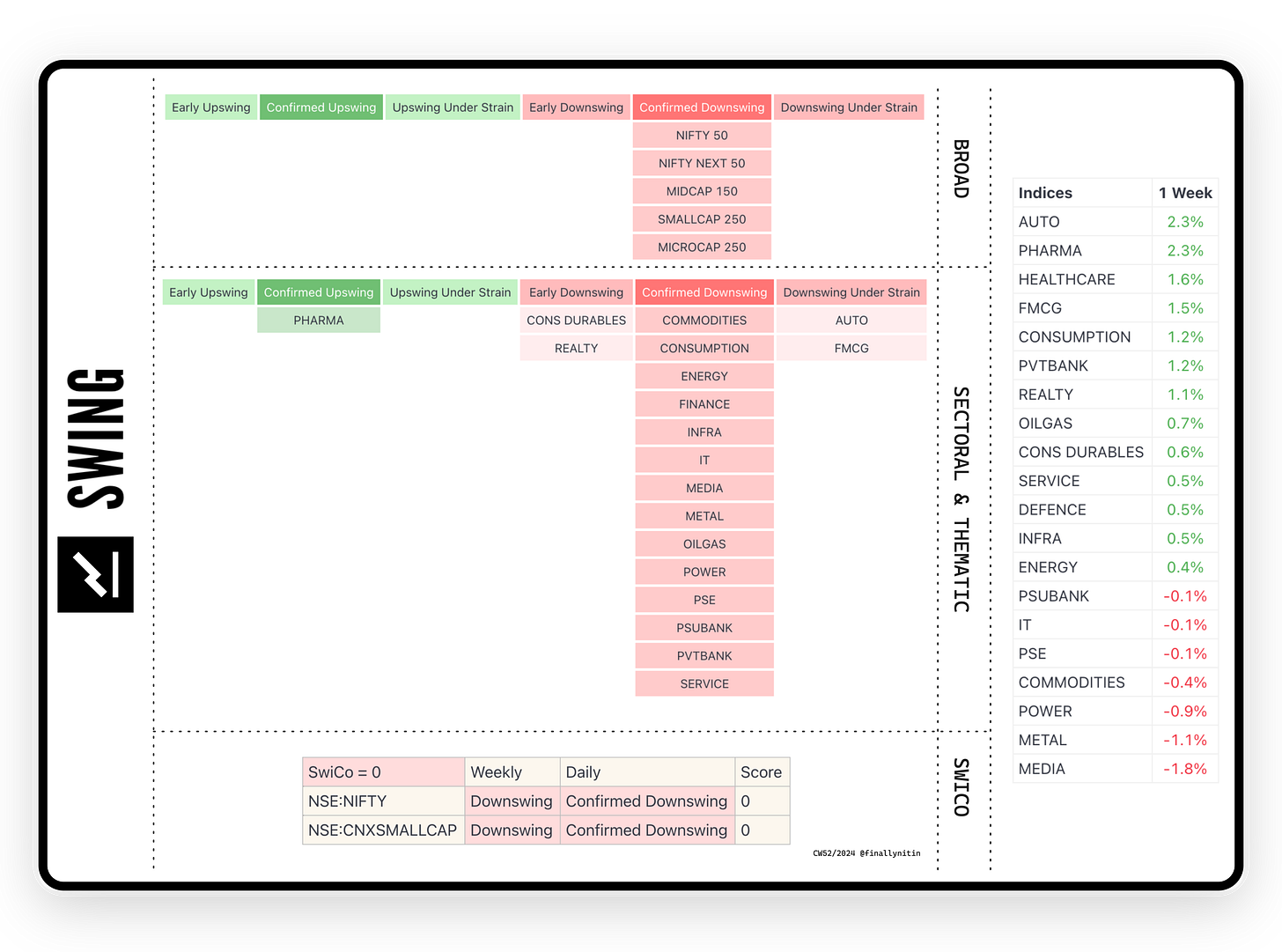

Swing → Confirmed Downswing

Most broad & sectoral indices are in a confirmed downswing.

Pharma & Healthcare are still in a confirmed upswing. Other this these, only Auto & FMCG are the only sectoral indices in a downswing under strain.

Swing Confidence is 0, which means that the portfolio should not be having any open risk.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.

Thank you for this! This is highly educational.

Could you please elaborate on/point me to relevant reading material to understand what 4R is?