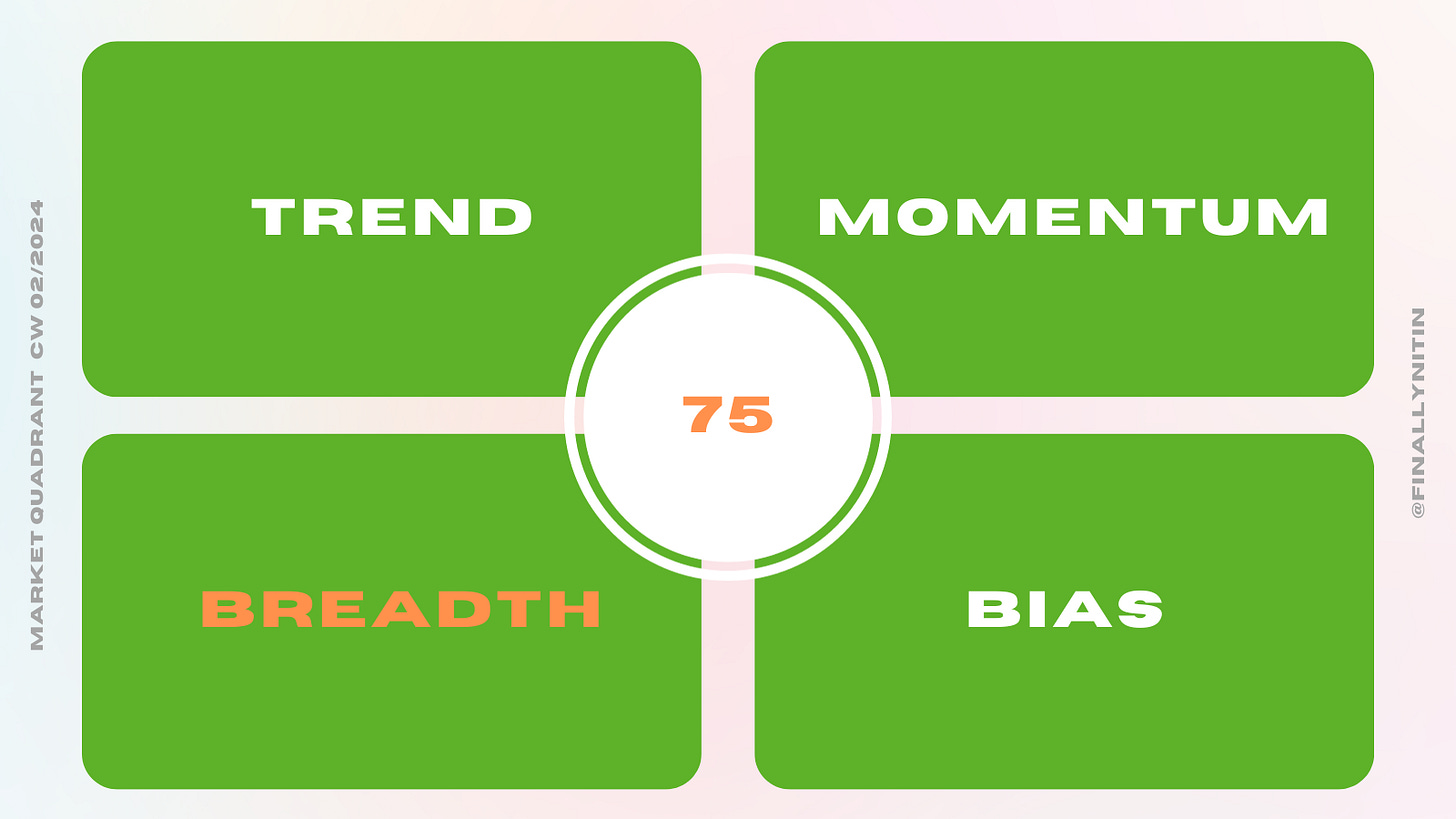

MarketQuadrant CW02/2024

Overbought markets remaining overbought longer than you can remain cautious.

⦿ Trend: Confirmed Uptrend

⦿ Momentum: Positive & improving

⦿ Breadth: Overbought

⦿ Bias: Positive

⦿ Swing: Confirmed Upswing

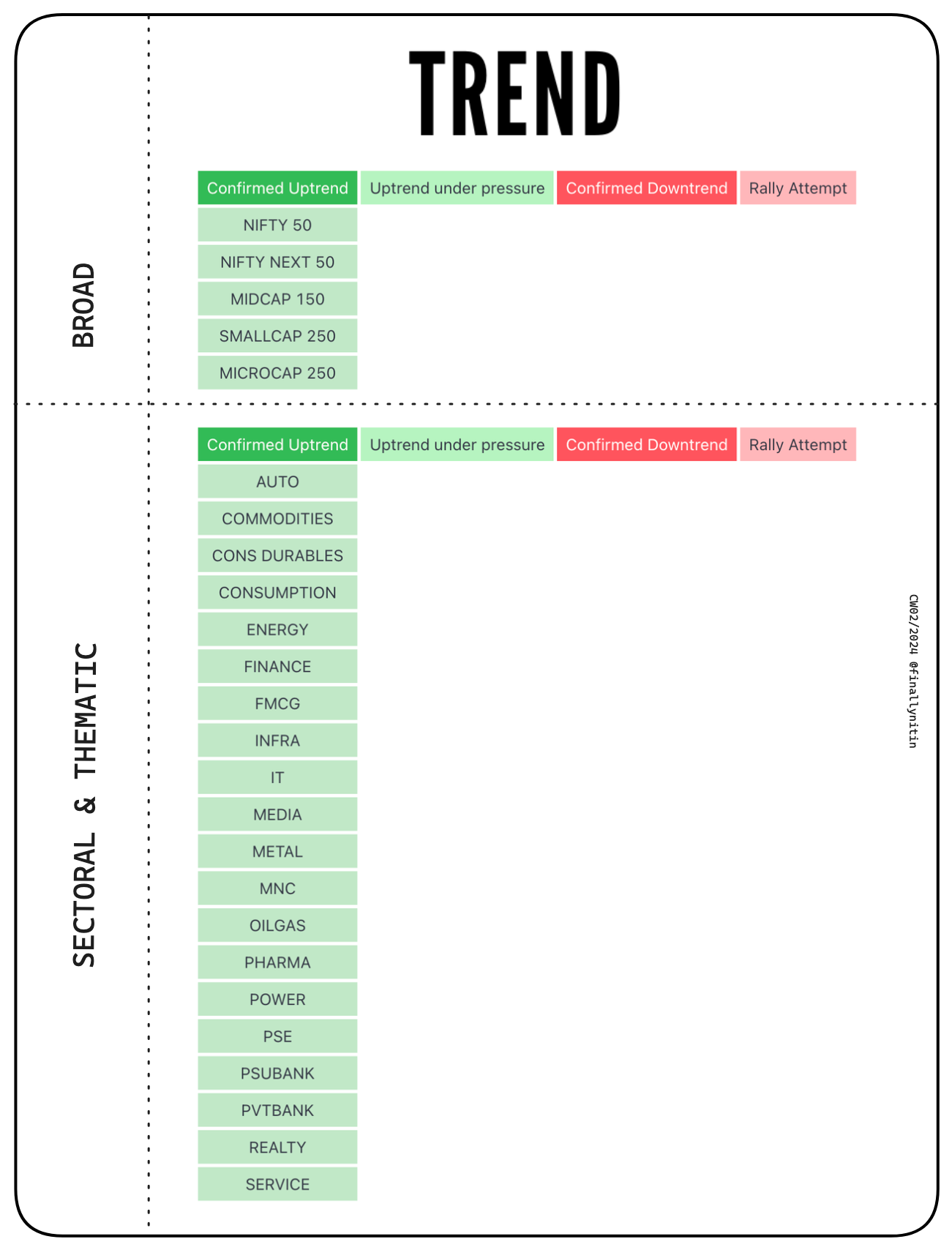

Trend → Confirmed Uptrend

⦿ Continuing from last week, all the broad indices stay in a confirmed uptrend.

⦿ All sectoral/thematic indices are also in a confirmed uptrend.

⦿ Not even a single index is in downtrend.

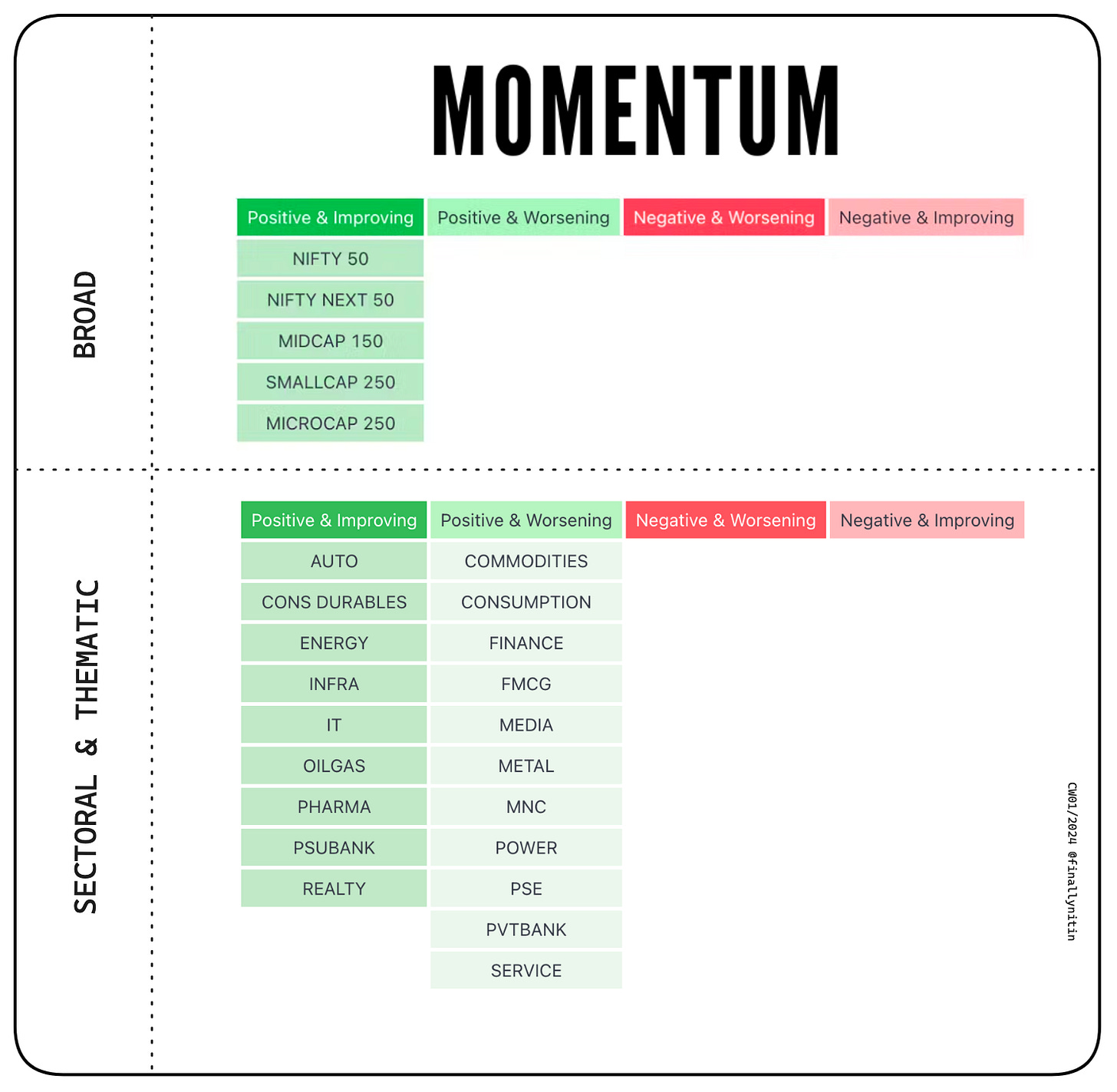

Momentum → Positive & improving

⦿ Most of the broad market indices & majority of the sectoral indices have positive & improving momentum.

⦿ Finance, FMCG, Media, & Power are some indices with positive but worsening momentum.

⦿ Auto & IT, which had worsening momentum last week, are back to being positive.

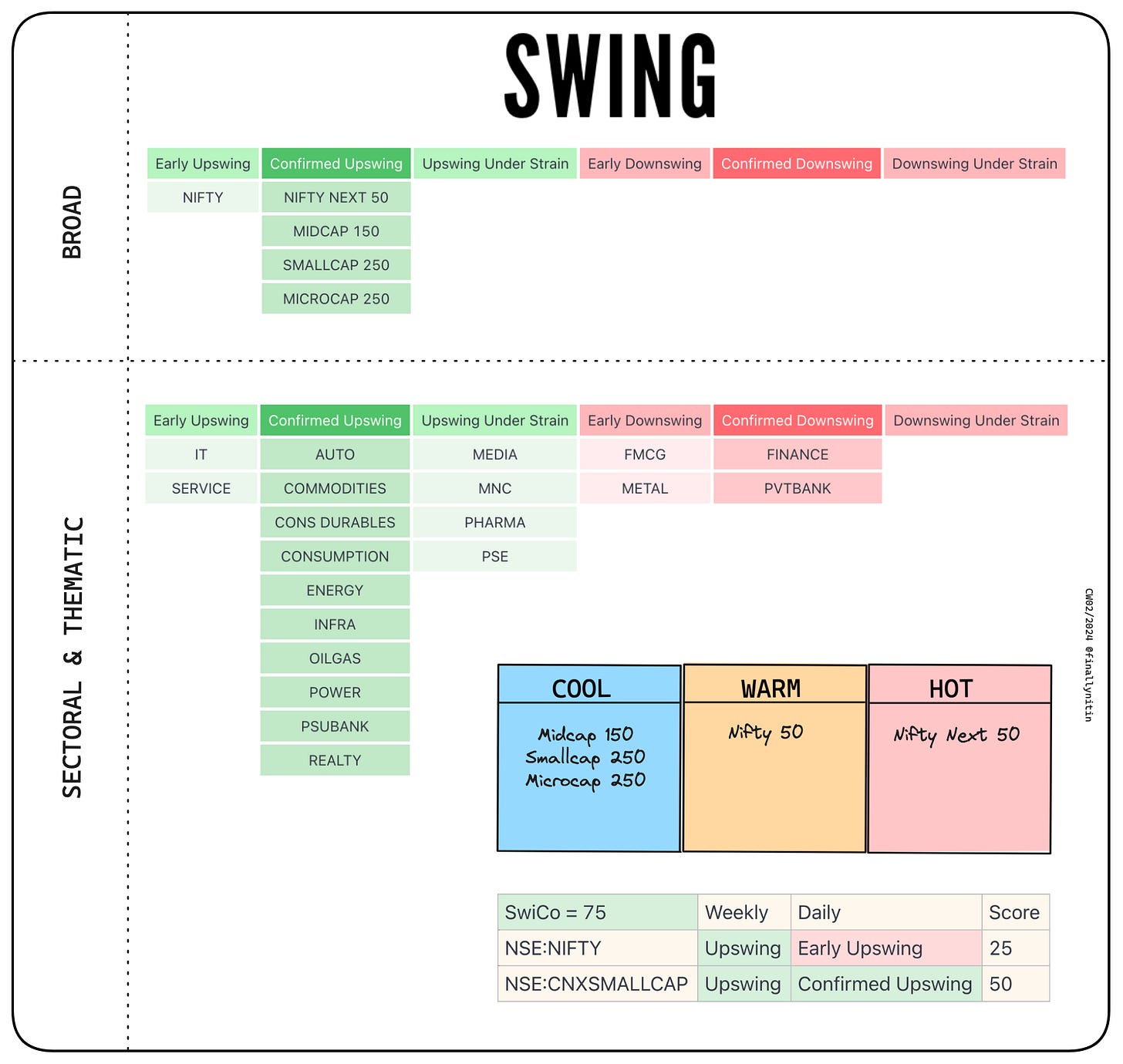

Swing → Confirmed Upswing

⦿ Majority of indices are in a confirmed upswing. IT is in an early upswing, while Finance & PVTbank are in a confirmed downswing.

⦿ Nifty is in an early upswing, while Smallcap 100 is in a confirmed upswing, Swing Confidence is 75, which means that the portfolio should take less than the maximum permissible open risk.

⦿ While overall weekly Swing Temperature is cool (which means that new swing positions can be taken), it is still warm/hot in Nifty 50/next 50. So a little caution here would be prudent.

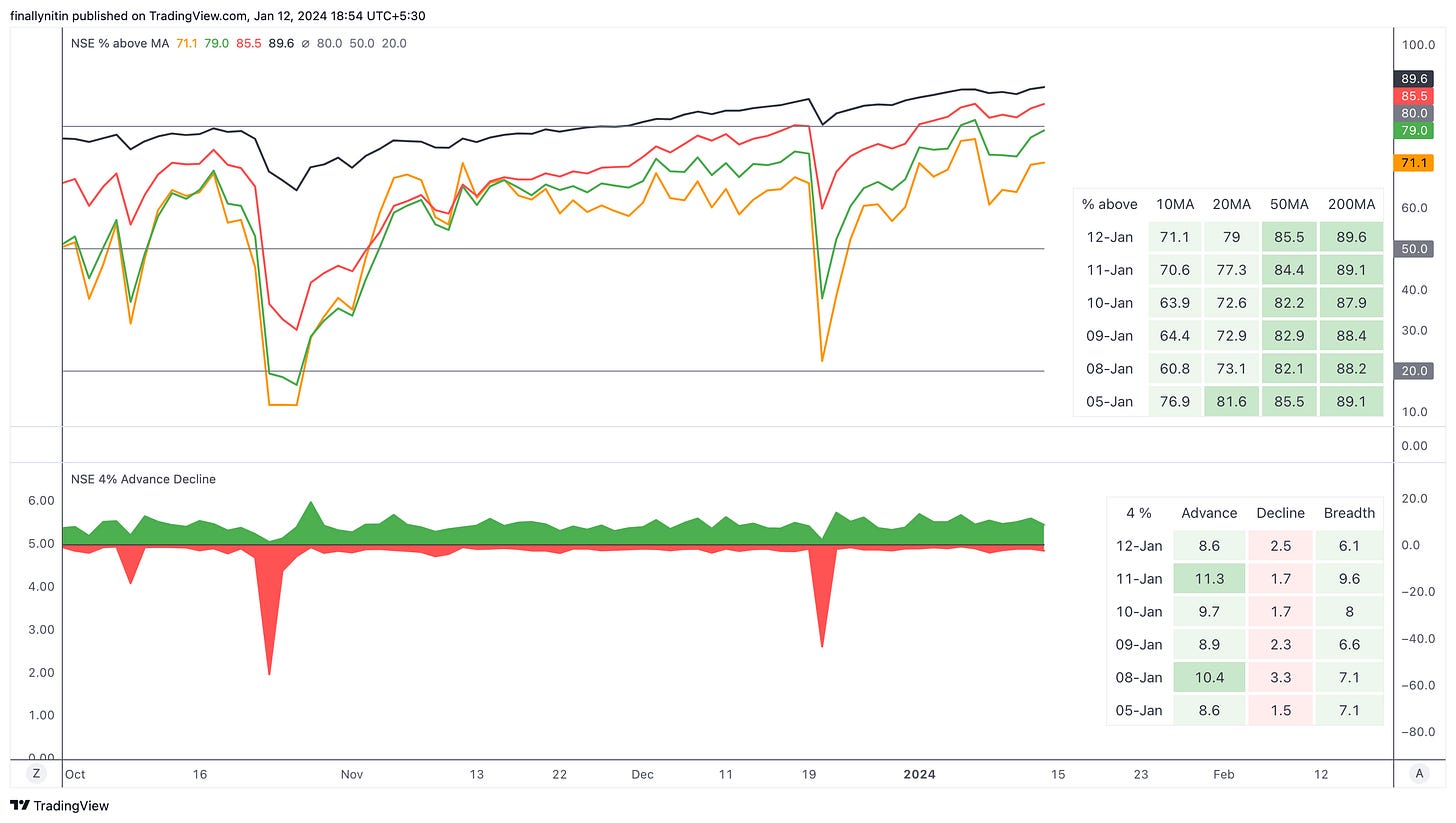

Market breadth → Overbought

⦿ Breadth as per moving averages: With the % of stocks above 50-day MA above 80, & those above 20-day MA nearing 80, the market breadth is still clearly overbought. The % of stocks above 10-day MA are near overbought. The % of stocks above 200-day MA stay in the sustainably bullish 80+ range.

⦿ Net breadth as per 4% advance & decline is positive, with intermittent double-digit advances.

⦿ After dipping down mid-week, Market breadth volume has been inching up, & now stands at 0.69, which indicates decent participation.

Bias → Positive

Currently, the bias is positive.

⦿ Majority of indices have stayed above the 50-day MA for past 3 consecutive days.

⦿ Net New Highs have stayed positive for past 3 consecutive days.

⦿ On lower timeframes, the 65-day & 20-day NNH are positive for past 3 consecutive days.

SA notes for CW 02/2024

Continuing for past 2 months, the bull swing is in a late stage now.

Market still keeps moving up, with good participation (decent volume & frequent double-digit 4% advances).

We are overbought on 50-day, but still some space on the 20 & 10.

A pullback can appear any day. It may take more number of days to appear than logical.

I'm still fully invested, & still wary of taking new positions (have funds beyond the 100% already invested).

Holding all the stocks with trailing stoplosses.

Surprisingly, a lot of breakouts are sustaining.

But this is definitely not the time to put on more size.

It would not be prudent to proactively close positions either, because bull rallies like these can sustain beyond our expectation.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you. Enjoy this market crossword for now:

Hey Nitin, 1st time reading your post. Love the flow, graphics and clarity of content.

#DilMaangeMore

How often would you be posting blogs?

Superb Nitin Bhai