⦿ Swing: Upswing under strain

⦿ Momentum: Positive but worsening

⦿ Breadth: Worsening

⦿ Bias: Positive

_______________________________________________

⦿ Trend (positional): Confirmed Uptrend

Swing → Upswing under strain

⦿ Most broad indices are in an upswing under strain. Smallcap index is still in a confirmed upswing, while Nifty 50 is in an early downswing.

⦿ Most sectoral indices are in an early downswing.

⦿ Swing Confidence is 25, which means that the portfolio can take only the minimum permissible open risk.

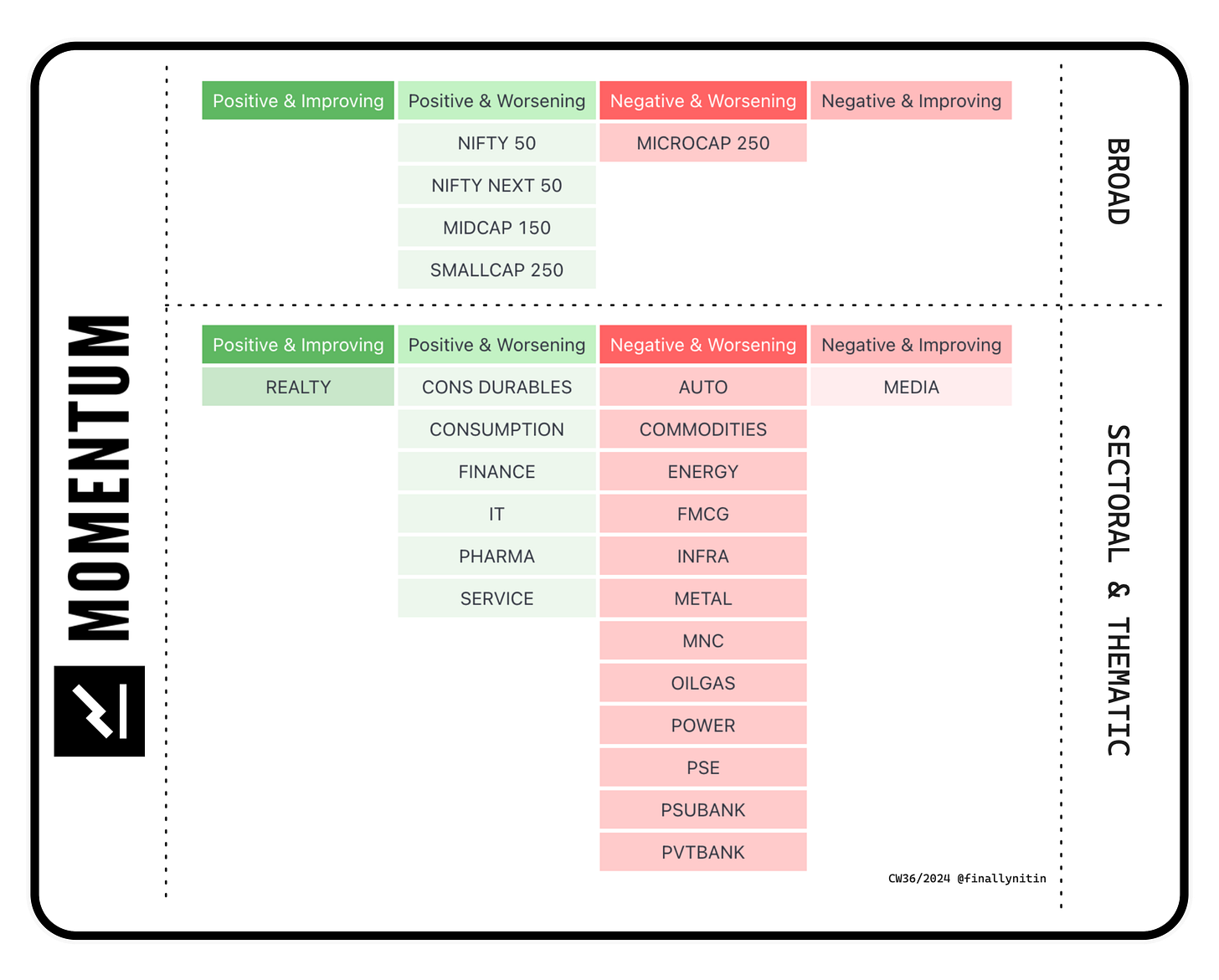

Momentum → Positive but Worsening

⦿ Most broad indices are having positive but worsening momentum. The Microcap 250 index is having negative & worsening momentum.

⦿ Most sectoral indices, on the other hand, are having negative & worsening momentum.

⦿ Consumer durables, consumption, Finance, IT, Pharma & service are notable indices having positive (but worsening) momentum.

Breadth → Worsening

█ Breadth with regard to extension: The last day of the week saw the % of stocks above 10-day MA & 20-day MA going below the bullish threshold of 50.

The % of stocks above the 50-day MA are still in the bullish zone above 50%.

The % of stocks above 200-day MA are have dropped below the 80 level. They need to stay above 80 for a strong bullish rally.

Stocks 15% up in 5 days are no longer extended for 2 weeks now.

█ Breadth with regard to participation: The net breadth as per 4% advance & decline, after staying green throughout the week, ended just in the red after a bearish Friday.

The 5-day ratio is green (above 2.0), but its value is now decreasing.

The Market breadth volume stayed dried up throughout the first 4 sessions & didn’t cross above the 1.0 level even during the big red Friday, indicating selective participation in both directions.

Stocksgeeks MBI gave 3 consecutive green days this week, with the 4R column getting progressively stronger. The last day made sure that the MBI has ended the week neutral. Both the short-term (20 Chg) & medium-term trend strength (50 Chg) are weakening. So compared from last week, the breadth is worsening.

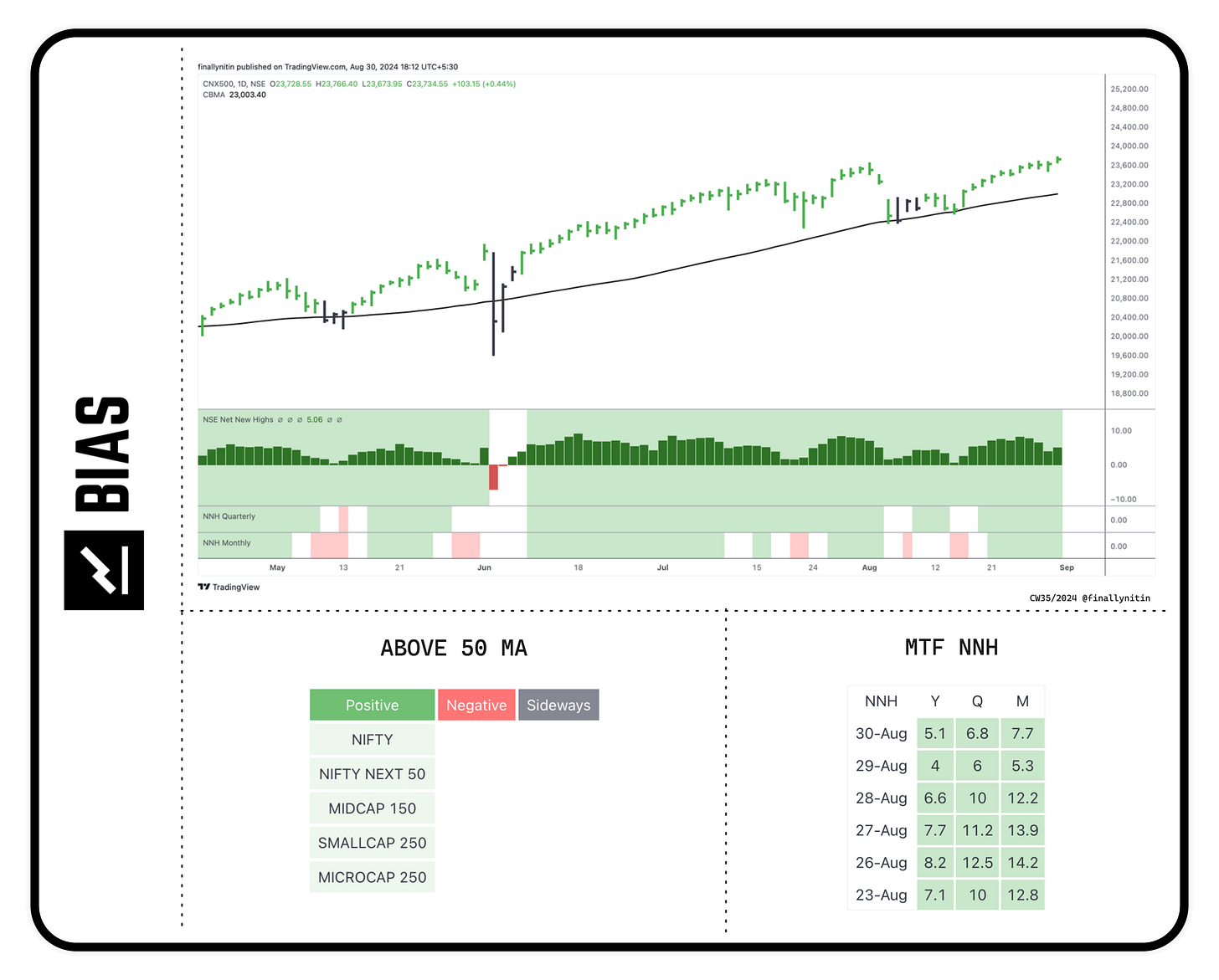

Bias → Positive

Currently, the bias is positive for 13 weeks now.

⦿ 52-week Net New Highs are positive for past 3 consecutive days.

⦿ All broad indices have stayed above the 50-day MA for past 3 consecutive days.

⦿ On lower timeframes, both the Quarterly (65-day) NNH and the Monthly (20-day) NNH are also positive for past 3 consecutive days.

That’s all for this week. If you'd like to know when I publish something new, just subscribe to my newsletter and you'll get the latest sent direct to you.