In the series of market breadth indicators, now presenting the Percentage of NSE stocks above Moving Averages script for TradingView.

Interpretation

Bullish bias: when >50% of stocks are above their 50-day and 200-day MAs

Bearish bias: when <50% of stocks are above their 50-day and 200-day MAs

Overbought: when >80% of stocks are above their 10-day and/or 20-day MAs and/or 50-day MAs

Oversold: when <20% of stocks are above their 10-day and 20-day MAs and/or 50-day MAs

Features

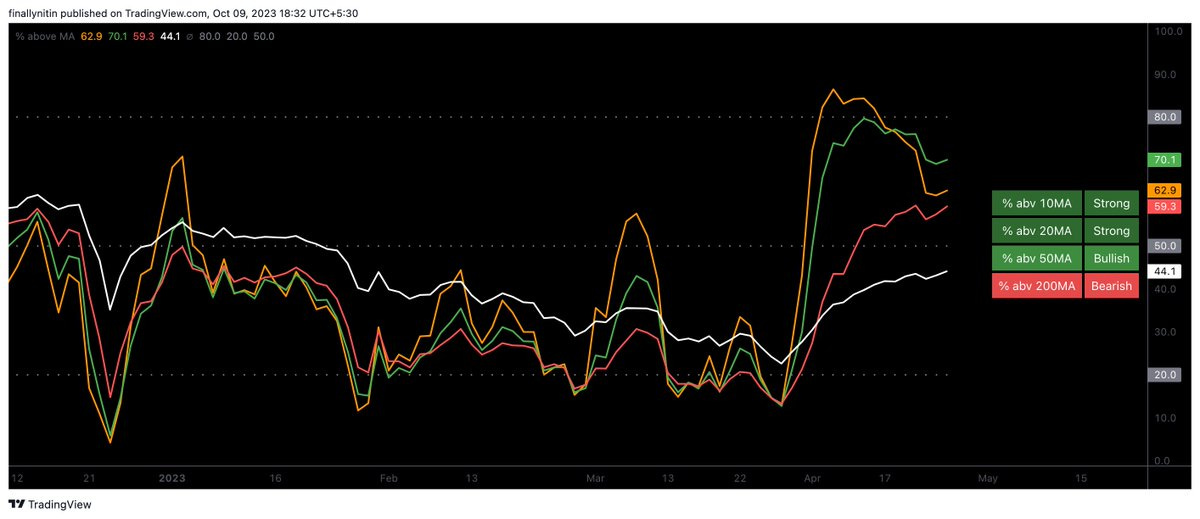

⦿ Default Mode

This indicator displays the % of NSE stocks trading above key moving averages. This script uses 10-day & 20-day EMA for short-term timeframes, & 50-day & 200-day EMA for medium to long-term timeframes. Individual Moving averages, & the table also, can be turned off.

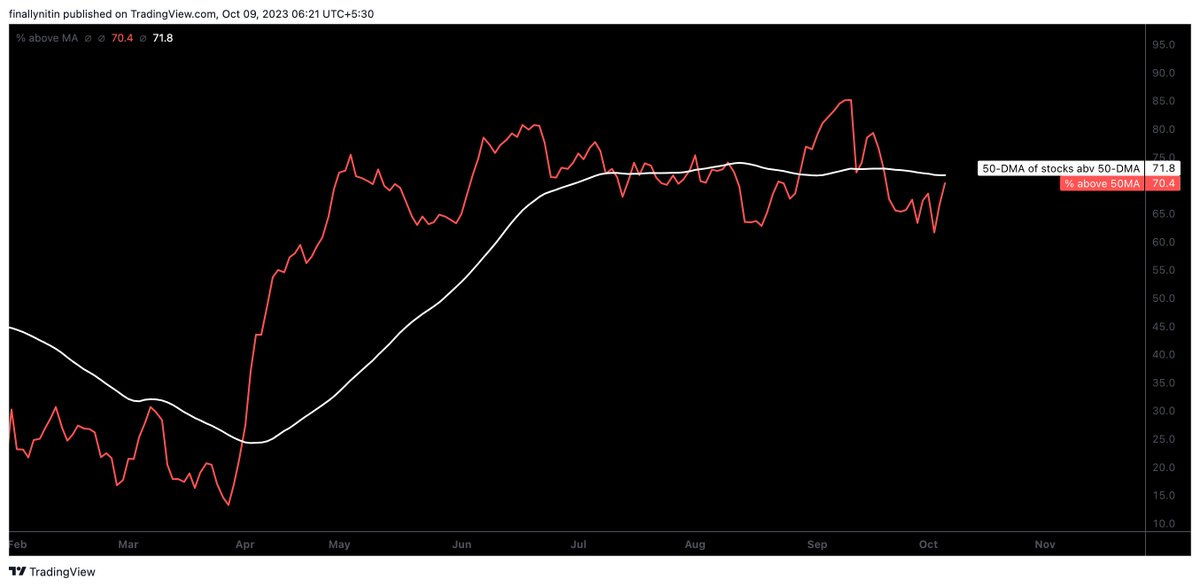

⦿ MAMB Mode

Turning-on the MA of market breadth displays the 50-day Moving Average of the % of stocks above the 50-day Moving Average. This is another way to visualise a smoothed version of the market breadth. If the % of stocks above the 50-day Moving Average is above its own 50-day Moving Average, then we can say that the breadth is strong.

⦿ Mini Mode

Turning on the mini-mode converts the table into a 4-color block, with the blocks reflecting the status of 10, 20, 50 & 200 MAs respectively, from top to bottom.

⦿ Text Mode

Turning on the text-mode converts the percentage numbers in the table into 1-word text descriptions.

Link

Here is the link to the Net new highs script for Tradingview:

Dependency

The script uses the Pine Seeds service to import custom data hosted in a GitHub repository and accesses it via TradingView as the frontend. So, the number of bars appearing on charts is fully dependent on the amount of historical data available. Any error or omission, if there, is a reflection of the hosted data, & not that of Tradingview.

Limitations

Such data has some limitations, like it can only be updated at EOD (End-of-Day), & only daily-based timeframes can be applied to such data. Irrespective of the intraday changes, only the last saved value on the chart is seen. So, it's best to use this script as EOD, rather than intraday. At the time of publication of this script, 375 days of historical data was available.

Credits

This script uses the NSE Market Breadth data from @swing_ka_sultan via a pine seed from @TheLogicalSwing. Hats off to these amazing individuals, without whose efforts, such scripts wouldn't have seen the light of this day!

Hey Nitin, Thanks for this creation. The data is loading till Dec only, will it correct in future?

Its loading data till 27th of December only, kindly check.

Thanks