Relative volume (RVol) vs Volume Buzz

Two different ways of looking at the same thing

Introduction

In this post, let’s understand the differences & similarities between Relative Volume (RVOL) and Volume Buzz.

Think of them as two different ways to look at the same thing: how active a stock is. It's a bit like choosing between a cup of strong tea or a mild coffee – both serve the purpose of waking you up, but the choice depends on your taste. And, at a time, you need only either one of the two.

Whether you pick RVOL or Volume Buzz depends on how you like to analyse the volumes. This article is all about understanding the values of these two metrics, helping you decide which one fits your mindset the best.

Calculating Relative Volume (RVOL)

Relative Volume (RVOL) helps you see whether a stock is getting more or less trading volume compared to what's typical for it.

Calculating RVOL is straightforward. You take the trading volume of the stock at the current moment and divide it by its average volume over a certain period, often calculated using a 20-period or a 50-period moving average.

Relative Volume = Volume / Average volumeInterpreting RVOL values isn't complicated. If you get an RVOL of 2.5, it means the stock is being traded 2.5 times more than its average volume. An RVOL of 1.0 indicates that the trading volume is just as you’d expect, right on the average. And if you see RVOL soaring above 3 or 4.0, that's a signal that the stock is experiencing much higher trading activity than usual – a situation that definitely deserves a closer look.

Calculating Volume Buzz

While RVOL is like checking the temperature in a room, Volume Buzz is similar to feeling the intensity of the heat or chill, measuring how much it's deviating from its normal temperature.

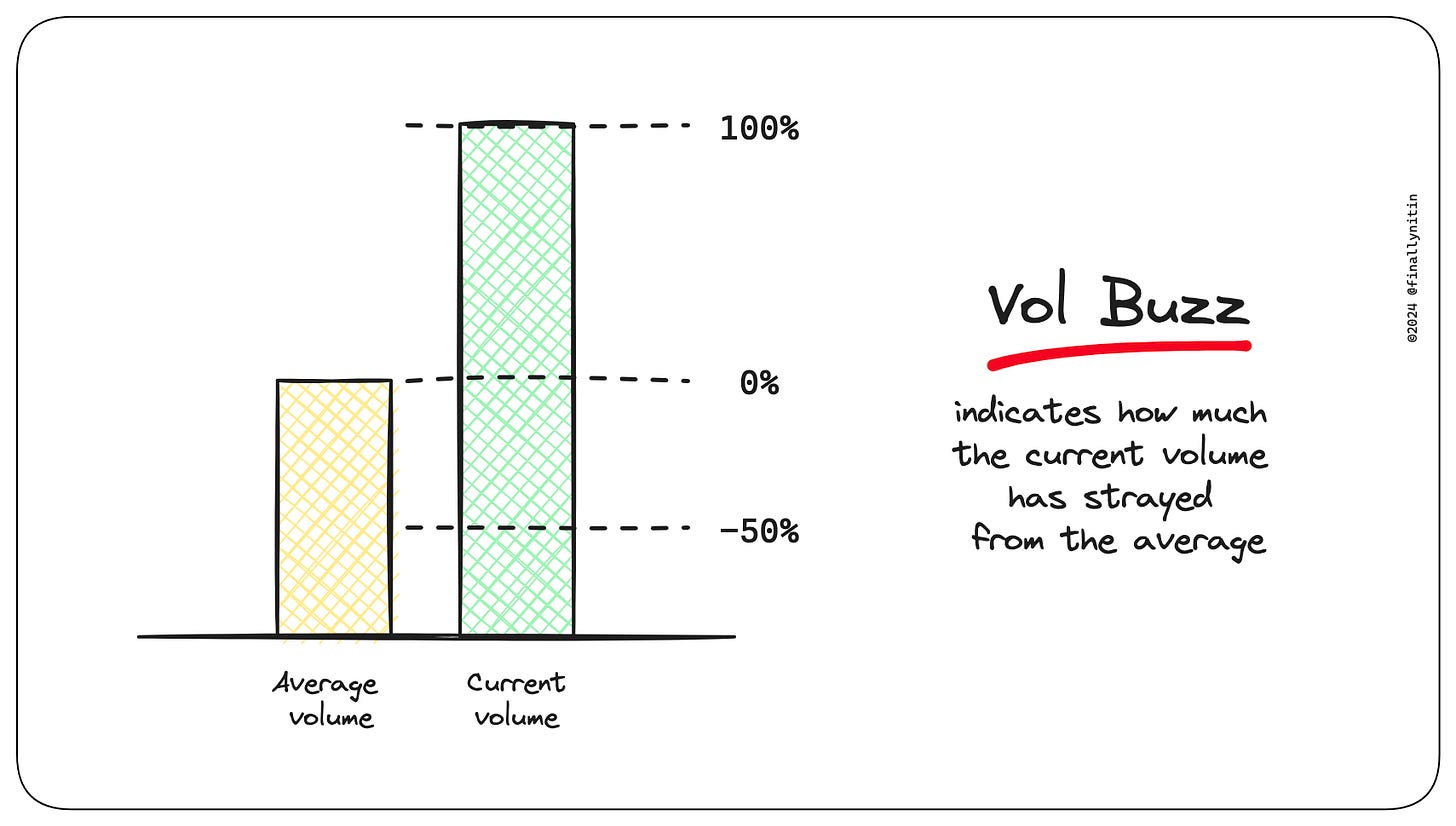

It's calculated by comparing the current trading volume to the average in percentage terms, that indicates how much the current volume has strayed from the norm.

Volume Buzz = (Volume − Average volume) / Average volumeAny positive value indicates the percentage by which the current volume exceeds the average. When you see a Volume Buzz of +100%, it's like a double-take moment. The stock is trading at 100% more than its average volume.

Conversely, a negative Volume Buzz shows that trading volume is below average. e.g. A value of -50% means the stock is trading at only half of its norm for this portion of the day.

The differences between RVOL and Volume Buzz

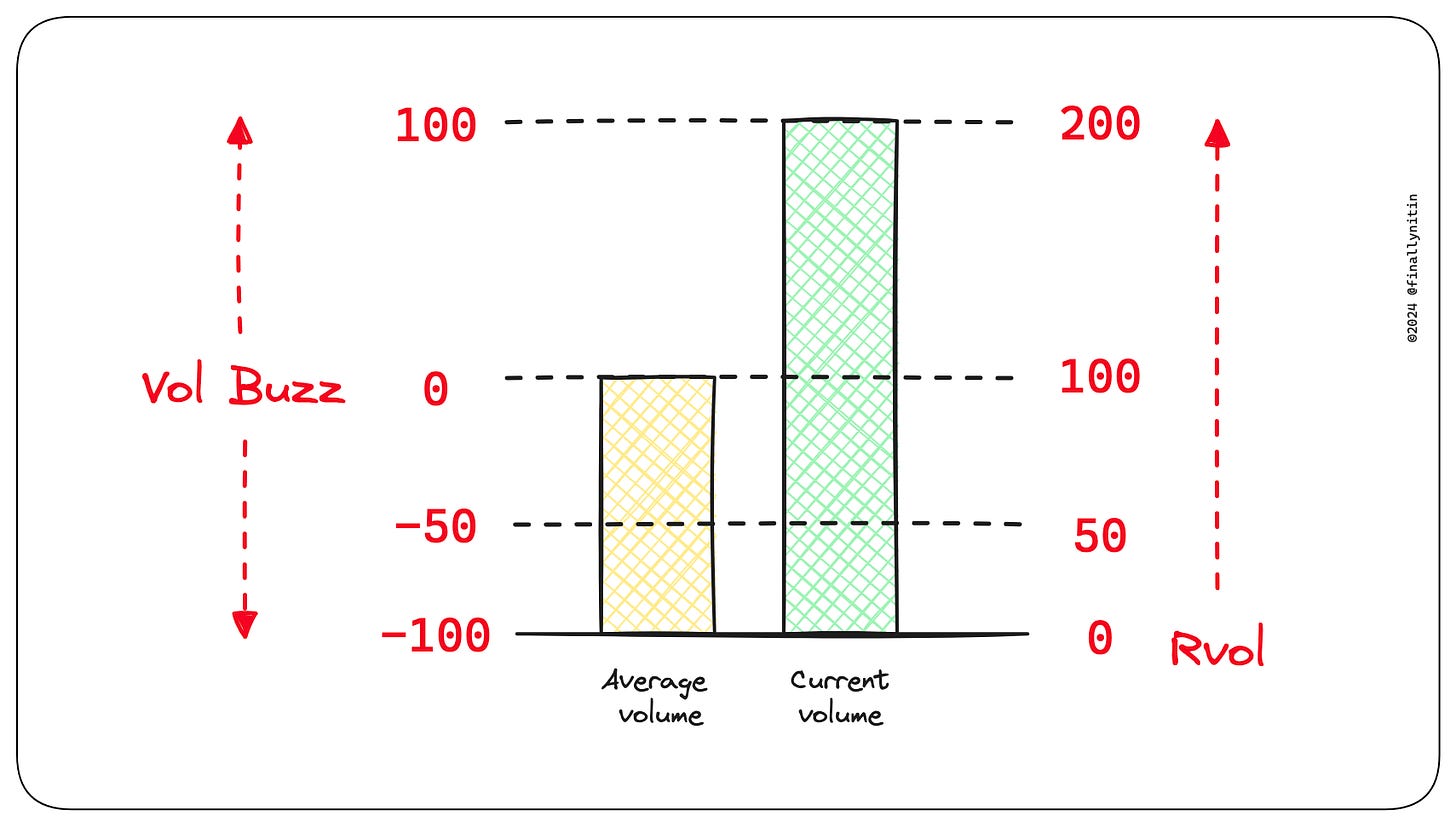

RVOL starts counting right from the beginning, setting its baseline at zero volume. A 100% RVOL indicates that the trading volume is precisely at its average level – not more, not less.

Volume Buzz, on the other hand, starts its count from where the moving average begins. Therefore, a 0% Volume Buzz means the current volume is exactly at its average.

Not using the current bar in the volume average for calculating RVol

Some Rvol indicators includes the current day while deciding the value of the average volume. i.e.

volume/AvgVol As per me, Rvol should be calculated as:

volume/AvgVol[1] i.e. current day must not be included while deciding the value of the average volume.

Because when we are comparing with average volume, today's volume inclusion in calculating the volume average makes the comparison unfair. While it doesn't make much difference, it is more accurate.

Using RVOL & Volume Buzz in the Simple Volumes

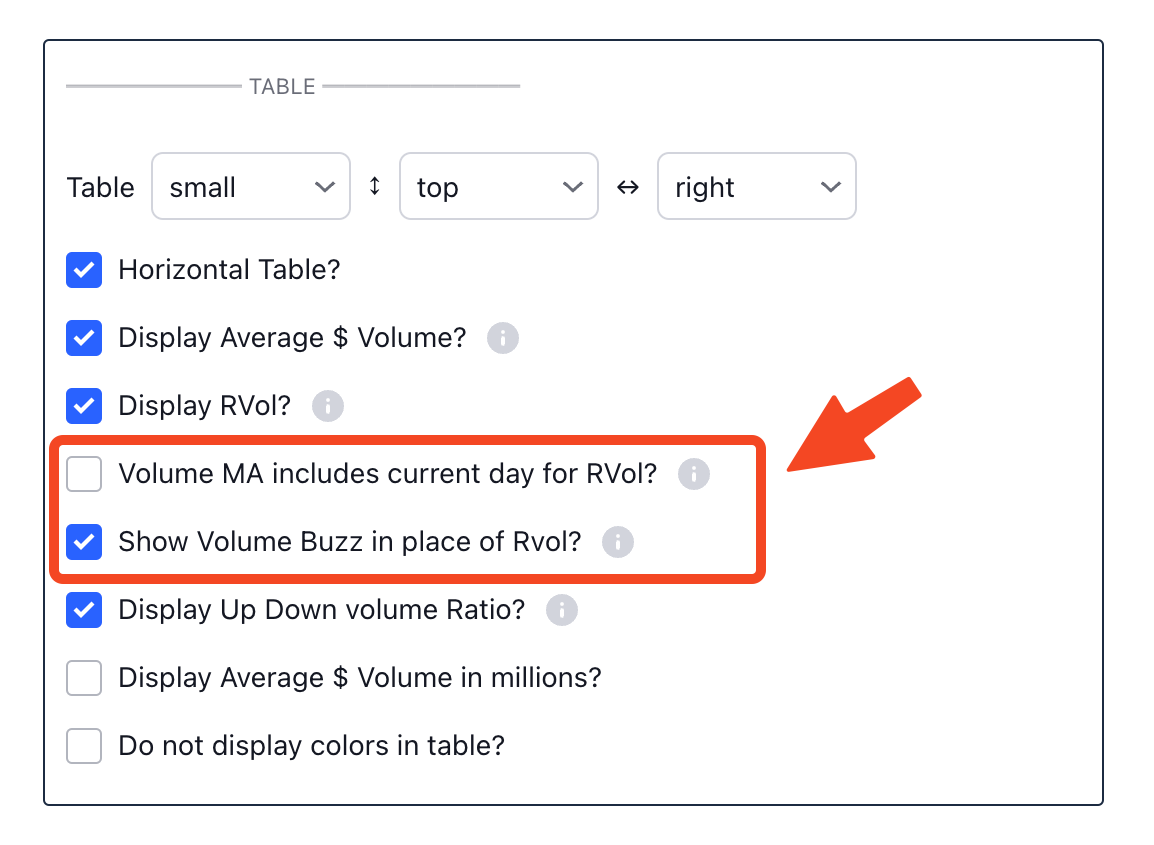

The Simple volumes indicator provides options to display the Volume buzz in place of the RVol. It also gives an option (turned off by default) to include the current day while deciding the value of the average volume used for calculating the RVol or volume buzz.

Here is the link for reading more about the Simple Volume indicator:

Simplifying Volumes

The time has finally arrived to simplify how we use the volume indicator on our charts. This is a post on what “simple” volumes are, & how to use them on Tradingview. The Simple volume indicator is minimalistic, in that, instead of introducing more bells & whistles, it strips away the conventional volume indicator from a lot of “

In the settings, you can turn on/off these options to get your desired result:

TL;DR

Relative Volume of +200% means that the stock is trading 100% more than its average volume.

Volume buzz of +100% means that the stock is trading 100% more than its average volume.

Thanks for explaining sir 🙏 also still QE is locked to use sir if you can check sir 🙏