I have a very simple method for swing trading in cash stocks.

With a Tradingview script at the end, here is my Simple Swing strategy.

What is T3 Moving Average?

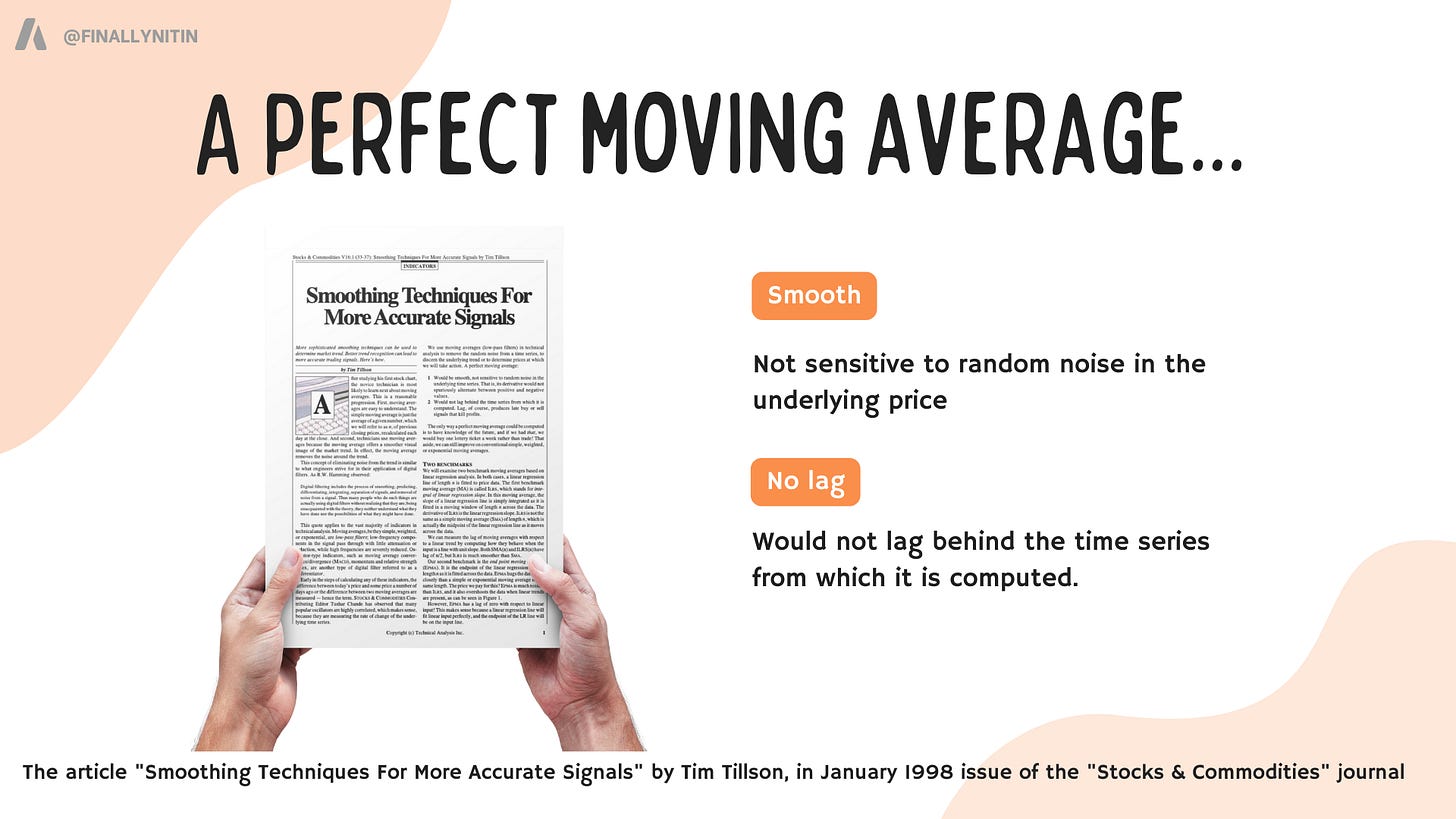

The Simple Swing indicator is based on the T3 Moving Average, which was first described by Tim Tillson, in the search for a “perfect” moving average, which would have 2 characterictics:

Smooth (not sensitive to random noise in the underlying price)

Would not lag behind the price

The smoothness of a filter could be improved by running it through itself multiple times, at the cost of increasing the phase lag. So, we choose a moving average with a very minimal lag (Generalized DEMA), & run it through itself multiple times to get a smoother version with minimal lag (T3MA ). The problem with multiple runs though these filters is that they increase their tendency to overshoot the data, giving an unusable result. To solve this problem, we need to simply turn down the volume by using a volume factor less than 1. Using a value for v less than 1, & running GDEMA (Generalized DEMA ) through itself multiple times we get a new, smoother moving average (T3) that does not overshoot the data:

T3(n) = GDEMA(GDEMA (GDEMA(n)))

In easy words, the T3 MA incorporates a smoothing technique which allows it to plot curves more gradual than common MA & with a smaller lag. During most of the time in a trend, price will stay well away from the T3MA. Thus, a decisive close beyond the T3 MA often indicates the end of a trend.

The ribbon & the swings

The T3MA ribbon consists of a fast and a slow moving average (MA).

The ribbon is green when the fast MA is above the slow MA. This green ribbon represents the upswing. Similarly, the red ribbon represents the downswing.

Traditionally, the entry is mainly done by crossovers between a fast and a slow moving average (MA). When the fast MA crosses up the slow MA, the trader takes it as a buy signal. Similarly, when the fast MA crosses down the slow MA, we get a sell signal. These are the green & red ribbons representing the “confirmed” swings. These traditional signals are lagging. So, we use the Early Swing signals.

In the Simple Swing Strategy, we propose the Early Upswing (E0) & Early Downswing (Ex) terminologies.

The Early Upswing starts when the T3 ribbon is red (i.e. Fast T3MA is lesser than slow T3MA), but the price has closed above the ribbon. This is the E0 candle.

Similarly, the Early Downswing starts when the T3 ribbon is green (i.e. Fast T3MA is greater than slow T3MA), but the price has closed below the ribbon. This is the Ex candle.

The long entry (or the short exit) is taken once the price closes above the red ribbon. Similarly, the long exit (or the short entry) is taken once the price closes below the green ribbon. Thereafter, the color of the ribbon confirms the swings. When we have the green ribbon, we are in a Confirmed upswing. When we have the red ribbon, we are in a Confirmed downswing.

When the price is inside the ribbon (either during an upswing or a downswing), the swing is no longer in a confirmed state, but under some pressure. We call this as a swing under strain.

Entries & Exits

The Entry is taken above the high of the E0 candle. Look for constructive price action at this juncture, preferably a descending trendline breakout.

Major part of an exit strategy in swing trading is selling into strength.

Here, we exit in parts based on 2 “sell into strength” components & 1 “trend-following” component:

Sell into strength: either the pre-decided R-multiple gets achieved, or the price gets extended

Trend-following: the swing gets over (signified by an Ex candle, & confirmed by the red ribbon thereafter)

The percentage of capital to be allocated to a particular trade as well as the quantity of partial profit booking (1/2, 1/3, or 1/4) is to be decided using the SwingConfidence™ score (details coming soon!).

You can scroll down my timeline to review a number of trades taken by me with the SimpleSwing strategy. The swings are an inherent nature of the markets, so with proper risk management, the strategy is bound to be profitable.

The script

Here is the link for the Tradingview script of Simple Swing: Simple Swing with T3 MA

The caveat

Every E0 candle does not lead to a consistent upswing, but almost every consistent upswing begins with an E0 candle. Context matters.

p.s. It should be noted that the terms “swing” & “trend” are not interchangable. You can have an upswing in a downtrend, & a downswing in an uptrend. An upswing in an uptrend is the most reliable environment for long positions, & vice versa.

Hope you find this useful.

Hello sir,

I have read this article. Started using this recently.

May I ask

1. In which Timeframe does it work well?

2. Is there any Part-2 of this article?

3. Does it replace the EMAs that we use?

4. Does this create any conflict / confusion with the EMSs?

I am a big fan of yours and also a follower at X (Ekalavya_T)

Thank you.