"Your first problem is to find a setup. Your second problem is to understand when that setup does and doesn’t work." ~ Pradeep Bonde

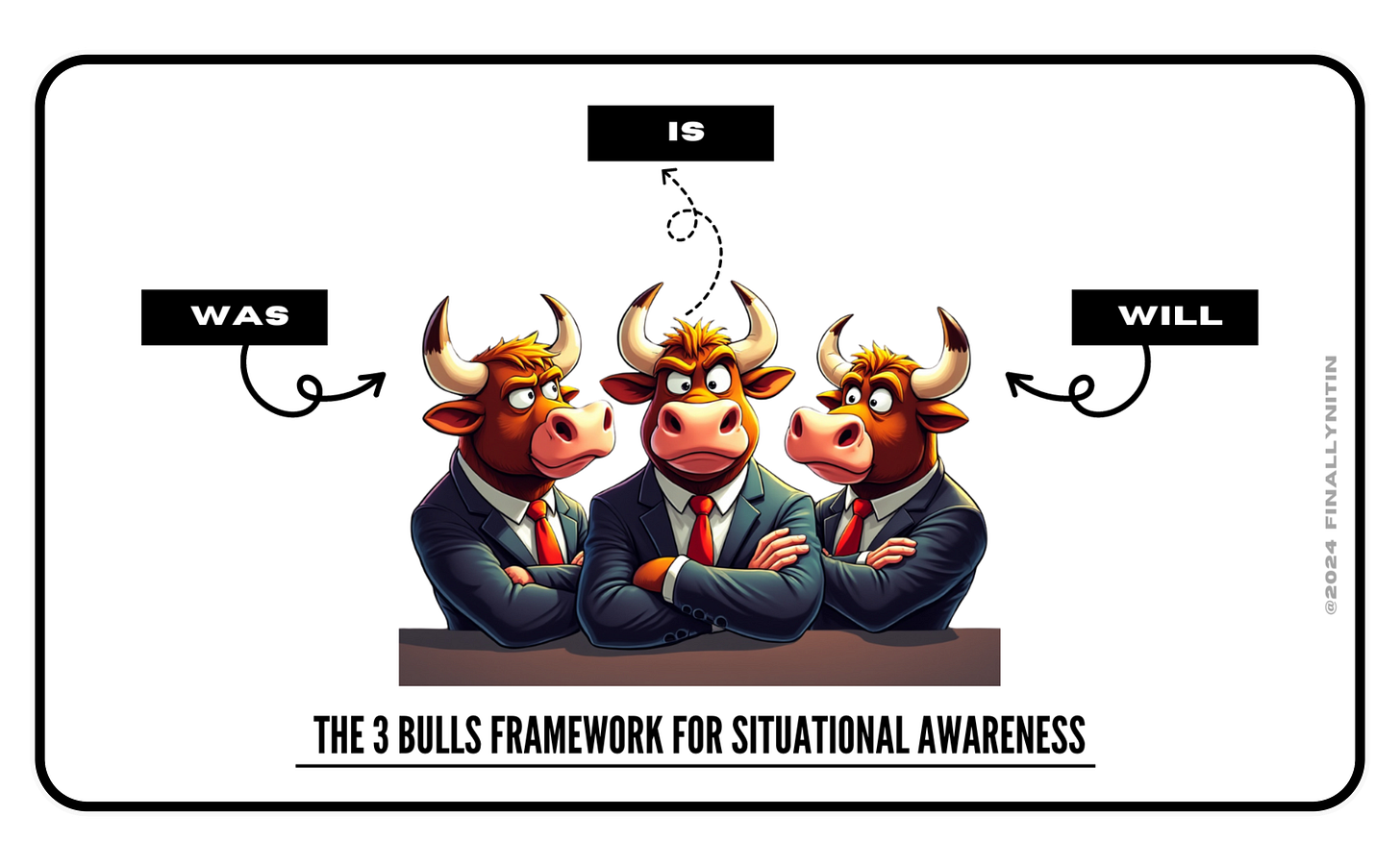

All situational awareness can be summed up in three queries:

Was: analysis of what has already happened

Will: anticipation of what can happen

Is: understanding what to do next

Was (analyse what happened):

This is what has already happened, & is almost completely objective. This includes both the general markets (quadrant) & your portfolio/watchlist feedback.

Bias (via 52-week NNH): should be positive as an essential condition for active swing trading

Swing (via Simple swing indicator): mostly the watchlist/portfolio stocks’ swing state will sync with the general market, & we want them both in an upswing. Also, context of the market cycle goes here.

Bull swing in a bull market

Bear swing in a bull market

Bull swing in a bear market

bear swing in a bear market

Momentum (via Homma momentum): improving, preferably positive

Breadth (via % of stocks above moving averages): green (strong or improving)

Watchlist/portfolio feedback: Mostly will be in sync. But sometimes, the portfolio will be out of sync. In such situations, portfolio feedback is to be preferred.

Then the broad awareness of how ‘young’ we are, both in terms of the swing & the overall market should be there.

Will (anticipate what can happen):

Neither is it possible, nor is it always necessary to ‘anticipate’ what’s gonna happen next. This is almost completely subjective.

Also, this differs from predicting the future. Anticipation is more about readiness or expectation of an event or outcome, & preparing for it, while prediction is an analytical, reasoned forecast of what will happen in the future, which is largely a futile exercise.

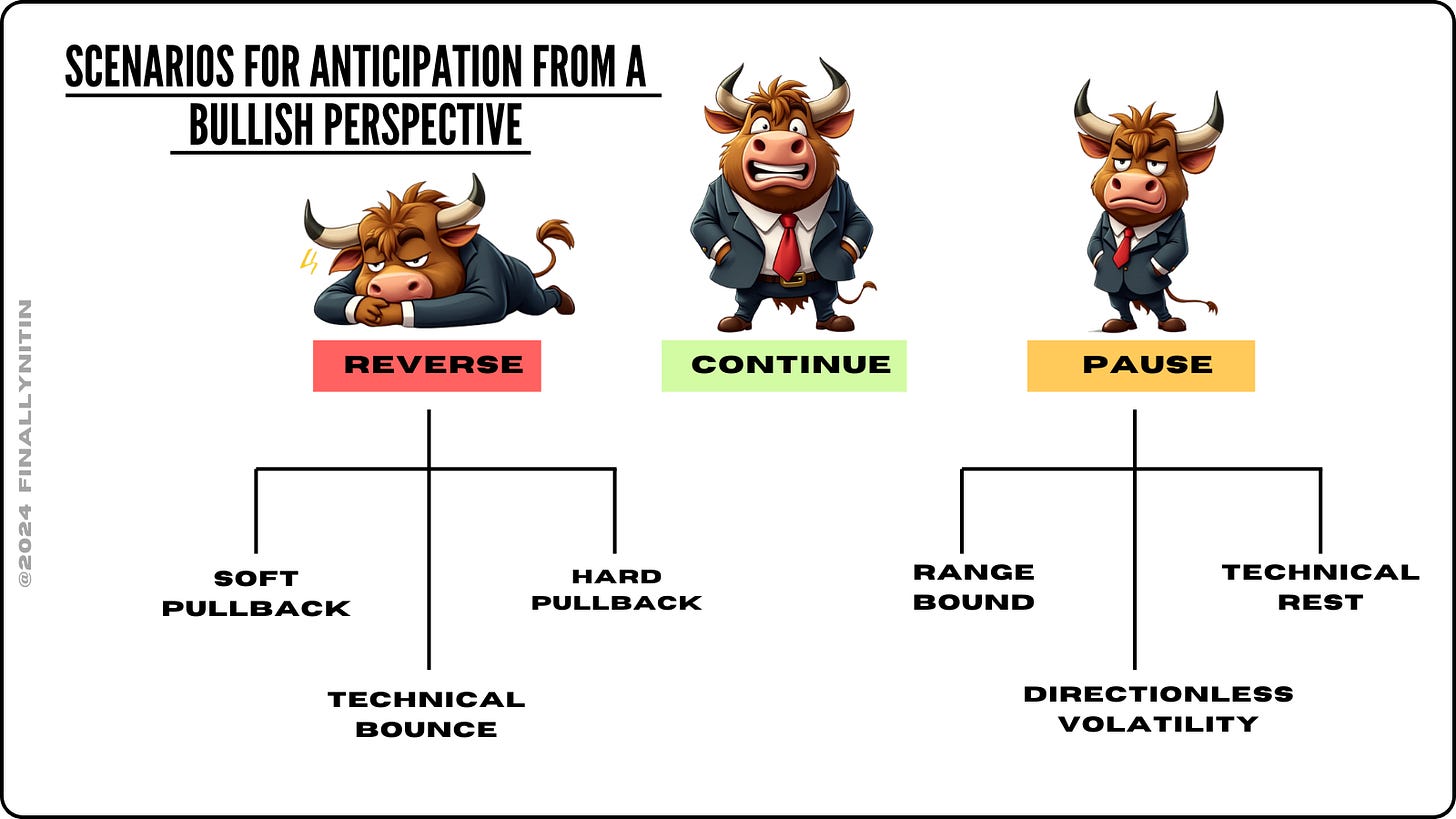

Broad anticipation is continuation or reversal. One just needs to trust the trend, & anticipate continuation, until proved wrong.

Buy every shakeout in a bull market. You’ll get proven wrong only once in the end.

Avoid every upburst in a bear market. You’ll get proven wrong only once in the end.

An awareness of being at unsustainable extremes can lead to an anticipation of a reversal. e.g. a dead cat bounce (from bottom), a deflection (from top), soft pullback (till 10 or 20), or a hard pullback (till 50). After extreme readings in the 4% advance/decline numbers, we can anticipate a reversal, & use reversal strategies for the day.

When the markets are heated, we anticipate some time needed to cool-off. In the light of this anticipation, we will decide to reduce (sell partials into strength) or at least hold (not take fresh positions).

Also, events & geopolitics goes here. Matters of awareness that neither the price chart nor the breadth indicators are capable of telling. It’s purely discretionary if you want to take decisions on such ‘awareness’ or dismiss it as noise. A recent example is when, owing to the Japanese carry trade fiasco, the world markets began to fall down badly on a Friday (02-Aug-2024), & I ‘knew’ that we are doing a big gap-down on Monday.

Elections, Budget, Fed meet & similar events lead to an anticipation of heightened volatility, & one might decide for or against trading with a very tight stoploss in such circumstances.

Is (understand what to do):

The present is nothing but the future transforming into the past. In the moment, we need answers to 5 pertinent questions, which are:

Sit-out in all cash

when the bias is negative (52-week NNH & CBMA red) & all the stocks in your portfolio have hit their stoplosses

Restart deploying funds after sitting out

when bias turn from red to green, or if the bias is already green, when the breadth & momentum begins to improve

Add to the risk taken (by increasing the RPT or going on margin)

When portfolio gives positive feedback. Mostly here momentum is positive & improving, while breadth is still not overbought

Hold, with no further fresh positions

Breadth begins to get overbought, & indices approach a resistance, or get extended, or momentum begin to weaken

Reduce (both deployed capital, & risk taken)

Streak of stoplosses, breadth beginning to worsen, momentum worsening

Another question that needs to be answered is which strategy is preferable in the current market? An outline could be:

Early bull market: positional

Established bull market: swing

Easy money phase: trial with 20

Hard money phase: R ya paar

Choppy market (burst & fade): intraday

Apart from broad strategies, which setups are working in the current market need to be answered. Some examples of these can be episodic pivots, IPOs, bursts, breakouts, & bounces from moving averages.

The 3 bulls framework

From what happened (‘was’) & what we anticipate to happen (’will’), we arrive at what we have to do (‘is’). This is dynamic, & can change form day-to-day, or stay the same for quite some time.

At times, things can be somewhat muddled up, so that the answers to all the queries might not be that forthcoming. That itself is an awareness, & here rather than blaming ourselves for not being able to decipher the markets, we should blame the markets for lacking clarity & not being decipherable.

One of the most comprehensive article on breadth and anticipation there is.

Thoroughly enjoyed reading it.

Learned even more.

And shall come back to it again in the future.

Thanks Nitin.

Great Article Nitin!

Can someone please provide some background on "CBMA red", like what is its full form and what does it mean?