Nothing triggers a swing trader more than the mention of the word 'intraday'. I feel that intraday trading is very misunderstood. Please read on with an open mind.

(Full-time & pro traders can skip reading this)

01: Swing Trading

Most 'swing' traders are nothing but modified intraday traders, with the only difference being that they carry their positions for the next (or many) day(s) till the SL (or TSL) gets hit.

For such swing trades, most decisions get determined during the day itself. For example:

⦿ Final identification of stocks, to narrow down to 1 or 2 from a watchlist of, say, 5 or 10:

high Rvol in the first few minutes

open = low

⦿ Exact entry point determination:

opening range breakout

chart patterns on minute charts

⦿ Stop loss placement:

low of the day

certain % points from entry

⦿ Even exit decisions are often taken intraday on the same (or later) day(s):

booking ½ at a certain R or UC during the day

exiting near EOD in case of squats

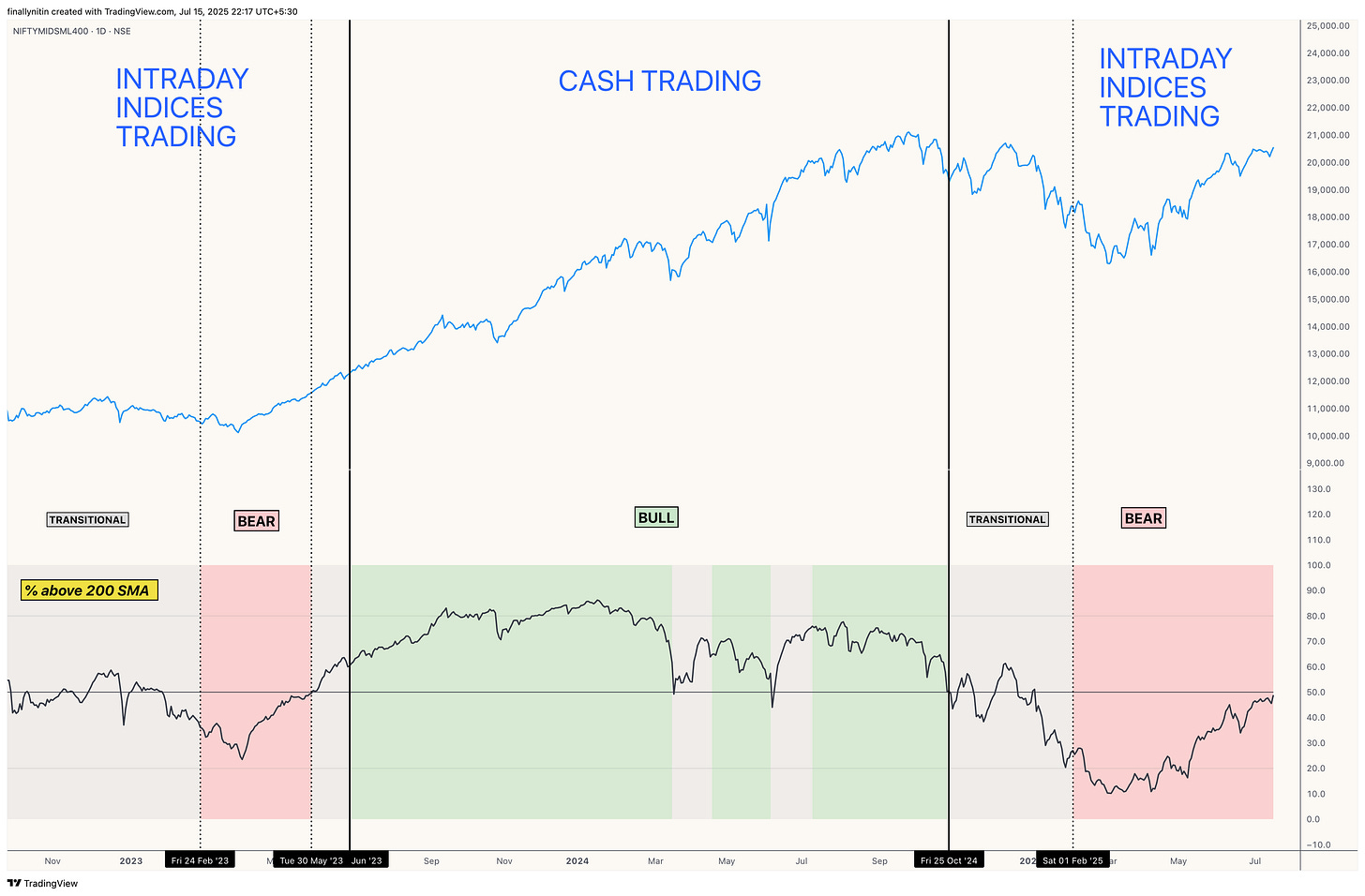

So much fire-fighting is not required in proper bull markets. I still remember the mega bull run of 2017 & the post-COVID times, where I would often trade weekly inside bars and three-week tight formations. I would place the trigger at the high of the previous week and the stop-loss at the low of the last week. I would enter the stock smoothly and then only review my position on weekends. Those were easy days. Such methods don't work efficiently in bear/transitional markets.

Bear/transitional markets are, for the most part, a hard money environment where only the most experienced, laborious & disciplined traders get significantly rewarded, if at all.

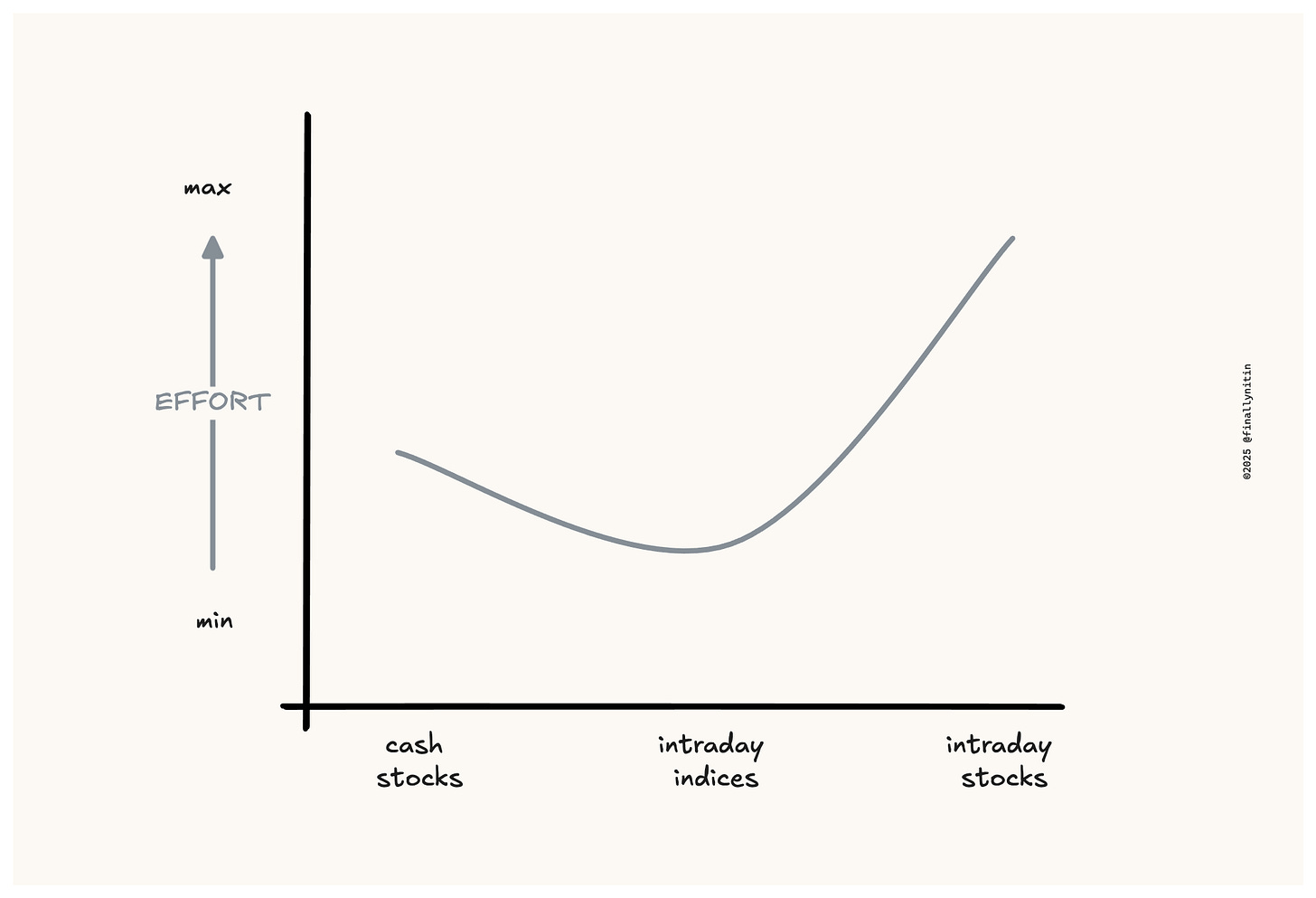

The ‘solution’ then becomes evident, & it is moving to a lower timeframe to get the entries & exits fine-tuned. So, basically it is:

Worse the market → greater the effort → lower the timeframe

02: Intraday Index Trading

Let's now compare swing to intraday index trading. Here, the trade is taken in the same 1 or 2 indices day after day, which can be either long or short, but not carried over to the next day. To understand this, let’s first see the pros & cons of intraday index trading:

⦿ Pros of intraday index trading:

Market breadth - not required

Demarcation between bull & bear markets - not required

Liquidity concerns - no concern

Nature of the stock (linear, choppy) - not needed

Earnings surprises- absent

Gap down - no concern

Price bank revision - absent

Fundamental checks - not needed

Scans - not needed

⦿ Cons of intraday index trading:

Active screen time

Not getting 20% moves in a day or 100R trades

All other things, like having a trading strategy, discipline, and good execution, are more or less the same. As is evident, intraday index trading has significant advantages if:

You’re not a very needy or greedy person

You know how to trade the indices

Overall, probably not as hugely rewarding as swing trading in bull markets, where 2x or 3x returns on the portfolio are doable, but with great potential to outperform swing trading returns during bear/choppy markets.

03: Intraday stock trading

Now compare this with intraday trading in different stocks. Among all the available trading methodologies, the one that I find the most challenging is intraday trading in stocks. Here, the trader creates a watchlist and scans for opportunities throughout the day, carrying positions only if they secure a cushion.

Here, you take the maximum pain of both a swing trader & an intraday trader, as the beast named stock selection comes into play, along with all the variables such as scans, breadth, earnings, fundamentals, linearity, momentum, price bands, and whatnot. Now, all the cons of swing trading are being combined with the biggest con of intraday trading (active screen time), & you are earning money with considerable effort on your part.

Yes, you can definitely do this, only if you are a full-time trader, and have got a lot of time & energy (& skill), both during the day and in the evening.

04: Conclusions

What’s the plan, then?

The plan is to predominantly trade indices intraday until a sustainable, easy-money environment returns.

How would you know that a proper bull market has started?

We define a 'bull' market as when the percentage of stocks above the 200-day SMA exceeds 50 and stays above 50 for at least a month.

What about the FOMO of seeing stocks flying away every now & then?

Seh lenge thoda. Might take a very high conviction trade on and off.

Disclaimer:

⦿ I'm a very flexible person & my views can change at any moment. So, please don't question me if you see me posting a cash trade in the near future. 😄

⦿ Please don't post the "bhaisahab-ye-kis-line-mein-aa-gaye-aap" & "jis-raah-par-tum-chal-rahe-ho-munna" memes. 😜

Counter with logic & not emotions. I'm always ready to change my mind if provided with sufficient evidence.

Good and detail analysis from Dr Nitin, thanks sir ji

Thank You