Trading is not as tough as people make it to be. You just need to be in the right stock at the right time with the right size. What do we mean by this easy-sounding phrase? Let’s explore.

Right Stock

There are three components to classify a stock as the right stock. Number one, it should be having a fresh up move. It should have entered stage two recently and might be at the first pullback. However, if it is more than three to four bases old, then it is certainly not a fresh up move.

Second, the right stock should be from a trending theme. There should be a group move, a catalyst, with a couple of similar names moving together. There should be an impetus for it to move up, such as some news.

Third, & the most important, is that it should offer some value to the market participants with respect to its future growth prospects. While this is difficult to measure, improving sales & earnings with a lot of year-on-year upside potential is one way to estimate it.

Right Size

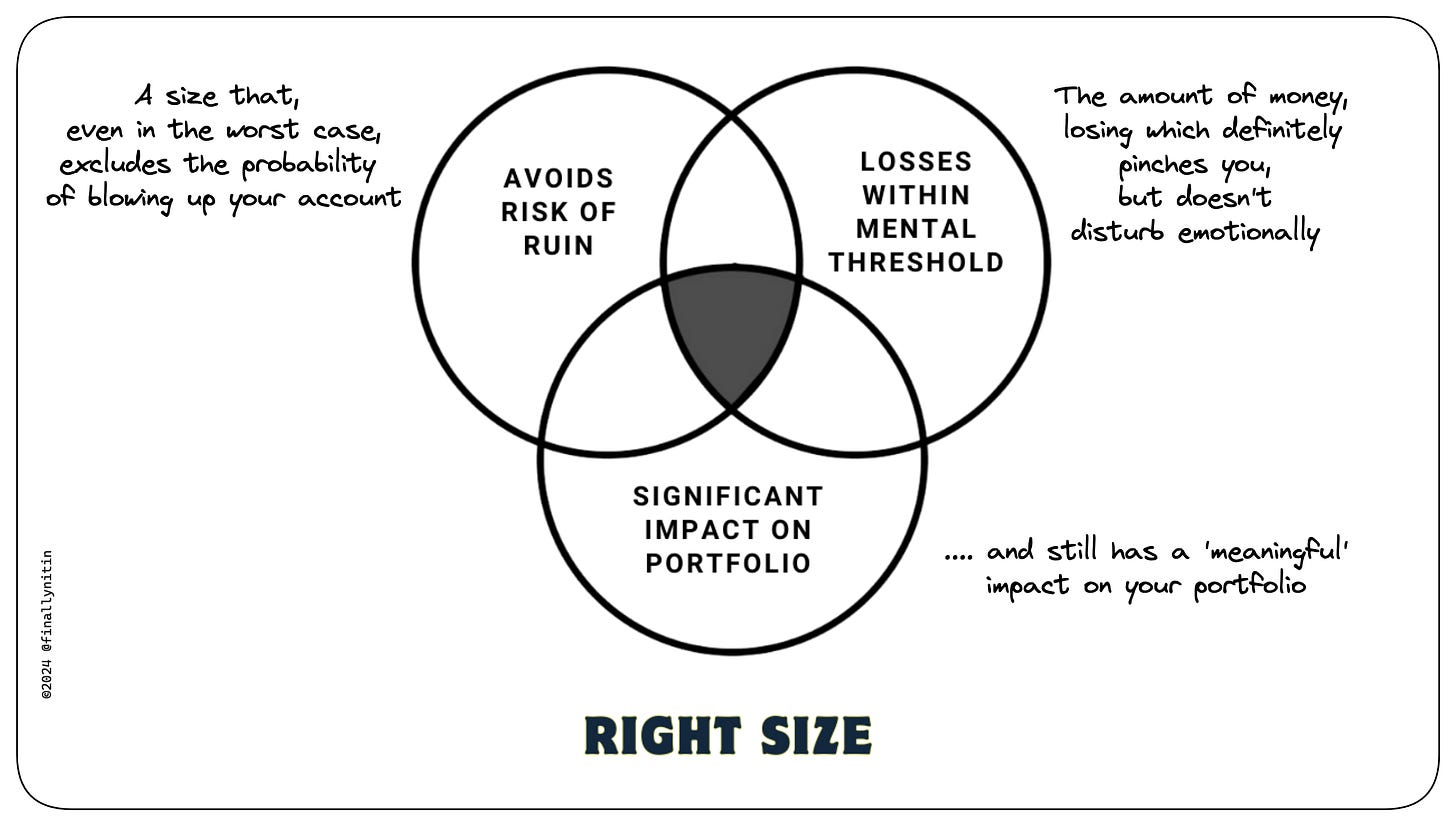

The right size has a significant impact on your portfolio. It should move the portfolio in a way that's meaningful as a contributor to your wealth-creation journey. Taking homeopathic positions in the right stock at the right time won't make a difference, and the effort wouldn't be worthwhile.

However, in this over-enthusiasm, the size of your bet shouldn't be so large that you risk blowing up your account. The size of the risk taken shouldn't be extreme, because if you lose all your chips, you won't be able to play the game. In the worst-to-worst scenario, your size should avoid the risk of ruin.

Any trading strategy will have wins and losses. And lastly, when you lose money, the frequency and amount of losses should definitely pinch you but not disturb you emotionally. The losses should be within the tolerance of your mental threshold.

Right Time

The right time can be again divided into three components: the right time within the stock, within your mind, and within the markets.

To enter a right stock with the right size, the right time with regard to the stock is when the trend of the stock is pausing. This indicates a lack of sellers amidst consolidating buyers, and eventually, they are going to drive the price up.

The second component is when you are in the right state of mind, when the time is right for you. If you are in a hurry, or you’re exhausted or agitated, then that's not the right time. Execution must be with a calm mind.

Thirdly, when the time in the market in general is right. When the markets are showing good upward moves, breakouts are sustaining, the market is more forgiving of your little mistakes, when stocks are making new 52-week highs, the breadth of the market is healthy, there is positive momentum, and good news. This is a market for making easy money, and that's the right time for the market.

So, you just need to be in the right stock at the right time with the right size, & then do nothing. From these three areas, identify where your problem is, & solve it.

Very insightful, thank you 🙏